If you're wondering what happened in crypto today, June 3 brings a flood of action. From Circle’s massive IPO valuation to Strategy’s bold Bitcoin buy, and from Tether’s gold backed stablecoin launch on TON to shifting dynamics in the gold vs silver ratio, there’s a lot unfolding. Let’s break it down.

Circle is a stablecoin powerhouse known for their issuance of USDC, and with a new attempt to IPO, they are in the news. It has filed under the ticker CRCL, and it is looking for a $7.2 billion valuation on the New York Stock Exchange with the buzz prompting investors to wonder: when is Circle USDC IPO launching?

It plans to raise $896 million through 32 million shares priced between $27-$28.

After delays due to Trump era economic uncertainties, this big Circle IPO relaunch reflects a new appetite for compliant crypto investment.

In another headline for why crypto market is up today, Michael Saylor’s firm Strategy just grabbed 705 BTC, spending roughly $75.1 million at an average price of $106,495 per coin.

Source: Michael Saylor X

At the same time, they’ve launched a new $250 million stock offering of STRD (10% Series A Perpetual Preferred Stock).

This takes Michael Saylor Bitcoin holding total to 580,955 BTC, more than any public company to date.

Key point: The strategy bitcoin buy shows no signs of slowing, even when others hesitate.

Tether has introduced its yellow shinny asset backed stablecoin, XAUt0, through a new omnichain setup deployed on the TON blockchain, as per WU Blockchain data.

Source: X

It follows the Omnichain Fungible Token (OFT) model, letting users move yellowish shinny asset tokens across blockchains with zero wrapping needed.

This collaboration between Tether and TON directly targets competition like PAXG, and even traditional gold ETFs.

Context: As the price of yellow metal jumps to $3,386/oz, the idea of using blockchain for physical assets is catching attention. That makes Tether xaut0 gold stablecoin on ton a story to watch.

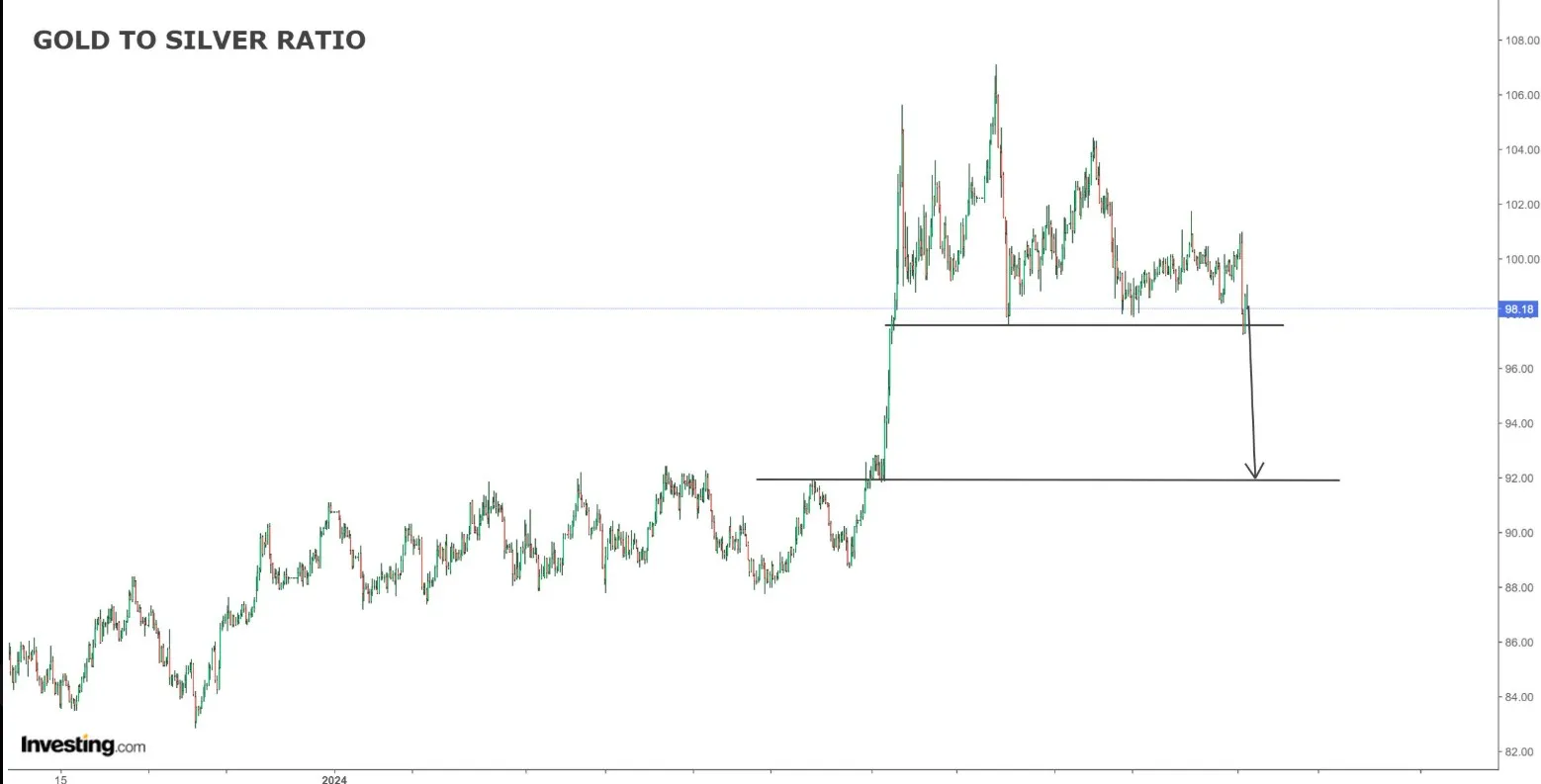

A new analysis by Rashad Hajiyev suggests the gold to silver ratio may drop fast—from 98 to 91—which could push silver to around $37.25/oz in a single day.

Source: Rashad Hajiyev X Account

Most trusted safe-heaven metal is already up 45% YoY and sits around $3,400/oz, while silver could spike quickly.

At the same time, Bitcoin holds at $105,375.46, up 0.96%, with trading volume up 10.44% at $44.05B.

In a world of shifting safe-havens, bitcoin vs gold and gold vs silver ratio are now major indicators of investor sentiment.

Even as digital dollars go mainstream, full adoption isn’t easy. Still, Citi sees stablecoins reaching $3.7 trillion by 2030, assuming regulation keeps pace.

In the U.S., the GENIUS Act, first proposed in Feb 2025, passed a Senate procedural vote on May 20.

Europe already implemented MiCA in June 2024, ensuring uniform rules for crypto issuers and consumer protections.

Yet confusion across countries still limits full adoption, keeping stablecoin growth uneven.

In case you missed it, what happened in crypto today isn’t just headlines—it’s history unfolding. From circle IPO news making waves on Wall Street to gold-backed stablecoins redefining digital asset, and Michael Saylor’s BTC moves reinforcing institutional confidence, June 3 brought the heat.

With shifting hard asset ratios and new legal progress on stablecoins, the crypto market shows it's maturing fast—just not evenly across the globe. Stay sharp, do your own research, and keep watching this space.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.