Strategy, (formerly MicroStrategy), is stepping forward with another huge move, in its Bitcoin plan. The organisation has announced a fundraising framework to raise an $250 million through offering a new class of stock STRD (10% Series A Perpetual Stride Preferred Stock). The proposal states to raise 2.5 million shares, at $100 each.

This step depicts that the company is bullish towards increasing its Bitcoin holdings. The management said the money raised will be used for general corporate purposes, including buying more Bitcoin and supporting day-to-day operations.

Source: Michael Saylor Twitter Handle

STRD is a type of preferred stock, which means it offers some fixed benefits. In this case, the stock promises a 10% yearly dividend, but only if the board decides to pay it. These dividends are non-cumulative, meaning if a dividend isn’t paid in one quarter, it won’t be made up in the next.

The first possible dividend payout date is September 30, 2025. Organisation can also buy back all STRD shares if less than 25% of the total shares remain on the market or if the company experiences a major internal change. In both cases, shareholders would receive $100 per share plus any declared, unpaid dividends.

Many major banks, including Barclays, Moelis & Company, Morgan Stanley, and TD Securities, are assisting in managing the stock sale. The offering is being made under a registration statement filed with the U.S. SEC.

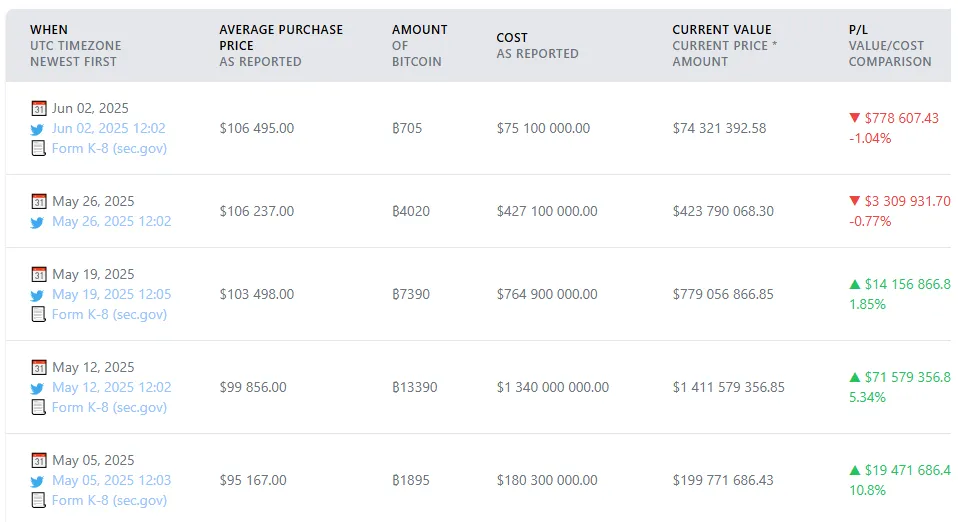

Right before announcing its stock offering, the company revealed that it had purchased another 705 BTC on June 2, 2025, spending about $75.1 million. The average price paid per Bitcoin was $106,495.

Source: Michael Saylor (MicroStrateg) Portfolio Tracker

This shows that the Michael Saylor's firm is actively using its resources to increase its Bitcoin holdings. Unlike many companies that simply hold crypto as an experiment, it continues to buy more BTC during both high and low market phases.

With this latest purchase, firm now holds a total of 580,955 BTC, more than any other public company.

Strategy has bought BTC about 4 times in the last month. It is evident that it will continue the same pace of buying this crypto.

Frequent purchases by Michael Saylor’s Strategy, are considered as a huge vote of confidence in BTC. Every time the organisation purchases more, it reduces the available supply within the market. This can be impactful in taking the BTC price upward in the long-term, especially if other corporations follow a similar strategy.

The company’s actions also help legitimize Bitcoin in the eyes of traditional investors and Wall Street. Strategy is using classic financial tools, like IPOs and bonds, to build one of the largest Bitcoin treasuries in the world. The coin is currently trading at $105,356.48 with an increase of 0.53% within the last 24 hours. After this news the trading volume has increased by 25.31% as per the CoinMarketCap.

With its new STRD shares offering and the recent purchase of 705 more Bitcoins, Strategy proves that it remains committed to its bold plan. As BTC continues to gain attention worldwide, the company is positioning itself at the center of this financial transformation, using old-school finance to power a new digital future.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.