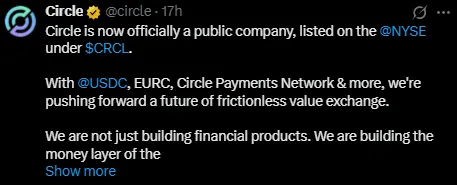

Circle Internet Group, the company behind the second-largest stablecoin USDC, just made a big move by going public. On June 5, Circle IPO listing on the New York Stock Exchange (NYSE) turned heads across the crypto and finance world.

Source: X

The company’s stock, listed as CRCL, opened at $69, way above its IPO price of $31, and closed at $83.23. That’s a 168% jump in just one day. The listing date became a historic moment—it’s the first stablecoin issuer to list on a major stock market and the biggest crypto IPO since Coinbase in 2021.

According to the IPO news, the company raised $1.05 billion through an upsized public offering, selling 34 million shares. This pushed the company's stock market valuation close to $18 billion at opening.

Source: TradingView

Circle NYSE share price peaked at $103.75, triggering multiple trading halts due to high volatility.

CRCL stock NYSE closed at $83.23, far above the initial range of $27–$28.

This signals growing investor interest in regulated crypto companies.

CEO Jeremy Allaire said this milestone showcases trust in the mission. He also introduced the Payments Network, which aims to enable real-time USDC settlements for global businesses. Besides USDC, the platform also issues EURC, a euro-pegged stablecoin.

Experts believe that stablecoins have the potential to transform the financial system, much like the internet transformed businesses. With a market capitalization of USDC as of now at $61.08 billion, the company is set for a strong position in the crypto space. The 24-hour volume of USDC is also at $14.12 billion, ranking it as the most utilized digital dollar.

Prior to this event, crypto communities were full of speculations about an impending acquisition. Rumors claimed Ripple offered to buy the company for $4–$11 billion. However, Ripple CEO Brad Garlinghouse publicly denied any acquisition talks.

Circle, too, clearly stated they were not in discussions to sell the company. Additionally, Ripple’s CTO, David Schwartz, later explained that the $6 billion offer post was just a joke shared on social media that was misunderstood.

Source: X

These rumors affected XRP as well. After the denial, XRP price crashed by 3.64%, dropping to $2.13. It currently holds a market cap of $125.34 billion, with $3.48 billion in 24-hour trading volume. However, this new journey has raised hopes of a Ripple IPO among the community.

With Circle's initial public offering now complete, many investors are asking—is Ripple next to go public? The company has already made headlines for its global reach, financial products, and ongoing SEC case. But as of now, CEO Brad Garlinghouse has made it clear: there are no plans for an IPO in the near future.

Despite that, whether Circle's success going public and Wall Street's interest increasing would have an effect on Ripple reconsidering is hard to say. That it will go public is purely speculation at this point, particularly with the issues surrounding the legality of it and the possibility of ETF talks being pursued.

Either way, the crypto world is evolving rapidly. With the success of corporations like Circle on the stock exchange, several other crypto companies could opt to be public companies in the future.

Circle's NYSE listing marked a major moment for crypto, showing resilience despite acquisition rumors and social media drama. The surge in CRCL stock highlights growing mainstream investor interest in crypto firms that follow regulations and show real growth. The successful IPO signals a shift where traditional finance and cryptocurrency are converging. Meanwhile, Ripple remains one to watch—whether it opts for a public offering or focuses on legal wins, it's clear that the digital space is entering a new, more institutional era.

Sourabh Agarwal is one of the co-founders of Coin Gabbar and a CA by profession. Besides being a crypto geek, Sourabh speaks the language called Finance. He contributes to #TeamGabbar by writing blogs on investment, finance, cryptocurrency, and the future of blockchain.

Sourabh is an explorer. When not writing, he can be found wandering through nature or journaling at a coffee shop. You can connect with Sourabh on Twitter and LinkedIn at (user name) or read out his blogs on (blog page link)