How does the U.S. government actually come up with a way to regulate cryptocurrencies? It's a big step toward an answer called the CLARITY Act. It is scheduled to go into the Senate markup process this coming January 2026, one of the key next steps needed to ensure the crypto market in the United States has clear, predictable rules.

The CLARITY Act tries to change that. The bill proposes that Bitcoin and similar cryptocurrencies would fall under the category of commodities, hence under the regulation of the CFTC, while investment tokens would come under the ambit of the SEC. This bill would go a long way in making the rules clear so that digital assets companies know exactly what to expect.

The bill has already passed the House of Representatives in July 2025 and is currently pending action in the Senate. During this stage, Senate committees are expected to examine, modify, and further improve the proposed legislation before a vote in a full Senate session.

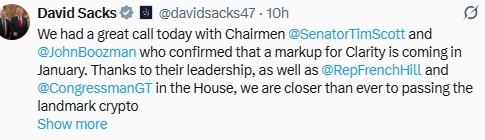

Source: X (formerly Twitter)

The White House AI and crypto czar, David Sacks recently tweeted an update confirming that Senate Banking Committee Chair Tim Scott and Agriculture Committee Chair John Boozman have confirmed that the markup for the CLARITY Act is set for January. Sacks thanked them for their leadership, along with Rep. French Hill and Rep. GT in the House, emphasizing that the U.S. is closer than ever to passing this landmark crypto market structure legislation.

It could be a big deal for how cryptocurrencies are regulated in the U.S., since right now the rules are a bit of a mess and businesses don't always know which regulations apply to them. With the passage of the CLARITY Act, things could be a lot more predictable, which is great for innovation and investment.

The U.S. has been playing catch-up when it comes to crypto regulations. Other countries, like the European Union, have already established a clear framework of their own, putting them one step ahead. If this bill after the GENIUS Act were to make their way into law, then that gap would be closed, and the U.S. would take the lead in digital assets regulation.

As the bill heads into markup this January, it's a move the crypto community continues to watch with bated breath. This will indeed be the principal move towards the creation of clear and fair rules in the digital asset market. As all goes according to plan, the CLARITY Act will advance in the Senate and could potentially even be signed into law later in 2026.

While some regulators have expressed apprehension over the bill, it has broad bipartisan support and thus is likely to pass. When signed into law, it may finally give clarity to the crypto market, finally establishing rules that businesses and investors alike can confidently follow.

Disclaimer: This article is for informational purposes only, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.