The talk of the Mira Network listing date is heating today, as the blockchain project recently shared two major updates. One is regarding a new system, and another is a token launch strategy.

On December 19, 2025, the project completed a crucial stage of its infrastructure migration, with strong support from Dysnix, its infrastructure partners. Let’s see what’s coming next, and what the major $MRX token updates.

Before we talk about the market debut, let’s understand what this project actually does. It helps real-world companies turn into "tokens" on the MIRA-20 blockchain. This feature gives the community a chance to become shareholders, and earn rewards.

Source: Mira Network Official X Account

Recently, the team decided to change their official name to Mirex $MRX. They did this to make sure nobody gets confused with other coins in the marketplace.

This system uses a dual-coin setup: Mirex coin, and Lumira Token. While $MRX handles the technical utility, Lumira Coin acts as the dynamic ecosystem fuel.

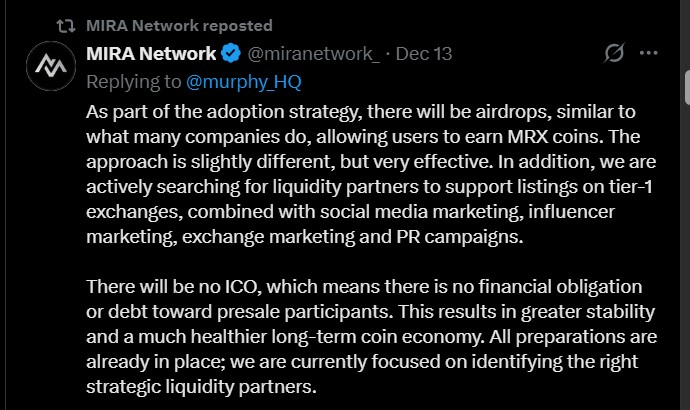

In a move that surprised many, the team confirmed there will be no ICO (Initial Coin Offering). Usually, projects sell coins to the public to raise money, but this project clearly said no.

Now the question come “Why”

Because they want to avoid debt and keep the coin's economy healthy.

Instead of a Mira Network ICO, they are focusing on a "Fair Launch."

The current focus has shifted to identifying strategic partners to support upcoming listings on Tier-1 exchanges.

This means the coin will enter the market in a way that protects investors and follows strict rules from Swiss regulators like FINMA. This strategy is making the Mira Network listing date even more anticipated by serious traders.

As the Mirex coin listing date is approaching soon, the project’s whitepaper has made the numbers very clear.

Source: Mira20 Whitepaper Website

There will be a total supply of 27,000,000 coins. Here is how they are split:

60% (16.2 Million): Reserved for mining.

20% (5.4 Million): Set aside for the presale rounds.

10% (2.7 Million): Kept for the team and advisors.

10% (2.7 Million): Used for liquidity to make trading easy.

The team has already passed a security check by CertiK, which means the code is safe and tested.

Even though there is no ICO, investors can still get coins! The team is planning a $MRX airdrop to reward the community. There will be 20 different airdrop events!

This is a great way for new users to earn coins without buying them. The Mira Network listing date is expected to bring the coin to "Tier-1" exchanges.

As per Coingabbar’s analysts, the listing exchanges may include MEXC, OKX, Binance, ByBit, and BitMart. These are all potential exchanges which match with many other new token launch criteria. As per the Mirex coin whitepaper, the price may launch around $0.95 USD.

Expert Opinion: "By skipping the ICO and choosing a fair launch, Mirex coin is choosing stability over quick cash. This is a very professional move that usually attracts big, long-term investors rather than short-term gamblers.”

The Mira Network listing date is a key moment for anyone interested in Real-World Assets (RWA). From moving away from the volatile "ICO culture" toward a more fair launch, Mirex $MRX token looks ready for a big 2026 debut.

Investors should watch for upcoming liquidity partner announcements as the Tier-1 exchange confirmation looks near.

Disclaimer: The information provided in this article is for educational purposes only. Cryptocurrency investments are risky, so always do your own research before investing in new tokens like Mirex.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.