In a big step for U.S. crypto traders, Coinbase launches 24/7 trading for Bitcoin and Ethereum futures. This is the first time that a CFTC-regulated platform in the U.S. is offering around-the-clock access to leveraged futures contracts. The move gives traders the ability to respond to crypto price changes at any time day or night, including weekends.

This change started on May 9, 2025, through Coinbase Derivatives LLC, a part of Coinbase. The goal is to match the 24/7 nature of cryptocurrency markets and give traders more control and flexibility, especially when prices move quickly. Announced on the official site of Coinbase.

Source: Coinbase

Till now, the futures market of the U.S. has been limited to conventional trading hours. This restricts traders to react quickly during significant price fluctuation outside of the trading hours. The platform is now transforming that, with the introduction of new services, investors and traders can grab the opportunities in real time.

The organisation is not doing this alone. It has collaborated with Nodal Clear, a CFTC-regulated clearinghouse to manage the back-end clearing of the transactions. This will act as an extra layer of security and transparency for users.

Market players like Virtu Financial will offer liquidity, helping ensure that trades can be fast and at fair prices. Top Futures Commission Merchants (FCMs) such as Wedbush Securities, ABN AMRO, and Coinbase Financial Markets will also support access to this new service.

This partnership makes it easier for the United States traders to onboard and start trading all within a regulated and secure environment.

The platform is also working on adding perpetual-style futures to its platform. These are popular in global trading, especially on platforms outside the U.S., because they don’t expire like regular futures. Once launched, it would be the first to bring these instruments into a U.S.-regulated setting.

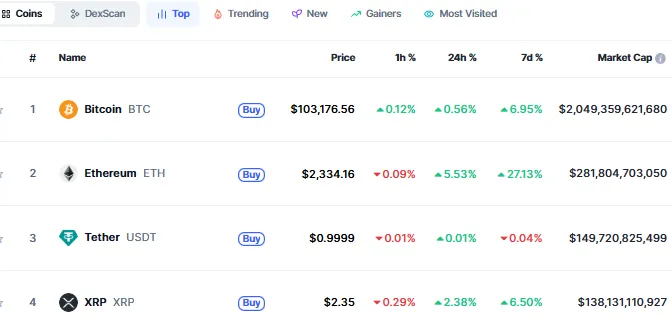

The launch has happened at the appropriate timing. Bitcoin has crossed $103,000, which resulted in increasing the market cap above $2 trillion. Ethereum has also witnessed strong gains, the currency is currently trading at $2334.51 as per the CoinMarketCap.

Source: CoinMarketCap

This crypto price surge is bringing in more institutional investors and increasing trading volumes. Coinbase's new 24/7 service perfectly aligns this increasing interest.

Coinbase is also extending its presence with a $2.9 billion Deribit Deal, the globe's largest crypto options exchange. This would bring crypto options trading onto its platform, allowing customers more avenues to trade under one umbrella.

Meanwhile, the organisation continues to resist ambiguous U.S. crypto regulations. A recent document request uncovered internal disputes within the SEC regarding how to treat digital assets, particularly Ethereum and XRP.

Through these optimistic steps, Coinbase is not only keeping pace with the market, it is setting it. By offering 24/7 regulated trading, the company is empowering traders with more freedom, access to tools, and flexibility they require in order to thrive in cryptocurrency markets.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.