Just when Wall Street thought the price increase was cooling off—it came roaring back. May’s PCE inflation report dropped like a bombshell, shaking up forecasts, delaying rate cut timelines, and rattling crypto sentiment.

Core PCE inflation, the Fed’s preferred cost increase gauge, surged to 2.7% in May 2025 — its highest level since February. The signal is loud and clear: data isn’t just sticky — it’s getting stickier.

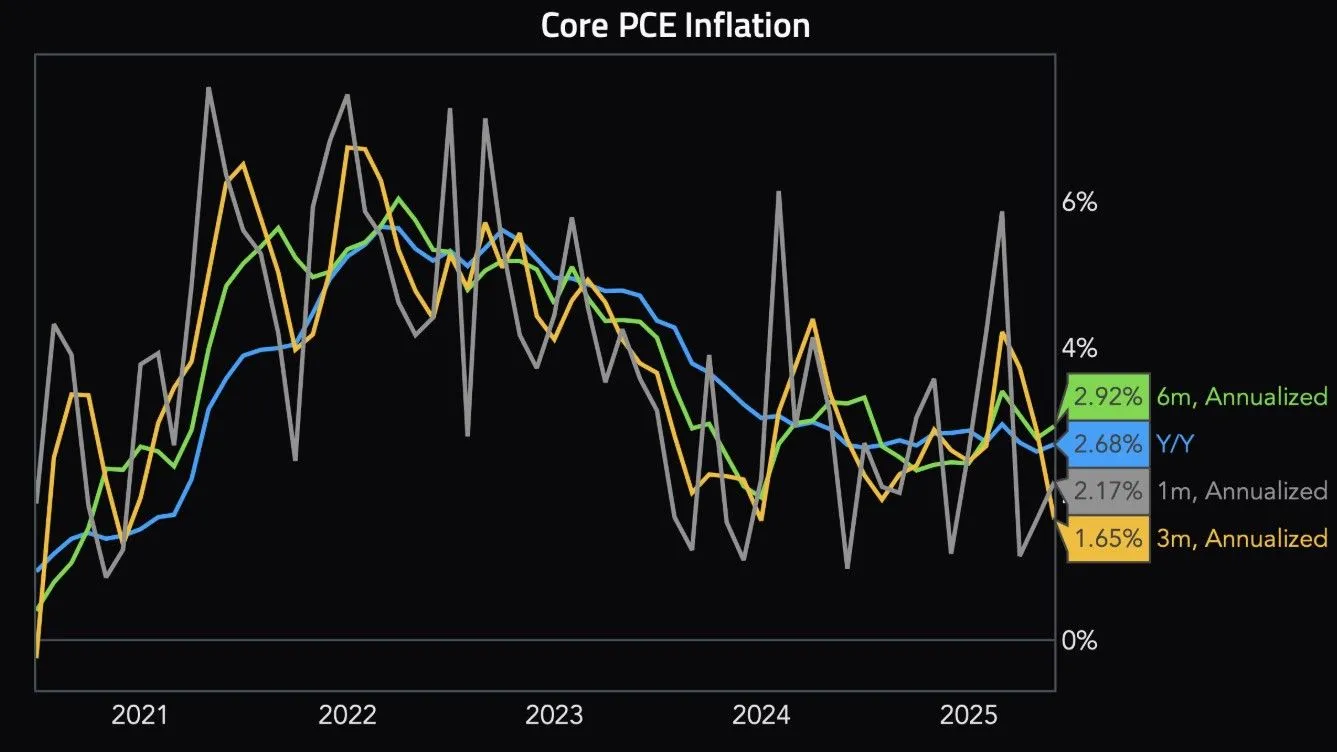

Here's US Core PCE inflation over different trailing periods from April to May:

And if you think the pain’s over, think again. New tariffs, strong wage growth, and consumer demand are still loading.

The U.S. economy just got a hot reminder that price surge isn’t backing down.

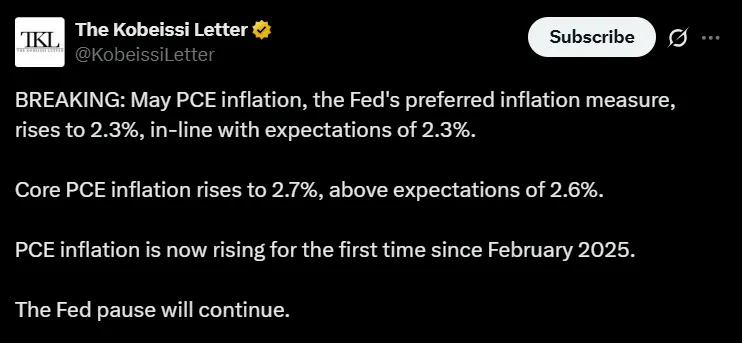

According to the May PCE report 2025, Core PCE surged 2.7% YoY, beating expectations of 2.6%. On a monthly basis, it rose 0.2%, above the 0.1% projection as per The Kobeissi Letter latest post on X. Meanwhile, headline PCE economic strain climbed to 2.3%, up from 2.1% in April.

This is the first time price hike has increased after 2 months of declines since February. Investors, Fed officials, and crypto heads are watching closely.

The May numbers reveal why it continues to surprise:

Widespread Price Increases

Core price hike, which excludes food and energy, shows persistent pressure across services and goods. High rates haven’t slowed prices yet.

Upcoming tariffs on Chinese imports are expected to drive this statistics up by another 1% or more by Q4 2025.

Wages and Demand Still Hot

Job growth remains strong, and rising wages mean high consumer spending continues, especially on goods — feeding more surge.

According to a bold call by Alpha Binwani Capital, the Fed is now more likely to delay its rate cut to September or beyond. Fed Chair Jerome Powell stance remains cautious, with his repeated calls for “patience.”

As The Kobeissi Letter posted on X:

“BREAKING: Stubborn inflation is the Fed’s number 1 enemy now.”

Markets are recalibrating fast. The era of “soft landing and summer cuts” might be over.

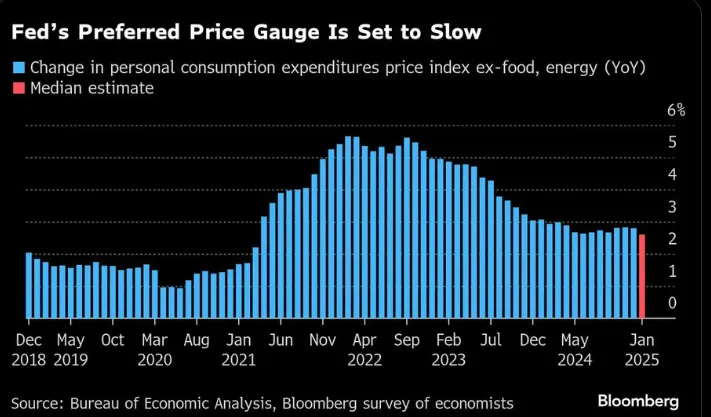

A recent Bloomberg chart sourced from the Bureau of Economic Analysis helps decode its comeback:

Blue Line: Core PCE inflation MoM — trending up since early 2024

Red Bars: Price hike-adjusted consumer spending — also rising

This shows that despite high interest rates, household demand remains strong, especially for goods. Rate surge hasn't cooled off American consumers yet.

Here’s what could fuel this event even more through 2025:

The full effect of the U.S.-China tariff hikes is due later this year, expected to push prices further upward.

Labor market tightness means salaries keep rising, maintaining spending power.

What does this mean for crypto investors? Here’s the breakdown:

Short-Term Pressure: If Fed cuts take longer than expected, expect pullbacks in Bitcoin and altcoins. Tightening liquidity and high-risk assets will lead to lower prices.

Mid-Term Opportunity: Concerns about centralized monetary systems, will resurface Crypto narratives as a hedge, especially for DeFi and Bitcoin vs. altcoin against this latest US inflation news today.

Long-Term Play: If it stays above 2.5% into 2026, crypto adoption could surge, driven by distrust in traditional monetary systems.

From higher core PCE inflation May 2025 to approaching tariff waves, the Fed is painted in a corner. cut rates and increase the price surge spiral—or hold steady and test the economy’s strength.

For crypto investors, and macro traders, this isn’t just another data point — it’s a cycle reset. If you’re not positioned for persistent monetary pressure and delayed rate relief, you’re already behind.

Buckle up — because what comes next may reshape not just markets, but the entire global macro playbook.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.