As digital asset continue to rise across many countries, a growing number of investors are actively searching for 0% Crypto Tax countries to legally keep more of their profits.

In a recent post by Bitinning, it highlighted 19 cryptocurrency tax free countries, drawing attention from traders, long-term holders, and digital nomads looking to earn extra through smarter location choices.

Verified data from 2026 sources confirms that many of these countries still allow individuals to earn from cryptocurrencies without paying capital gains duties.

The interest comes at a time when global crypto reporting rules are expanding, making investors more aware of digital assets levy by country differences.

Instead of illegal crypto tax avoidance, many users are choosing legal relocation or residency options in jurisdictions where taxes are zero or very low. This allows them to earn extra from trading, investing, or holding virtual currencies long term.

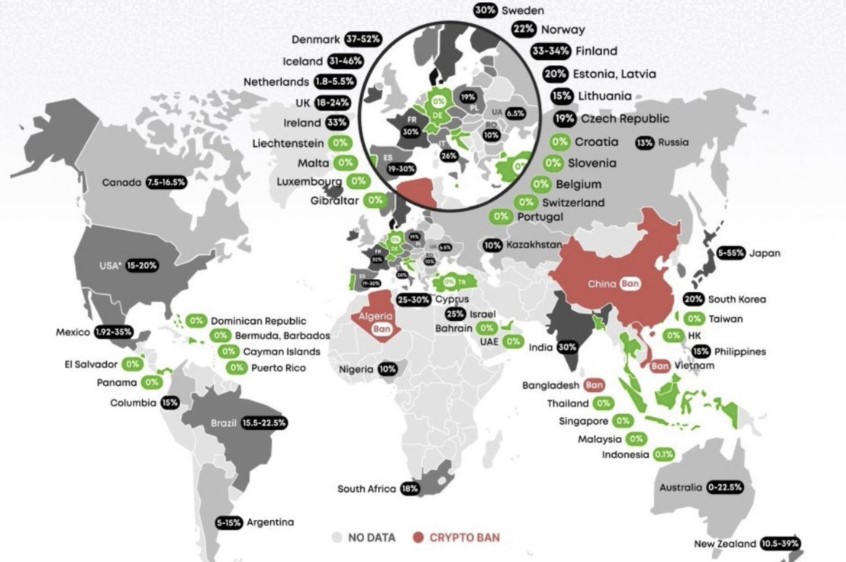

Several countries continue to offer 0% Crypto Tax on individual cryptocurrency gains in 2026:

United Arab Emirates (UAE): No personal income-tax or capital gains digital currency taxes

Singapore: No capital gains crypto-tax for non-professional traders

El Salvador: One of the biggest National-level Bitcoin holder, allows levy free Bitcoin gains

Cayman Islands, Bermuda, Gibraltar: Offshore crypto-tax free countries

Switzerland: Private investors often enjoy 0% levy on cryptos

These locations are considered some of the best countries for legally earning more from cryptocurrency activities.

Not every low-tax country is fully tax-free. Some apply conditions that investors must understand before moving:

Portugal: Short-term cryptocurrencies gains are taxed, but long-term holdings remain tax-free

Germany: Capital gains crypto-tax is 0% only if digital asset is held for over one year

Malta: Crypto-tax benefits depend on long-term investment structure

Knowing these rules helps investors avoid mistakes while planning earnings across borders.

While some countries offer 0% Crypto Tax, others impose heavy levy and stricter regulations. In some states even without strict rules, absence of clarity or vagueness on the digital assets’ status can also put pressure on traders.

India: India has the largest digital coins adopting population, still it does not consist of any clear rules for virtual assets trading except a heavy 30% crypto tax rate with 1% TDS on transactions.

United States: Despite being known as a favorite destination for the enthusiasts, the country imposes high capital gains taxes along with state-level taxes.

Japan & Denmark: Some of the highest levy rates globally, where Japan is planning lower rates, but they are not in effect yet.

However, countries such as China, Algeria, Bangladesh, Egypt, and Morocco continue to prohibit most cryptocurrency trading, payments, or mining activities. They have taken an even more strict approach.

In these regions, cryptocurrencies is often restricted due to concerns over capital control, financial stability, and misuse. For investors searching for more profits, these locations are generally avoided, as earning or holding virtual tokens can lead to legal risks rather than benefit in taxes.

Cryptocurrency has moved beyond speculation. Today, it is used for payments, reserves, and investments by individuals, institutions, and governments. As virtual currency adoption grows, tax-planning has become part of the earning strategy.

Choosing a country with 0% Crypto Tax does not mean avoiding the law—it means understanding rate by country and earning smarter. With regulations tightening globally, legal tax-friendly locations are becoming key destinations for the investors looking to maximize real returns.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult a qualified professional before making relocation or investment decisions.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.