The upcoming Cronos App Launch is creating fresh buzz in the Cronos ecosystem. The team has confirmed a soft launch is expected around April, along with a rebrand from Cronos chain to CronosApp. The idea is simply to make the platform more user-friendly and position it as a stronger trading and Web3 platform.

Backed by Crypto.com’s reported 150+ million users, the app aims to bring DeFi, NFTs, gaming, and Web3 tools into one mobile-focused experience. Many investors following Cronos news today are now asking one big question: can this launch help CRO recover from its recent monthly losses?

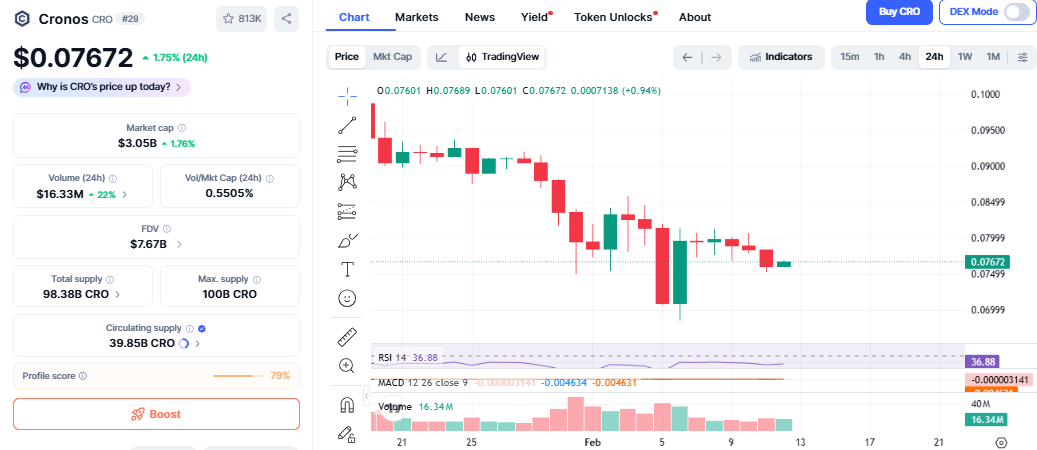

Right now, it is trading near $0.0767, showing a 24-hour gain of around 1.7%. The price has moved between roughly $0.0760 and $0.0769 during the day, which shows tight consolidation. There is no strong breakout yet, but there is also no heavy selling.

Source: CoinMarketCap

However, when we zoom out, the picture looks weaker. It is still down 23.72% over the past month. That monthly drop reminds investors that the token has been under pressure for weeks. The recent small bounce does not erase that decline, but it may signal some stability.

Looking at the chart, it is hovering close to an important balance zone. Buyers are defending the area near $0.0753, while sellers are active near $0.0772. This creates a narrow range where the price is moving sideways.

The Cronos App Launch is not just a name change. During a recent AMA, the management explained that they want to turn Cronos into a stronger trading venue.

They also spoke about making sure revenue flows back to the CRO token.

Two ideas were discussed. One is using a community pool burn mechanism. The second is using revenue to buy back and burn tokens. Both methods could reduce supply over time, which may support price if demand grows.

Source: X (formerly Twitter)

It already powers the network. It is used for gas fees, staking, governance, and incentives across DeFi, NFTs, and gaming. If the app brings more users into the ecosystem, demand for the crypto could increase naturally.

There are also signs of bigger plans. Fireblocks integration hints at possible institutional access. Marketing campaigns and partnerships tied to Crypto.com may also improve visibility. But the market usually waits to see real results before reacting strongly.

This recent news could support token, but the chart shows the token is still stabilizing after its recent drop.

For strength to return, it needs to move above the $0.078–$0.080 zone.

A clear break above that area could push the price toward $0.085, and possibly even $0.09 if market sentiment improves.

On the downside, $0.075 remains key support. If that level breaks, it could slip toward the $0.072–$0.070 range.

Since the token is still down more than 20% over the past month, a full recovery may take time. The app launch may improve sentiment, but stronger volume and better overall market conditions will be needed for a sustained move higher.

The Launch gives the project a stronger story. A rebrand, new app, and revenue-focused strategy are positive long-term steps. But price recovery will likely depend on two things: overall crypto market stability and real user adoption once the app goes live.

For now, it looks stable but cautious. The token needs a clear breakout above resistance to shift momentum in its favor. Until that happens, it may continue moving sideways.

Investors are watching closely. If adoption grows after launch, it could slowly rebuild strength. But if market pressure returns, recovery may take more time.

YMYL Disclaimer: This content is for informational purposes only and not financial advice. Crypto investments are risky and volatile. Always do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.