Highlights

Experts caution that almost 80% of projects that are hacked do not completely recover.

Long term damage is caused by a breakdown of trust and ineffective response rather than loss of funds.

The greatest security threats now are human error and AI-based Crypto Hack.

A recent alert by Immunefi CEO Mitchell Amador tells an ugly truth in the crypto industry: nearly half of crypto projects that are hit with major hacks do not fully recuperate.

Experts say that stolen money is hardly the real cause of the damage. Rather, projects fail because they are operationalized into a state of paralysis, unable to manage the crisis, and lose user confidence at the critical response stage.

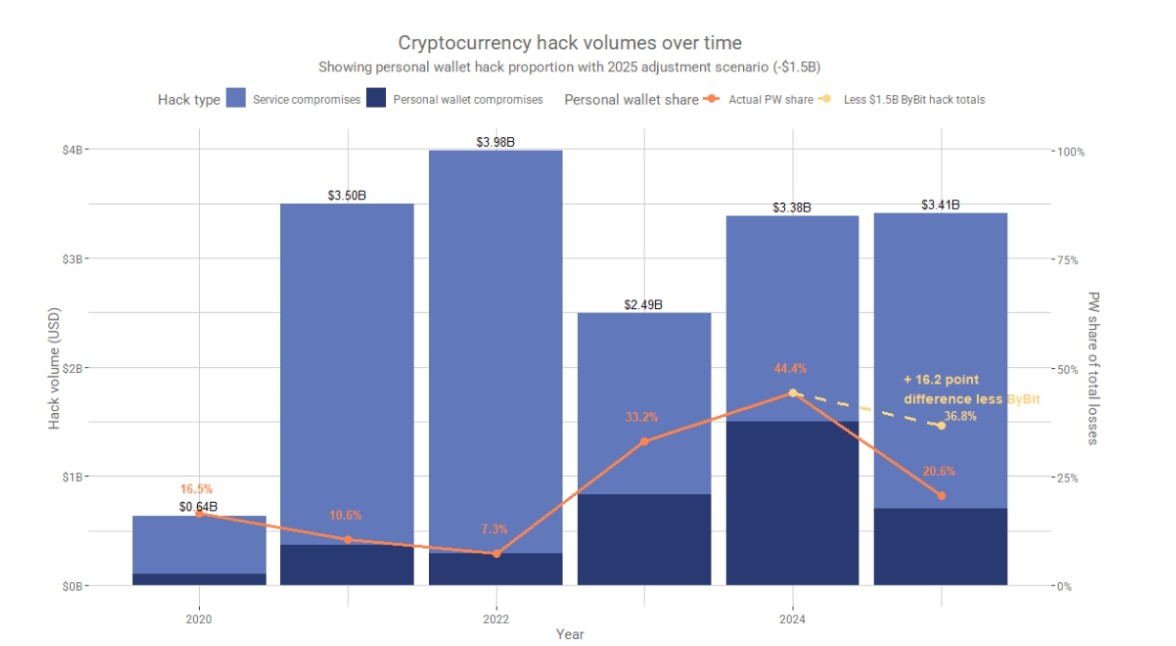

The results are against a background of a drastic increase in crypto-related hacks, which have hit a total loss of $3.4 billion in the year 2025, the highest since 2022. Security leaders emphasize that the response to an exploit by a project can usually be the difference between the project and its death.

source: Wu Blockchain

The majority of hacked crypto projects are unsuccessful due to the lack of readiness for emergency security situations. Amador states that a significant number of teams do not realize how vulnerable they are to attacks and do not have a clear incident response plan. Once a breach is realized, confusion arises, the process of decision-making becomes slow, and important actions are postponed.

This breakdown leads to:

Prolonged downtime

Loss of user confidence

Liquidity drain

Long-term reputational loss.

Users will not come back once they lose trust.

The initial few hours of a cryptocurrency hack are the most destructive. Teams tend to be reluctant, argue in-house, or even attempt to conceal the problem to prevent social criticism.

Most projects postpone stopping smart contracts, fearing their reputation being damaged, which usually leads to more losses.

There is bad communication, which aggravates the situation.

The silence generates panic among the users, which increases fear instead of containing it. Scholars concur that quick, open communication is essential despite the unavailability of the information.

Any crypto project is based on trust. According to Kerberus CEO Alex Katz, a major exploit is a death sentence to most platforms. When the users lose confidence, they withdraw money, liquidity is lost, and the project is hard to sustain.

Reputational damage is usually irreversible, even when the technical defect is resolved, and it is almost impossible to recover.

Not anymore. Although exploits of smart contracts continue to happen, human and operational errors are currently the major contributors to crypto losses. These include:

Sanctioning malicious transactions.

Falling for phishing scams

Revealing personal keys or seed phrases.

A case in point is that of a user who lost more than 282 million after being duped by a fake support agent posing as a hardware wallet vendor.

Hacks of cryptos increased to 2025, with a total loss of $3.4 billion. Almost 69% of all losses were caused by only three significant events, such as the $1.4 billion Bybit hack. These statistics demonstrate the increasing magnitude and complexity of attacks on both platforms and individual users.

Source: X

The use of artificial intelligence has helped to make attacks more efficient. Hackers have adopted AI to execute massive social engineering campaigns, in which they send thousands of personalized phishing messages each day. This has greatly enhanced success rates, particularly for the less-experienced users.

Yes. Regardless of increasing threats, the experts are hopeful. Amador thinks that the year 2026 may be the year of crypto security, as it will be powered by:

Better development practices.

Stronger audits

On-chain monitoring tools

Premier threat intelligence and firewalling.

Nevertheless, specialists emphasize that technical security is not sufficient. The projects should also invest in incident response planning and communication strategies.

Disclosure: It is not financial advice. Do Your Own Research before investing. CoinGabbar has no liability for any financial loss. Cryptocurrencies are very unpredictable, and you can lose all your money.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.