The international crypto market is consolidating, probably because of the long holiday weekend. The overall market capitalization has increased marginally to $2.67 trillion with a 0.36% increase, and trading volume fell 19.7% to $60.1 billion, as per CoinMarketCap. DeFi activity accounted for $5.12 billion (8.51%), and stablecoins took over with $55.42 billion (92.22%). Bitcoin dominance decreased marginally to 62.97%, down 0.02% from the previous day.

The market continues to stay calm and balanced, and traders are most probably waiting for the big one.

A few major events are shaping the crypto world today. The news is sending mixed messages to traders, and hence creating a guarded atmosphere in the community.

BlackRock's $13 Million Bitcoin Buy: BlackRock, the asset management titan, has made another $13 million Bitcoin buy, its second in two days. The information was provided by Arkham Intelligence on X (Twitter). Although BlackRock has typically invested through ETFs, this outright purchase has drawn surprise. Some speculate that they might be privy to some future developments that would be favorable to Bitcoin. The move is viewed as a significant expression of faith in the leading crypto asset.

Spot Bitcoin ETFs Experience Inflows, Ethereum Does Not: On April 17, Spot Bitcoin ETFs recorded a massive net inflow of $107.83 million, bringing their total to $35.37 billion, indicating more investor interest in Bitcoin as opposed to Ethereum. Bitcoin ETFs recorded $1.55 billion in total traded value and $94.51 billion in net asset value, which accounts for 5.59% of the market capitalization of BTC.

Source: SoSoValue

Meanwhile, Ethereum spot ETFs saw no inflows, with $178.76 million in value changing hands and $5.27 billion in assets under management—only 2.76% of Ethereum's market capitalization.

Trump Talks Trade Peace with China: Former U.S. President Donald Trump mentioned on Thursday that China may be ready for trade talks. He also discussed positive conversations with leaders from Mexico, Japan, and Italy. Although there’s been no response from China yet, the timing of these talks — and BlackRock’s BTC buys — has made people wonder if the two are connected.

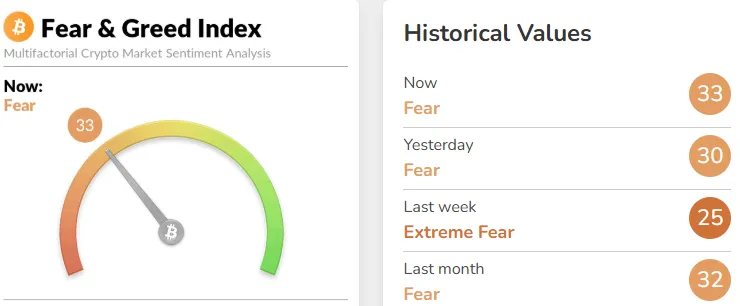

Fear and Greed Index Shows Fear is Still Dominant: The Fear and Greed Index currently sits at 33, indicating the market remains in a state of fear. Although it has improved slightly from yesterday’s 30 and last week’s extreme fear level of 25, investor sentiment is still cautious.

Such conditions typically lead to slower trading activity and hesitation, as traders remain wary of potential downturns.

Despite all this, there’s a new worry that could change everything. According to The Kobeissi Letter, Foreign investors are pulling money out of U.S. stocks. Last week, about $6.5 billion was withdrawn, the second-largest outflow on record. Only the March 2023 banking crisis saw a bigger pullback. Currently, foreigners hold $18.5 trillion worth of U.S. stocks—20% of the total stocks. They also hold a large share of U.S. Treasuries and corporate bonds.

Source: X

This exit shows a drop in confidence among global investors. A sharp chart drop labeled “Foreigners selling US equity funds” highlights the largest dip in inflows since 2020. If traditional markets continue to shake, many fear that crypto assets—often seen as high-risk—could be the next to get hit. If panic develops, a sell-off on a large scale will follow, potentially causing a crash.

In the meantime, the crypto space remains subdued but is observing intently. Traders and platforms await whether this calm will be broken upward—or downward. The coming days may be crucial for projects, coins, and market in general.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.