Big things are happening around this token right now, and it’s not just price talk. BlackRock just bought $13 million worth of BTC, Trump dropped a surprising China update, and Michael Saylor posted a mysterious “Bitcoin is Calling” message.

Are these moves connected? Or just a wild coincidence? Let’s break it all down

In the fast-paced world of crypto, timing is everything. Within just a few hours, three major events unfolded—each raising suspicions across the market.

U.S. President Donald Trump suggested that China is open to trade talks despite growing tensions.

Asset management giant BlackRock made its second consecutive purchase, totaling $13 million.

Michael Saylor shared a cryptic message: "Bitcoin is Calling."

Is this a signal of what’s coming next for the king of crypto?

According to Arkham Intelligence , BlackRock has bought another $13 million worth of $BTC, just a day after a similar purchase, according to Arkham Intelligence.

Source: Arkham X Account

While Blackrock invested in Bitcoin through ETFs before, this direct buying is a big deal. It usually means they’re confident about this coins future—or they might know something big is coming.

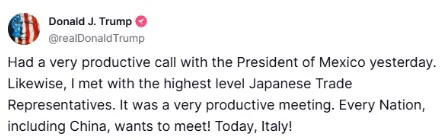

On Thursday, Donald Trump said that China might be ready to talk about ending the ongoing trade war. He mentioned having good conversations with leaders from Mexico, Japan, and even hinted at meetings with Italy and China.

Source: Donal Trump X Account

However, China hasn’t confirmed anything yet. The interesting part? Just after Trump’s comments, BlackRock bought more of this top cryptocurrency—making people wonder if there’s a connection.

Adding further intrigue to the scenario, MicroStrategy founder Michael Saylor posted a cryptic message on X: "Bitcoin is Calling". No explanation. No follow-up. Just an image suggesting urgency or opportunity.

While no official filing has confirmed a new acquisition yet, the timing of his post—alongside BlackRock’s accumulation and political developments—has fueled market speculation.

Could MicroStrategy be preparing for another major purchase?

According to TradingView, at the time of writing:

Source: TradingView

Bitcoin Price: $84,667.53

24-Hour Change: +0.06%

Market Capitalization: $1.68 trillion

24-Hour Trading Volume: $21.31 billion (down 23.06%)

Despite low volume, its price remains stable. This is often seen as an accumulation phase, especially when institutions are buying while retail activity remains muted. A significant drop in volume with steady value usually implies that large investors are quietly entering positions.

Analysis: Is This Coordinated Buying or Market Misinterpretation?

There are two ways to interpret this sequence of events:

Coordinated Institutional Buying Based on Macro Signals

Big players like BlackRock (and maybe MicroStrategy) could be acting on early hints about possible U.S.-China trade talks or changes in economic policy. They might be buying this crypto now to get ahead of a big market move.

Coincidence Amplified by Market Sentiment

These events might not be connected at all—but since they’re happening close together, its looking all of these is linked. Although we may not see immediate price movement, the psychological impact on retail investors could still drive short-term volatility.

Either way, when major institutions start making moves in worlds largest cryptocurrency, it’s usually not by accident.

Even if there’s no clear connection between these events, one thing is obvious—big players are making moves, and this largest currency isn’t dropping now.

With BlackRock buying more BTC, Trump hinting at China talks, and Michael Saylor teasing something big, it feels like something is building up behind the scenes.

If China confirms a meeting or MicroStrategy announces another BTC buy, its price could shoot up quickly.

Note: Keep an eye on the next 48–72 hours. If MicroStrategy files a BTC purchase or geopolitical developments escalate, we could witness a key pivot in Bitcoin's market trajectory.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.