After a tough drop of 10.92% on what traders called "Black Monday," the global crypto landscape is showing signs of recovery. According to CoinMarketCap, today, the total crypto market cap stands at $2.51 trillion, up by 3.04% in just one day. However, the 24-hour trading volume dropped by 12.39%, now sitting at $150.17 billion.

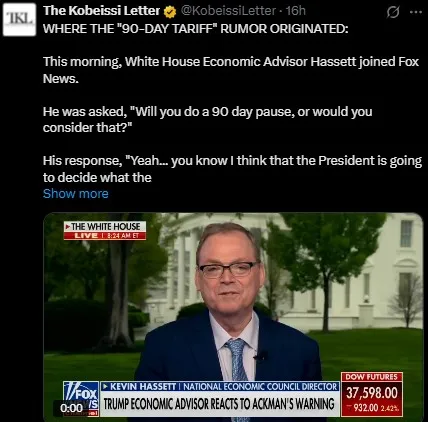

Trump Tariff 90 Days Pause News: The biggest reason behind the sudden bounce was the Trump tariff rumor. On April 7, a report suggested that President Trump was planning a 90-day delay on tariffs for all nations except China. Although later called “fake news” by the White House, this news caused confusion and volatility. The Kobeissi Letter shared the details over X.

Source: X

White House official Kevin Hassett denied the report, saying Trump would stick to tough tariffs.

Sectors globally crashed, including oil and stocks, but Bitcoin (BTC) and other coins bounced back briefly.

Starting April 6, a global 10% baseline import tariff kicked in. The U.S. also raised tariffs on Chinese and EU goods, and China responded with a 34% tariff on U.S. products.

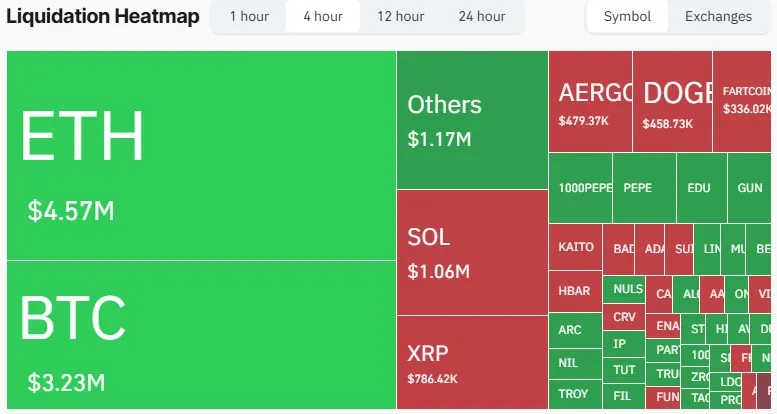

Liquidation Map Shows Market Confidence: Another reason for the recovery is a drop in liquidations. On April 7, over 460,000 traders were liquidated, amounting to $1.42 billion. But today, the number dropped to 117,814 traders, with total liquidations at $437.66 million, according to Coinglass.

Source: Coinglass

This decline shows that traders are getting more confident, and fewer high-risk positions are being wiped out.

Bitcoin and Altcoin Price Surge: As per CoinMarketCap data, the price of Bitcoin (BTC) rose from $76,361.56 on April 7 to $79,260.27 today—an intraday gain of 2.75%. Its market cap now stands at $1.56 trillion with $67.57 billion in 24-hour trading volume.

Source: CoinMarketCap

Other top coins also showed gains. Ethereum rose by 5.04%, Solana by 8.30%, and XRP by 6.18%. This shows that some confidence has returned to the industry.

Fear and Greed Index Indicates Extreme Fear: Despite the bounce, warning signs remain. The Fear and Greed Index is showing "Extreme Fear" at 24, up slightly from 23 yesterday.

Last week, it was 34, and last month, 27. This suggests that users are still nervous and that the sector could crash again if negative news hits.

The next big updates to watch are the CPI and PPI data, which will be released on April 10 and 11. These inflation numbers could affect how investors feel. Also, further clarification about the fake Trump tariff news may impact industry direction.

The crypto market has demonstrated solid indications of rebounding after Black Monday. The rebound was facilitated by declining liquidations, the increase in Bitcoin's price, and speculation over Trump's tariff policy. Nevertheless, investors should be vigilant. Extreme fear still lingers, and future data releases may lead to further price volatility.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.