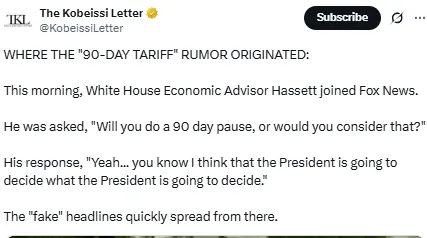

On Monday, the White House dismissed a report in the media as “fake news”, the talk was that the US President Donald Trump was planning a 90-day delay in the reciprocal tariffs to all countries, with an exception of China.

As stated by the Kobeissi letter earlier today, quoting White House Economic Council Director Kevin Hassett that the US President was mulling a three-month delay in implementing Trump tariffs of all nations, except China.

This follows stock markets and crude oil prices plummeting further today for markets as Trump remained adamant about his tariffs in the face of recession worries.

The crypto market crash on April 7, 2025, which wiped out 10.92% of value and dropped the global market cap to $2.37 trillion, echoes the panic of Black Monday in 1987. After the news cryptocurrency like bitcoin had a increase of 3.68% in last 24 hours.

Trading floors worldwide were swept by waves of additional selling following last week's steep losses, as Trump urged Americans to "be strong, courageous, and patient," just before the New York stock market opened to declines of more than three percent.

Earlier this day, Trump claimed he talked to European and Asian leaders at the weekend, who will try to persuade him to reduce tariffs of up to 50% that are to be imposed this week. After the fake news came into picture the market again gyrated during this whole scenario.

On Sunday, Hassett had defended Trump tariffs and contradicted the assumption that they would make American consumers pay more. "So, the reality is, the nations are not happy and retaliating and, by the way, sitting down. I received a report from the [U.S. Trade Representative] yesterday evening that over 50 nations have contacted the president to initiate a negotiation. But they're doing so because they recognize that they bear much of the tariff. And so, I don't think that you're going to see a significant impact on the consumer in the U.S. because I do believe that the reason why we have a persistent, long-term trade deficit is because these individuals have very inelastic supply," he said to ABC News.

A 10-percent "baseline" import tariff from across the globe went into effect Saturday. A range of nations will be targeted by increased duties from Wednesday, with duties of 34 percent on Chinese products and 20 percent on EU products.

Beijing last week said it would impose a 34-percent tariff on US products, effective Thursday.

Global markets are in shambles as President Trump refuses to budge on his belligerent tariff policy, even as economic recession fears rise. With the imposition of heavy import tariff on major trade partners looming and with no indication that the policy is going to change, investor sentiment keeps deteriorating. With negotiations stalled and tensions escalating, the world waits to see if the increasing financial pressure will get leaders back to the bargaining table—or broaden the gap in the world trade picture.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.