Key Highlights:

The global cryptocurrency market capitalization to $3.3T.

Bitcoin and Ethereum remained stable, while the altcoins fluctuated, albeit unevenly.

The Fear and Greed Index shows signs of positive trends.

Overall Crypto Market Update, January 6, 2026: The cryptocurrency on rise, with increasing capitalization and volume, led by Bitcoin and Ethereum.

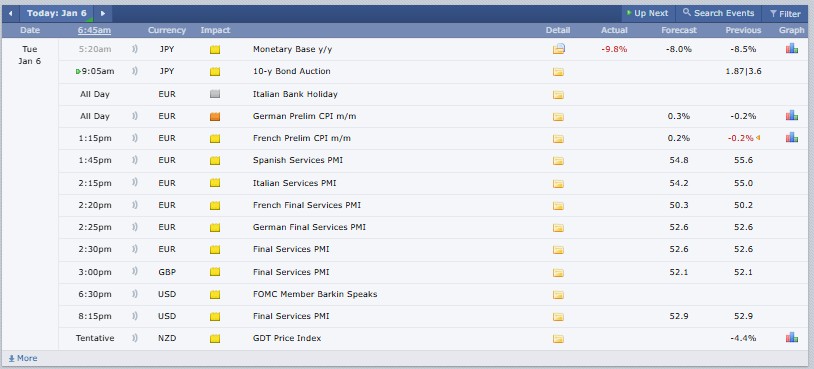

Source: Forex Factory

The global cryptocurrency market today recorded a capitalization of $3.3 trillion, reflecting a 1.3% upward trend in the last 24 hours. Total trading volume noted $143 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 56.8%, while Ethereum (ETH) carries 11.8%. As of now, 18923 cryptocurrencies are being tracked. The largest gainers of the industry are Polkadot and XRP Ledger Ecosystem in the last 24 hours.

Bitcoin (BTC) and Ethereum (ETH) Price:

Note: BTC and ETH are often viewed as less volatile historically, but still risky.

Bitcoin (BTC) price today reached $93983.17, rose by 0.93% in the last 24 hours, with a trading volume of $48.59 billion and a market cap of $1.8 trillion.

Ethereum (ETH) priced today at $321.95, slightly up 0.9% in 24 hours, with a trading volume of $25.66 billion and a market cap of $390 billion.

Top 5 Trending Coins in 24 Hours:

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

Bitcoin (BTC) trades at $94,079.14, up 1.36%, with strong trading volume (TV) of $49.13 billion.

XRP price today is at $2.39, recording a sharp 11.97% gain, while TV stands at $6.7 billion.

Ethereum (ETH) trades at $3,240.14, rising 1.83%, supported by $25.95B in TV.

Solana (SOL) is priced at $138.35, up 1.57%, with TV reaching $4.96B.

GaiAI (GAIX) trades at $0.1204, gaining 0.33%, while posting $147.39 million in TV.

Top 3 Gainers in 24 hours:

(Ranked by 24-hour percentage gain)

Virtuals Protocol (VIRTUAL) is priced at $1.08, up 15.39%, with a trading activity of about $416.8 million

Sui (SUI) is priced at $1.96, gaining 14.47%, and has recorded a strong trading activity of around $1.61 billion.

Lighter (LIT) is priced at $3.05, up 12.26%, with a notable trading activity of about $37.3 million.

Top 3 Losers in 24 hours

(Ranked by 24-hour percentage loss)

MYX Finance (MYX) is at $4.89, down 21.02%, with a trading volume of about $40.4 million.

Canton (CC) at $0.1402, showing a 7.42% dip, with trading volume close to $36.9 million

Midnight (NIGHT) at $0.08588 drops 4.17%, recording a TV of around $49.6 million

Stablecoins and Defi Update:

Stablecoin markets noted no change over the past 24 hours, with a market capitalization of $312.5 billion and trading volume of $114.4 billion.

The Decentralized Finance (DeFi) market increased 2.4% over the last 24 hours, recording a market cap of $114.4 billion and trading volume (TV) at $5.4 billion. Defi dominance globally marked 3.5%.

Source: Alternative Me

Today’s Fear and Greed Index is 44 (Fear), rising from 26 yesterday, 23 last week, and 20 last month. Prices stabilized, volatility eased, and buying returned, but uncertainty remains, keeping sentiment cautious rather than greedy amid macro and liquidity concerns.

(Note: All of these updates affect traders, as they affect liquidity, sentiment, and potential returns, and thus have to be monitored closely.)

1. U.S. Crypto Law Faces Delay

TD Cowen said US crypto structure laws may advance this year but likely pass in 2027, with rules by 2029, as conflict-of-interest limits spark political debate in Washington today.

2. Crypto Firms Fund MAGA PAC

Gemini and Crypto. com-linked Foris Dax donated over $21 million to pro-Trump MAGA Inc., boosting its funds to $294 million for 2026 U.S. midterm election campaigns aimed at influencing Congress control.

3. 1inch 2025 Trading Surge

1inch’s 2025 review: swap volume hit $214B, up 39%, with 114M trades. Ethereum led, while BNB Chain surged nearly tenfold, alongside Arbitrum and Base networks worldwide today.

4. Lighter Begins LIT Buyback

Lighter has started using protocol fees to buy back LIT, with its treasury holding about 180,526 LIT worth nearly $540,000 so far after official announcement release.

5. Bitcoin Options Signal Calm

Bitcoin options data shows traders favor $100,000 call options over $80,000 puts, while fading put premiums suggest easing risk fears and stabilizing sentiment, analysts say, ahead of January expiry.

Compared to yesterday’s crypto market update, today’s shows a meaningful shift in confidence. Total capitalization increased to $3.3 trillion, up about 1.3%, while 24-hour trading volume reached $143 billion. The Fear and Greed Index jumped from 26 to 44, signaling a move away from panic. Bitcoin remained near $94,000, posting sub-1% gains, while Ethereum rose around 0.9%. Overall, volatility declined, and sentiment improved from yesterday.

To crypto users, the data is an indicator of a more relaxed yet cautious market. Enhanced liquidity, less fear, and stable blue-chip prices provide short-term trading. However, macro uncertainty and regulatory delays imply that risks exist. Strategic position sizing and close tracking are essential.

Risk Context: This commentary is only informational and not for long-term conditions. It does not indicate the direction of the price or indicate an action to be taken on the investment.

Based on the 24-hour update, the investment is risky but selectively profitable. Today is positive, but regulatory uncertainty and macro risks remain. Investors with long-term investments are advised to remain conservative, whereas short-term traders are likely to enjoy controlled and well-investigated opportunities.

Disclaimer: This is not financial advice. Do Your Own Research before investing. CoinGabbar is not liable for any financial loss. The crypto assets are risky, and you may lose all your investments. Not all regions can offer some of the services or assets discussed.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.