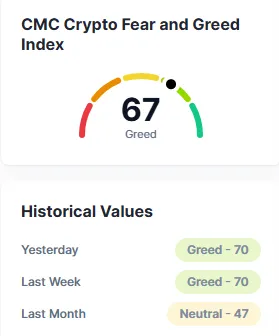

The global crypto market is worth $3.91 trillion today. Total trading volume in the past 24 hours was $264 billion. The leading coin is Bitcoin, which controls 60.2% of the market, while Ethereum is at 11.1%. The Fear and Greed Index stands at 67 (Greed), down a little from yesterday's 70. Both Bitcoin and Ethereum are down slightly today.

Source: CoinMarketCap

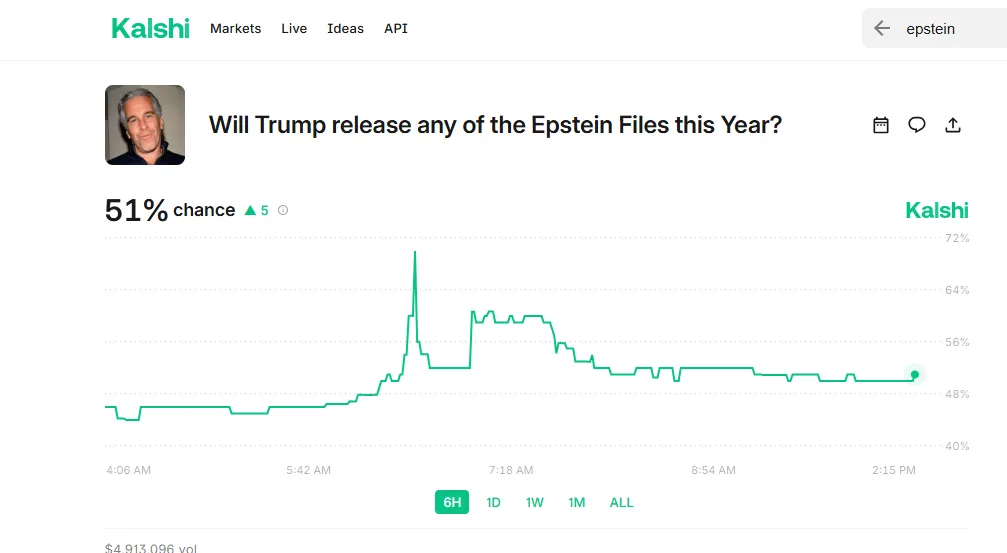

There was a political drama wave in the crypto market following rumors that Donald Trump's name is implicated in the Jeffrey Epstein files. This news, according to sources, was from a classified DOJ report in May.

Forecasting platform Kalsi has put 51% chances of Trump speaking to these allegations.

If he does, experts say that he could attempt to use it to restore public faith, particularly with young voters who value transparency.

Trump is also meeting the Federal Reserve, fueling speculation regarding interest rate cuts, which typically underpin cryptocurrency prices. When he uses political defense in combination with economic strategy, the crypto market may have a sharp bounce back from today's 1.30% decline.

Source: Kalshi

In Europe, the crypto market is experiencing a buzz due to a new alliance between 21Shares and Societe Generale, a leading European bank. The alliance is aimed at increasing Bitcoin and Ethereum ETPs (Exchange-Traded Products).

Now, institutional investors in Eastern Europe and Germany can easily trade cryptobacked investment products such as ABTC, CBTC, AETH, and CETH. This action boosts liquidity, enhances trade execution, and provides more visibility to leading digital assets.

SocGen's Martina Schroettle described it as a "milestone," and 21Shares also stated that the action contributes to broader digital currency access in Europe. The partnership will make more money flow into Ethereum-based ETPs, which have already recorded record inflows this year.

What are Bitcoin and Ethereum ETPs?

ETPs are investment products that track the price of assets such as Bitcoin or Ethereum but where the investor never actually owns the coins. This makes it easier for people to invest in crypto using safer, more conventional systems.

21Shares is also planning to list further ETFs in the U.S., including those focused on Polkadot, Litecoin, and XRP, which marks increasing demand for regulated digita investment.

Source: Wu Blockchain

The U.S. government currently possesses more than 198,000 BTC, worth approximately $23.5 billion. They were seized from criminal investigations such as the Bitfinex hack, the Silk Road bust, and others.

Contrary to recent speculations, no large sales have occurred in recent times. A few officials, such as Senator Cynthia Lummis, expressed worries that the majority of the BTC were sold, but data from the blockchain indicated otherwise. Only the U.S. The Marshals Service had transferred a minor amount.

These untroubled government wallets are closely monitored. If the U.S. were to sell only a fraction of these holdings, the crypto market may experience significant price changes.

Source: X- Wu Blockchain

Tether, the developer of USDT, has plans to enter the institutional stablecoin market in the U.S., CEO Paolo Ardoino explained that the preparations have already begun, and an official release will take place soon.

This is barely after the GENIUS Act was signed into law, providing new regulations on stablecoins. Major banks such as JPMorgan, Wells Fargo, and Citigroup are also getting ready to issue their own coins under the new regulations.

Ardoino thinks that Tether also has the advantage because it already has experience in the crypto market even when the traditional banks enter into the competition. JPMorgan forecasts that the market for stablecoins may expand to $2 trillion by the year 2028.

Source: X (Formerly Twitter)

The current situation is a blend of uncertainty and potential. While politically oriented news such as the Trump-Epstein rumors creates uncertainty, large-scale developments such as the 21Shares–SocGen deal and Tether's U.S. expansion indicate actual advancement toward crypto adoption.

With the Federal Reserve meeting on the horizon, and growing government involvement, traders and investors will need to stay alert.

Dishika Ahuja is a skilled crypto writer with a year of experience in blockchain and digital assets. She excels at breaking down complex concepts, making the world of cryptocurrency accessible to all. From Bitcoin and altcoins to NFTs and DeFi, Dishika presents the latest trends in a straightforward and easy-to-understand manner. She keeps a close eye on market updates, price shifts, and emerging innovations to deliver insightful content. Her writing supports both newcomers and seasoned investors in navigating the fast-changing crypto landscape. Dishika is a firm believer in blockchain technology and its potential to transform global finance.

6 months ago

😃🙃🙃🙃🙃