Key Highlights:

The world crypto market capitalization has increased to $2.43 trillion and slightly recovers within the past 24 hours.

Bitcoin still has a dominant position of 56.5%, and Ethereum records consistent increases.

Fear and Greed Index remains at 10 (Extreme Fear), indicating a wary attitude of the investors.

Cryptocurrency Market Overview, 17 February 2026: The cryptocurrency has achieved modest growth due to an increase in DeFi and a mixed performance of altcoins, and the general climate of extreme fear and major shifts in the industry have continued to affect investor confidence.

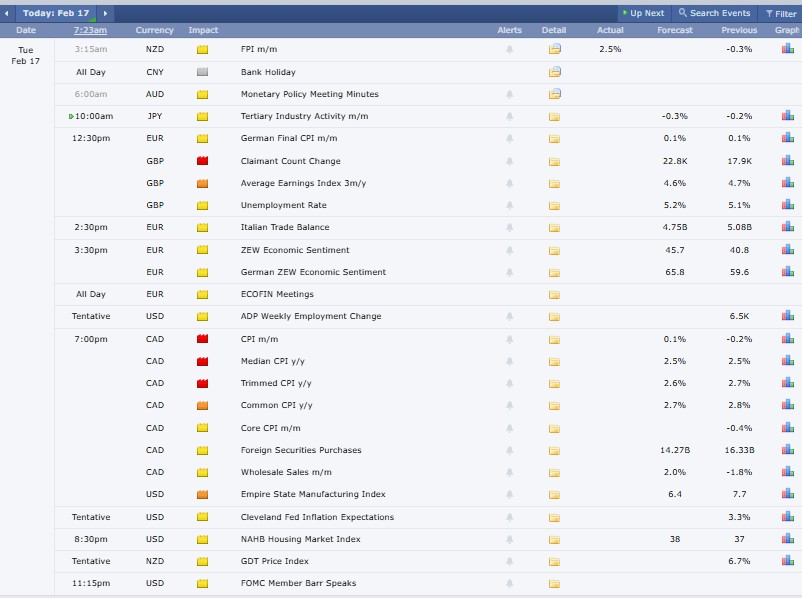

Source: Forex Factory

The global cryptocurrency market today reached a capitalization of $2.43 trillion, noted 0.7% upward trend in the last 24 hours, whereas Total trading volume was recorded at $91.6 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 56.5%, while Ethereum (ETH) carries 9.89%. The largest gainers of the industry are Options and the XRP Ledger Ecosystem in the past day.

Bitcoin (BTC) and Ethereum (ETH) Price Analysis:

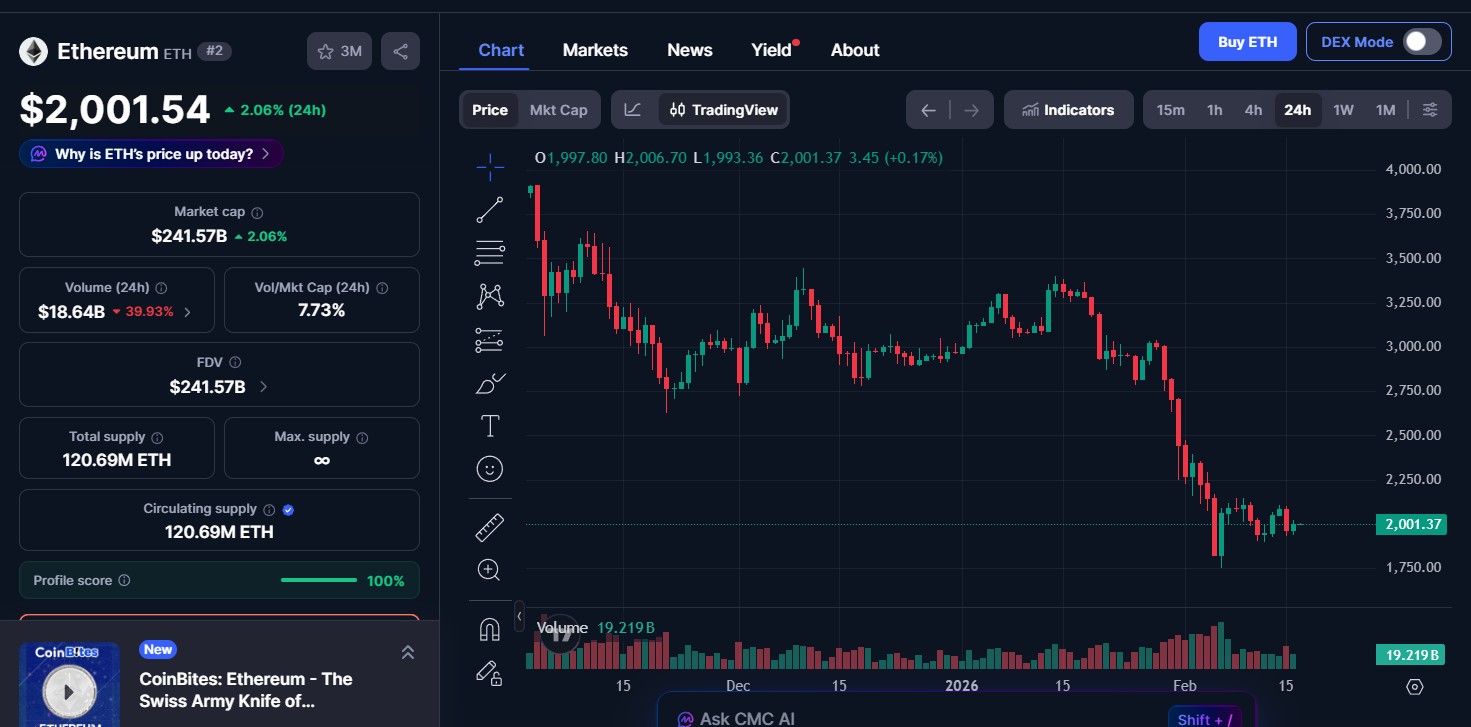

(Note: BTC and ETH are often viewed as less volatile historically, but still risky. The data recorded from CoinMarketCap)

Bitcoin (BTC) price today reached $68830.2, slightly up 0.37% in the last 24-H, with a trading volume of $33.55 billion and a market cap of $1.37 trillion.

Ethereum (ETH) price today is at $2001.54, soars 2.06% in 24 hours with a trading volume of $18.64 billion and a market cap of $241.5 billion.

Top Trending Crypto Coins Price in 24 Hours:

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

Rocket Pool price (RPL): $2.64, up 53.6% in the last 24 hours, trading volume (TV): $48.53M.

Zama price (ZAMA): $0.02252, rises 7.38% in the last 24 hours, TV: $471.07M.

Bittensor price (TAO): $193.93, gains 3.73% in the last 24 hours, TV: $401.92M.

Siren price (SIREN): $0.2229, jumps 53.84% in the last 24 hours, TV: $42.39M.

Tria price (TRIA): $0.01667, falls 6.11%, TV: $402.98M.

Top 3 Crypto Gainers in 24 hours:

(Ranked by 24-hour percentage gain)

MemeCore price today (M): $1.43, jumps 10.34%, trading activity $8.87M.

Cosmos price today (ATOM): $2.28, climbs 7.24%, trading activity $87.34M.

Nexo price today (NEXO): $0.8936, rises 7.09%, trading activity $19.31M.

Top 3 Crypto Losers in 24 hours

(Ranked by 24-hour percentage loss)

Humanity Protocol price (H): $0.194, down 11.75%, trading activity around $47.85 million.

MYX Finance price (MYX): $1.88, fell 9.75%, trading activity near $18.27 million.

Pippin price (PIPPIN): $0.6356, declined 9.41%, trading activity close to $58.21 million.

Stablecoins and Defi Update:

Stablecoins reflects 0.1% positive change over the past 24 hours, with a market capitalization of $309.4 billion and trading volume of $69 billion.

The Overall (Defi) Decentralized Finance market escalated 3.8% over the last 24 hours, recording a market cap of $51.3 billion and trading volume (TV) at $3.8 billion. Defi dominance globally marked 2.1%.

Source: Alternative Me

Today’s Crypto Fear and Greed Index stands at 10, signaling extreme fear among investors due to market volatility and declining altcoin prices. Yesterday scored 12, last week 9, while last month’s 49 showed neutral sentiment, reflecting cautious trading psychology overall.

(Note: All of these updates have an effect on traders, as they affect liquidity, sentiment, and potential returns, and thus have to be monitored closely.)

1. Cyprus Court Allows Safe Deposit Box Search: The Supreme Court of Cyprus allowed police to open the Israeli couple’s bank safe box in a $700 million crypto fraud investigation led by France across borders.

2. Cash Developers Launch ZODL: Zcash developers formed Zcash Open Development Lab. Josh Swihart confirms wallet rename, funds safe. Users need no action after the governance dispute exit.

3. Paradigm: Bitcoin Mining Supports Power Grids: Bitcoin mining balances grids with adaptive demand, consuming 0.23% of world power and generating minimal emissions, as miners drop load at random.

4. Solana x402 Shares Fall as Polygon Competition Increases: The x402 micropayment control of the Solana token is weakened by Polygon. According to SolanaFloor, the transactions of Solana are declining every week, although the total payments made across networks in the past few weeks were recorded at $16.4 million.

5. Bitcoin Sales Boost: Steak n Shake records high same-store sales following Bitcoin payments, which gives its reserves and finances employee Bitcoin rewards.

6. Trader Associated with LIBRA Comes Back With Massive Losses: The last activity occurred five days ago when Hayden Davis made a loss of over $3 million trading in PUMP, PENGUIN, and TROVE, returning to Solana meme coin trading.

The current value of 10 is a lower value than the previous 12 in the Fear and Greed Index and the previous 9 in the Fear and Greed Index, which means that the sentiment is still fearful but stable. Capitalization growth and higher gains in Ethereum represent selective optimism despite volatility.

Cryptocurrency users are experiencing a recovery and uncertainty balance. Although the dominance of Bitcoin is an indicator of stability, the volatility of altcoins and the fear of traders indicate that they need to pay attention to liquidity, news, and the development of DeFi before making short-term decisions.

Risk Context: It is not a long-term conditions commentary, but is just informational in nature and does not indicate a direction in which the price is headed or an action to be taken on investment.

The 24-hour update suggests crypto investment remains risky but opportunistic. Moderate growth and sector gains may benefit careful traders, but extreme fear sentiment highlights uncertainty, making research-based and cautious investment strategies essential right now.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile and risky. Always conduct your own research and consult a qualified financial advisor before making investment decisions. Not all regions can offer some of the services or assets discussed.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.