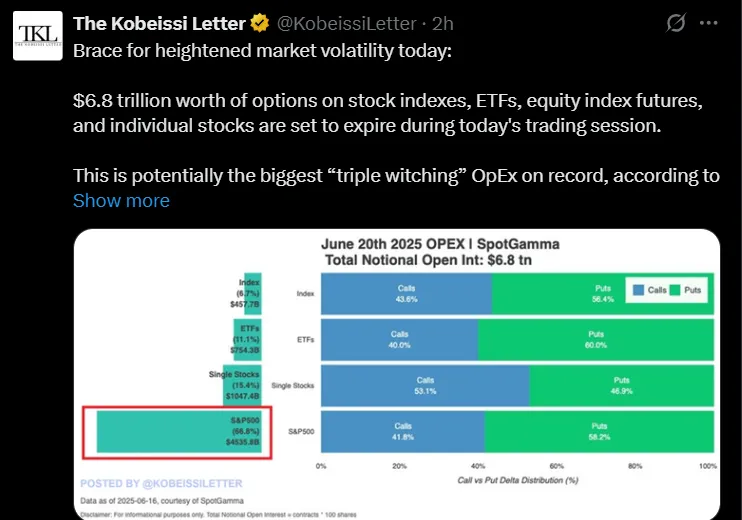

Today is not just another trading day—it's potentially the most volatile markets session of 2025. According to The Kobeissi Letter and data from SpotGamma, over $6.8 trillion worth of contracts are set to expire across indexes, ETFs, futures, and individual stocks.

This extreme option expiry this week June 21 is being called the biggest triple witching of June 2025, and it’s bringing serious heat.

Source: The Kobeissi Letter

What’s even more concerning? This isn't just a Wall Street cryptic tale anymore. Cryptocurrency markets are already flinching.

Here’s what we’re seeing:

Crypto Markets Cap: $3.23 trillion (down 0.36%)

24-Hour Trading Volume: $94.66 billion (down 16.65%)

This kind of cryptocurrency market cap drop, combined with thinning volume, is why analysts are warning about crypto market volatility today. Liquidity is drying up, and that's a one of a kind mix.

Triple witching refers to the simultaneous expiration of stock options, stock index options, and index futures. This already creates high volatility—but today’s event is different:

It’s the first post-holiday monthly OpEx in over 25 years

The scale—$6.8 trillion in notional value—makes it the largest on record

Analysts relying on SpotGamma options data say the setup could magnify intraday chaos

Put simply, this isn’t a regular expiry. This is today’s option expiry news that every serious trader is tracking.

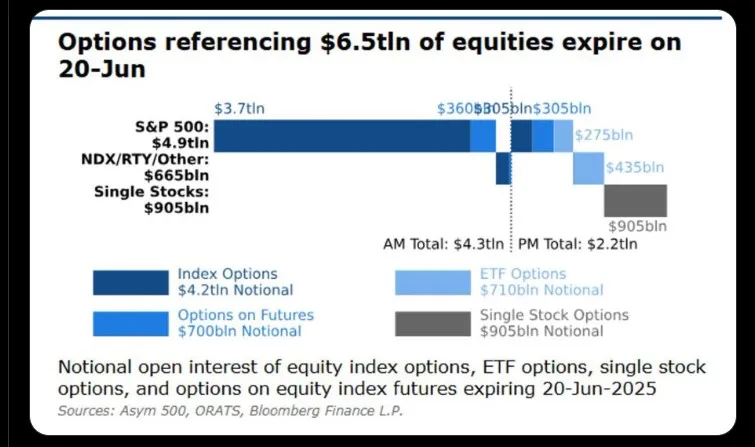

Out of the around $6.8T expiring today, $4.5 trillion is tied to S&P 500 index option alone. These contracts influence institutional strategies, dealer hedging, and momentum shifts.

Source: fxevolution X Account

As the S&P 500 OpEx flows unwind, Wall Street liquidity may temporarily get stuck or redirected. This is crucial because as per my expertise being an cryptocurrency analyst for a long time now:

“When big money tightens up in stocks, crypto often feels the aftershock.”

This is exactly why cryptocurrency markets is down today—large players are adjusting risk in real-time.

Aside from index contracts, $1 trillion in single-stock options are also expiring today. Stocks like Apple, NVIDIA stock, and Tesla could see massive swings.

Crypto traders should remember: when high-beta tech names move violently, Bitcoin and altcoins often correlate in short-term moves.

It’s not just about contracts — liquidity is drying up across markets.

As noted earlier, trading volume has dropped over 16%, and the crypto market cap fall shows even the digital asset world isn’t immune. This mix of low liquidity and massive expiry is why options expiry June 21 is such a red flag for risk managers.

To catch the moves, traders should monitor these timeframes:

10 AM ET – Initial hedging response

1–2 PM ET – Midday gamma flips

3:30 PM ET – Final hour of expiry chaos

Any of these windows could trigger large liquidations or short-term rallies in Bitcoin, Ethereum, and altcoins.

Today is not just about stocks — it’s a system-wide risk event. The biggest S&P 500 OpEx in history is unfolding as a crypto market crash, with liquidity drying up, making both markets more vulnerable to shock.

If you’re in cryptocurrency, don’t look away — this isn’t just a stock market event. This is the warning for crypto market volatility today.

Whether this leads to a breakout or breakdown, one thing’s certain: June 21, 2025, will go down as a historic moment in options market history.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.