What happened in Crypto Today ?

The mood in the crypto market has shifted sharply. The greed just a week ago has now turned into fear with sentiment dropping to 44. Investors are suddenly cautious and watching every move of Bitcoins and Altcoins.

Source: Alternativeme

This quick swing highlights how fragile confidence is and how headlines and market signals are driving emotions day by day.

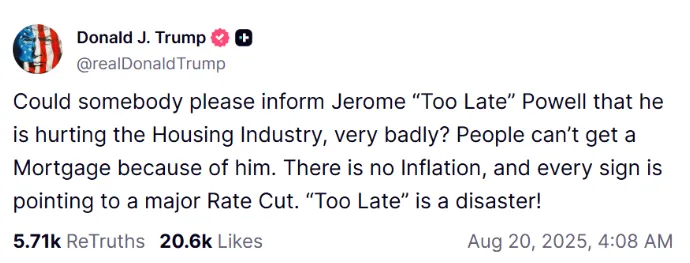

U.S. President Donald Trump has renewed criticism of Federal Reserve Chair Jerome Powell for claiming high interest rates are hurting the housing market and limiting access to housing loans. Ahead of Jerome Powell’s keynote at the Jackson Hole conference the investors are closely watching for clues on future rate moves.

Source: Truth official

Trump is pressing for major cuts, while most analysts expect only a small reduction in September. The debate is also shaking crypto markets, with Bitcoin and Ethereum likely to react sharply to Powell’s stance.

Michael Saylor Bitcoin commitment remains strong despite MSTR stock dropping over 8% in recent days. The company introduced new equity guidelines that allows more flexibility in issuing shares that are aiming to raise capital for further BTC purchases.

Source: X

Recently, MSTR added 430 coins at an average price of $119,666, bringing holdings to over 629,000 BTC. While analysts warn of risks tied to debt and dilution, Michael Saylor continues to double down on Bitcoin and betting on long-term growth.

The U.S. is shifting its approach to asset regulation. SEC Chair Paul Atkins announced plans to implement the President’s Digital Assets Working Group recommendations quickly. Through Project Crypto, the SEC will offer clearer rules, safe harbors, and tailored guidance for token offerings like ICOs, airdrops, and network rewards.

Source: X

Tokens will no longer be automatically treated as securities. And the industry leaders welcomed the move and saw it as a chance for innovation without fear. This marks a major step toward making the U.S. a hub for decentralized technology.

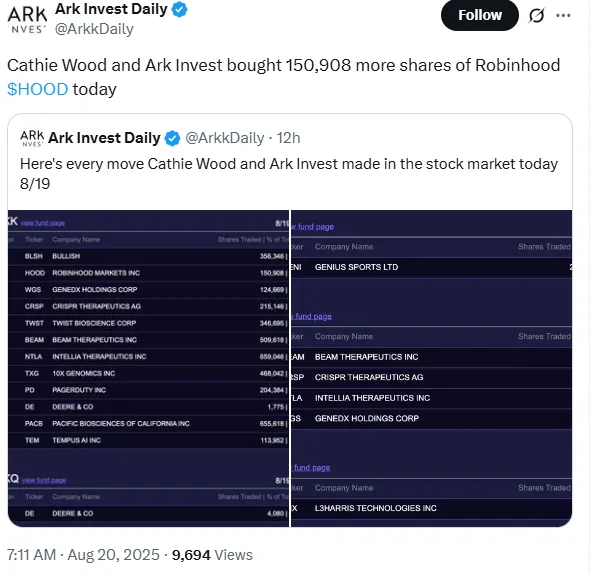

Ark Invest has boosted its stake in Robinhood, buying over 150,000 HOOD shares worth $16.2 million, marking three days of regular buyings. This indicates the strong confidence in Robinhood’s growth as both a trading platform as a digital economy player.

Source: X

Ark is also increasing its exposure to Bullish, and shows interest in decentralised focused exchanges. Meanwhile, Robinhood added the SUI token to its platform, focusing on attracting more traders. These moves highlight Ark’s long-term strategy to back companies bridging traditional markets and the fast-evolving digital finance world.

Elon Musk has paused his plans to launch the ‘American Party’ to focus on his businesses, including Tesla. Reports suggest he wants to maintain ties with key figures like Vice President JD Vance and avoid disrupting Republican chances in upcoming elections.

Source: X

His decision comes after disagreements over the “One Big Beautiful Bill Act” and concerns about political fallout. Elon Musk’s move signals a shift from political ambitions back to business priorities while keeping influence in U.S. politics.

Today market is full of energy, with new projects and innovations keeping things exciting. Staying updated with the Crypto news helps everyone spot opportunities and stay ahead in the digital finance world.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.