India just dropped a digital bombshell today. On August 20, the Indian Government confirmed that blockchain technology is no longer just talk—it’s entering land records, supply chains, and online commerce,as per the Crypto India latest X post.

This marks one of the boldest steps in India blockchain adoption, giving the country a chance to build systems that are transparent, tamper-proof, and faster than ever before.

For businesses, citizens, and banks, this is not just another India crypto news—it’s the start of a online transformation. Let’s break down what more to come and how it will unfold.

According to the Ministry of Electronics and Information Technology (MeitY), this chain ledger will be used in governance to cut corruption, track goods, and ensure trust in digital commerce.

This announcement comes at a time when trade tensions are rising globally. Just a few days back, the United States under Donald Trump slapped 50% tariffs on Indian goods, putting pressure on exports.

By strengthening domestic digital systems, the culturally diversified country is sending a strong signal; “It wants independence in both technology and trade.”

Land Records + Supply Chains + Digital Commerce

The integration covers land ownership records, where fraud and disputes are common.

Using distributed ledgers, ownership entries will be permanent and transparent, reducing middlemen and fake transfers.

Supply chains, especially agriculture and pharmaceuticals, will benefit as chain ensures every product is traceable from origin to consumer.

As someone tracking this space closely, my analysis is that this isn’t about theory anymore—This news proves that the government is making real-world moves.

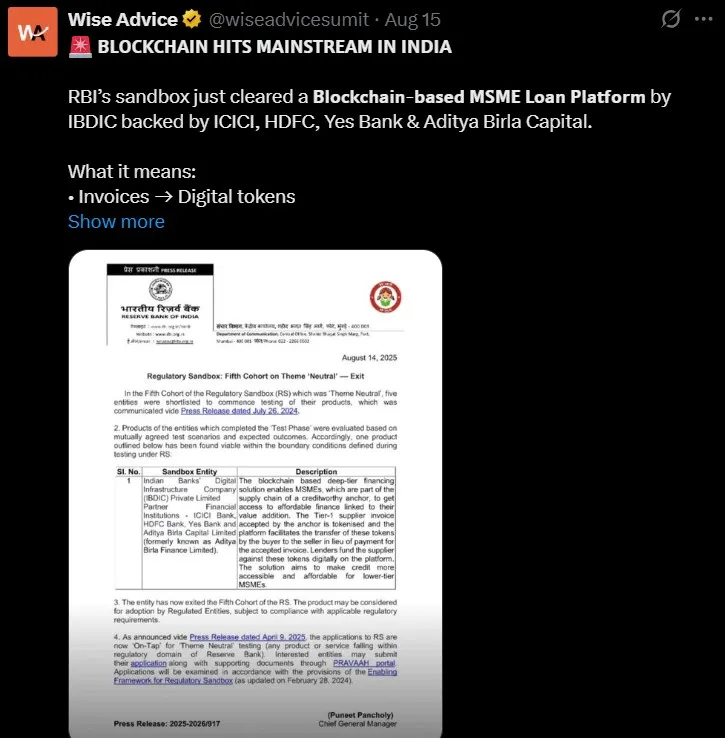

On August 15, as confirmed by the Wise Advice official post, RBI sandbox has just approved a blockchain-based MSME loan platform by IBDIC, backed by ICICI, HDFC, Yes Bank, and Aditya Birla Capital.

Here’s how it works:

Business invoices turn into digital tokens for instant verification.

Small firms get cheaper, quicker credit without long delays.

Supply chain finance faces less fraud risk because of transparent tracking.

For micro, small, and medium enterprises that often struggle with liquidity, this is a breakthrough.

As global shocks like Trump’s tariffs hit, India blockchain adoption is becoming a shield—making trade quicker and credit simpler.

From MeitY’s governance push to the RBI sandbox approval, the strategy is clear: use technology as a shield and a growth engine.

Analysts say this move could inspire other developing countries to follow the same path. The larger picture? The crypto adoption now extends beyond trading coins like Bitcoin or Ethereum; it’s about building economic resilience.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.