The cryptocurrency venture capital (VC) sector remained highly active in 2025, highlighting the growing confidence of investors in blockchain technology and digital assets. The recent analytics from Crypto Rank highlights how the Crypto VC activity in the year 2025 soared and which trends dominated most.

In 2025 alone, investors poured over $171 billion into blockchain startups, signaling renewed trust in the future of distributed assets.

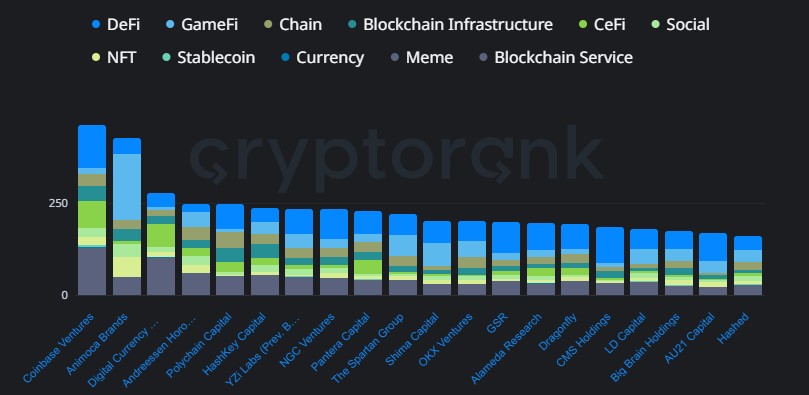

Talking about the leading performer of the year, according to the data, Coinbase Ventures topped the charts by participating in 87 deals, making it the most prolific funder in the sector.

Other active players include Animoca Brands with 52 deals, YZi Labs with 40 deals, and both GSR and Amber Group with 39 deals each. Panthera Capital closed 37 deals, while Selini Capital, Mirana Ventures, and Big Brain Holdings were also active with 33 deals each.

Venture Capital or VCs refer to investment made in early-stage companies with high growth potential. In the crypto world, this usually means funding startups in sectors like DeFi (decentralized finance), GameFi, NFTs (non-fungible tokens), Centralized Finance, and blockchain infrastructure.

These investments help startups develop new products, expand operations, and attract talent, while giving VCs a chance to profit if the company succeeds. For example, a successful DeFi protocol could grow into a multi-billion-dollar project, giving early backers substantial returns.

According to the findings, crypto startups raised $171.37 billion across 10,582 funding rounds in 2025. Funding sizes varied widely:

Over 2,200 rounds raised $1–3 million, typical for early-stage startups.

Around 1,000 rounds raised $3–10 million, often for scaling operations.

More than 2,800 rounds raised $50 million or more, mainly for established projects or high-potential startups.

Here, funding rounds indicate the stage of the company's growth.

Seed and Pre-seed: Earliest stages, where financial supporters help founders build their products and get the business off the ground.

Series A/B/C: Growth stage, providing funds to scale operations and reach more customers.

Strategic Rounds: It often includes corporate investors or partners to strengthen their market presence.

Undisclosed rounds: The final one, where the company does not share the amount raised, usually for privacy or strategic reasons.

According to market analysts, In 2025, undisclosed stages are increasingly common as funds prioritize strategic positioning over publicity. Seed and strategic rounds follow next, suggesting that while institutional investors are cautious about public announcements, funding is flowing steadily across all stages.

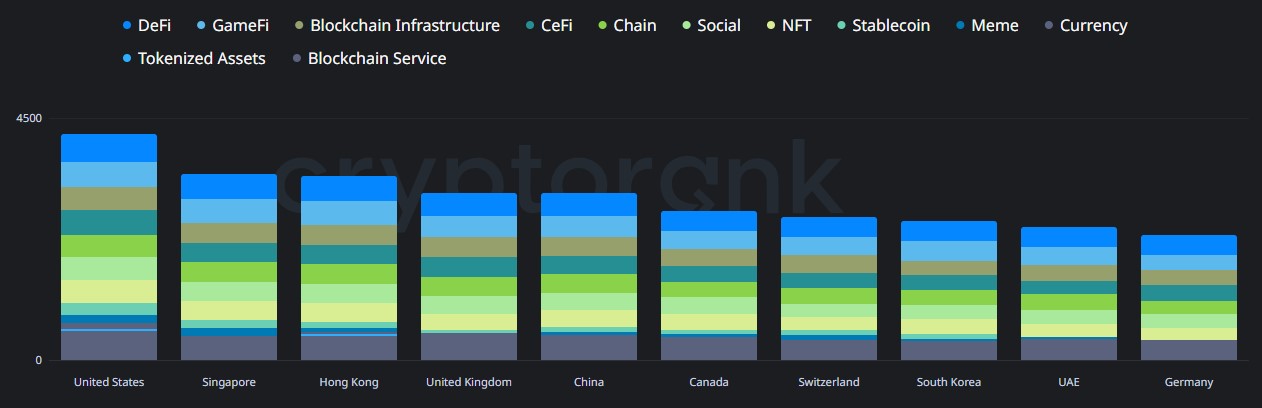

In a general pattern or proving the historical trend, countries with potential technological ecosystems and regulatory clarity. As the hints are clear enough for the United States to be on top, it has 4,500+ projects gathering the funds from investors.

Other nations on the top list with their projects include:

Singapore: ~3,800 projects

Hong Kong: ~3,600 projects

United Kingdom: ~3,300 projects

China: ~3,200 projects

While funders are targeting regions that combine talent, regulation, and market opportunity, emerging nations are also seeing a growth trend in overall statistics.

The high crypto VC activity indicates a healthy and growing digital assets ecosystem. Platforms like Coinbase and Animoca Brands are not just providing funds, they are influencing which early-stage blockchain startups succeed. Startups in DeFi, GameFi, NFTs, and blockchain infrastructure are likely to gain traction because of this support.

The monthly fundraising peaks in Q1 and Q4 2025 suggest strategic targeting of high-potential projects, which could accelerate innovation in the sector.

Looking forward, this strong VC activity could help blockchain startup develop more scalable products, attract global users, and compete with traditional tech industries.

Disclaimer: This article is for informational purposes and not investment advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.