Can a company that owns more digital asset than its total market value still lose investor trust? That is the big question around MSTR Stock Performance as Strategy Inc. ends 2025 close to its lowest levels in years.

Strategy stock, earlier known as MicroStrategy, fell nearly 49% in 2025 and recently hit a new 52-week low near $153.

Source: X (formerly Twitter)

This drop places MSTR Stock Performance among the weakest large-cap stocks of the year. What makes this more surprising is that BTC itself fell only about 6% during the same period.

Several reasons pushed the Microstrategy Performance lower. Price weakness of the cryptocurrency played a part, as BTC slipped from earlier highs near $126,000 to around $87,000. But the stock fell much more than the digital asset, showing that other issues were also at work.

One major concern has been share dilution. The company kept issuing new shares to buy more crypto asset. While this helped increase Microstrategy Bitcoin holdings, it also increased the number of shares, which reduced value for existing shareholders. This put steady pressure on the price.

There were also fears about index exclusion. Economist Peter Schiff said if Strategy were part of the S&P 500, its nearly 47.5% fall would make it one of the worst performers in the index. Schiff also criticized Michael Saylor’s conviction on the digital currency, saying it damaged shareholder value.

Source: X (formerly Twitter)

Because of these concerns, MSTR Stock is now trading at a 20% to 25% discount compared to the value of its assets. This kind of gap is rare for the company and has caught the market’s attention.

Even with weak MSTR Stock Performance, Strategy’s balance sheet remains heavily backed by BTC.

The company holds 672,497 BTC, bought at an average price of around $75,000 per coin.

At current BTC price levels near $87,000, these holdings are worth roughly $58 to $59 billion.

This value is higher than firm’s current market cap of about $46 to $47 billion.

The company also holds more than $2.1 billion in cash and does not face major debt payments until 2028.

Most importantly, Strategy’s BTC is not used as collateral for loans. This means there are no forced selling rules if coin's prices fall.

Some online voices have raised fears that Strategy could be in trouble if it drops to $74,000. However, the numbers do not support this concern. Even at $74,000, Strategy’s crypto asset would still be worth close to $50 billion, far higher than its total debt of around $8.2 billion.

The weak MSTR stock performance is more related to market fear and sentiment than bankruptcy risk. Michael Saylor's firm has enough cash reserves to cover the cost and dividends for more than two years without selling any of the coins.

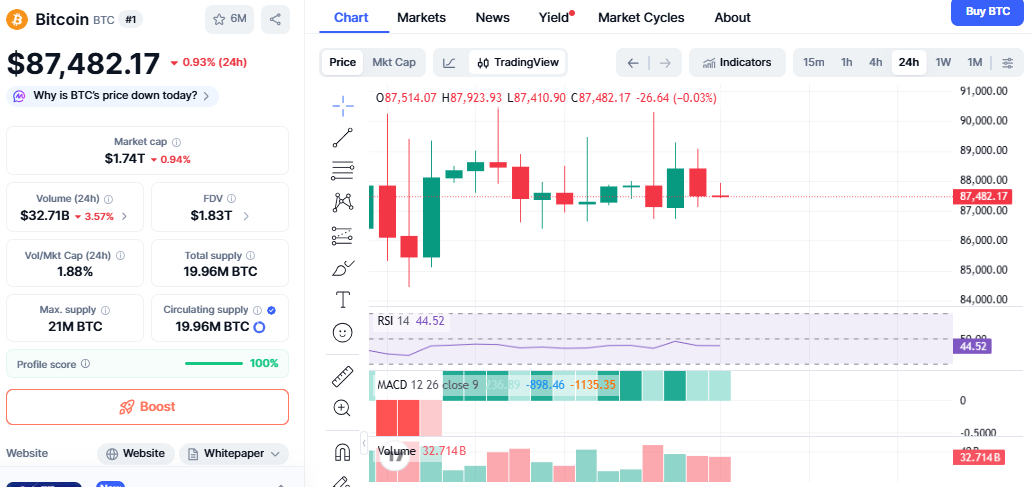

Bitcoin price today is trading below key resistance at $89,000. ETF outflows, regulatory uncertainty, and risk-off investor sentiment have slowed the market. Consolidation rather than crash-that's what technical signals are suggesting.

Source: CoinMarketCap

The Bitcoin price prediction indicates that BTC could continue to range between $86,000 and $90,000 in the near future. A successful move above resistance could push the firm out of its deep discount.

Critics like Peter Schiff continue to have a say, but organisation’s large Bitcoin position, cash reserves, and long-term perspective on its main asset keep the company in a stable financial condition. Whether investors get rewarded that patience in 2026 will have much to do with which way the cryptocurrency goes from here.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.