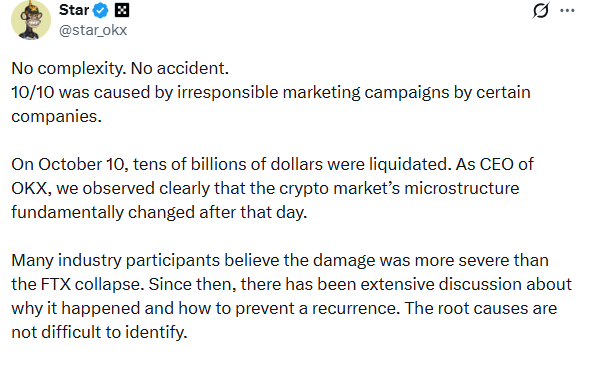

The crypto world is currently split over who to blame for the October 10 crypto market crash. This event was the biggest "wipeout" in the history of digital money. Star Xu, the CEO of OKX, has publicly blamed Binance and its founder, Changpeng Zhao (CZ). He claims that Binance ran "irresponsible" marketing ads that put the whole market at risk. However, CZ is fighting back. He says these claims are "far-fetched" and that the October 10 crypto crash was actually caused by global economic problems.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

The main argument is about a token called USDe. OKX says Binance treated USDe like a safe stablecoin, even though it was actually a high-risk investment. This led to a "leverage loop." In simple terms, users borrowed money to buy USDe, then used that USDe to borrow even more. When the digital arena dipped, this whole "house of cards" fell apart. This caused $19 billion in losses during the the tenth month 10 crypto price collapse, leaving many traders with nothing.

Star Xu did not hold back in his critique. He explained that the October 10 crypto price collapse happened because the exchange gave USDe "special treatment." By letting users use it as collateral for big loans, The top exchange created a massive bubble. Xu believes that "short-term yield games" destroyed the trust that the industry has worked years to build. He argues that even a small market shock was enough to start the the tenth month 10 Digital assets price collapse because the system was already too weak.

The top exchange has a very different story. They released a report showing that the October 10 Digital assets price collapse was a "macro shock." This means it was caused by big world events, not just one exchange. Their main points include:

The Trade War: A surprise 100% tariff announcement from the U.S. sent all markets including stocks into a panic.

Ethereum Traffic: The Ethereum network got too crowded. This made it impossible for "market makers" to move money fast enough to stop the price drop.

Global Liquidity: Order books "went thin" everywhere. This means there weren't enough buyers to stop the falling prices on any exchange.

CZ also pointed out that most of the liquidations happened before Binance had any technical glitches. He believes the October 10 Digital assets price collapse was a natural, though painful, part of the market clearing out bad debt.

The industry is now entering a new phase. Most experts believe the October 10 Digital assets price collapse has forced exchanges to be more honest about risk. We will likely see fewer "get-rich-quick" schemes and more focus on "Proof of Risk." While the fight between OKX and Binance continues, the market is slowly recovering. Many see this crash as a "test" that the crypto world survived, even if it was a very expensive lesson.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.