Binance has expanded its derivative offerings with the launch of USDⓈ-margined perpetual contracts for Platinum (XPTUSDT) and Palladium (XPDUSDT). These perpetual futures allow investors to speculate or hedge prices of these industrial metals without owning them physically with up to 100x leverage, without owning the physical asset.

Source: Binance Official

The trading begins on January 30, 2026, at 10:00 UTC for platinum and 10:15 UTC for palladium, where:

Settlement: USDT-based, no physical metal required

Leverage: Up to 100x

Minimum Trade: 0.001 XPT/XPD

Funding Fees: Settled every 8 hours

Trading Availability: 24/7 via Binance Futures

Trading Mode: Supports multi-asset mode

These new contracts give traders regulated access to precious metals with high liquidity and continuous market exposure, making it easier to diversify portfolios or manage industrial metal price risks.

The news of Binance perpetual listing comes at the time when both the metals are showing high volatility after rallying in January 2026.

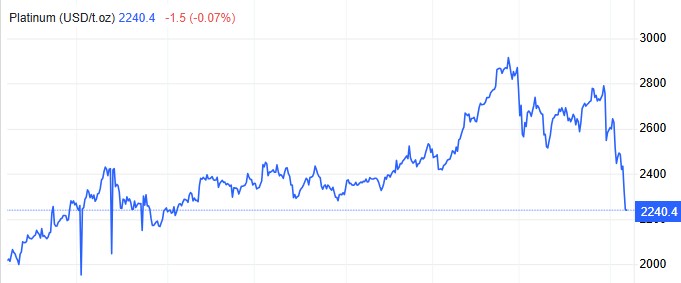

Platinum, widely used in catalytic converters, hydrogen fuel tech, electronics, and jewelry, spot price recently pulled back to $2,400–$2,500 per ounce. The value is currently down ~7–9% intraday from the record highs near $2,880 reached on January 26.

Source: Trading Economics

On the other hand, Palladium, which is mostly used in automobile catalytic converters and industrial applications, is trading around $1,762–$1,770 per ounce. It is also down 12% from recent peaks of $2,100–$2,200.

Although being down in today's market, both metals have seen massive yearly gains, platinum +140% and palladium +65%, driven by industrial demand, supply constraints, and renewed investor interest.

There is much news on how traditional markets are increasingly including crypto assets into their portfolio, but the recent trend of hard assets on crypto platforms is gathering more attention.

The increasing trend of precious metals’ addition on crypto exchanges presents the long-term demand and trust these assets have. Binance itself expands its portfolio after including Gold (XAUUSDT) and Silver (XAGUSDT) perps earlier this January. Other major crypto exchanges are also offering hard assets:

Coinbase: Gold, silver, platinum, and copper futures

Bybit: Gold and silver perps

MEXC: Gold and silver futures with up to 50x leverage

Gate.io: 24/7 gold and silver trading

Ostium Labs: Decentralized perpetuals for gold, silver, and others

The growth is driven by the investors who seek high-leveraged exposure along with trading flexibility without owning physical assets.

Currently, the trading of metals is only available as perpetual futures because they allow easy, around-the-clock leveraged trading and hedging without the need of physical maintenance. Spot metal trading would require physical delivery, custody, and insurance, which is more complex and costly for exchanges.

Spot listings may appear in the future if regulations allow physically backed products in the crypto ecosystem, but for now, perpetual futures offer flexibility, liquidity, and active market participation.

Disclaimer: This article is for informational purposes only and not financial advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.