Bitcoin price rally is in tears and this time it is not following the usual market rules. According to The Kobeissi Letter, BTC is now moving upward in a straight line that is something rarely seen in the traditional markets.

Source: X

In just three months, the total crypto market has grown by over $1 trillion while the US Dollar has dropped by 11% in the past six months. Despite rising interest rates, Bitcoin price rally continues to surge.

This strange combination is what Kobeissi calls “crisis mode” for the golden currency where it thrives when the system shows signs of stress.

A major turning point came on July 3, when the US House passed President Trump’s massive spending bill, often referred to as the “Big Beautiful Bill”.

Since then, Bitcoin price rally has gained more than $15,000 which is marking one of its sharpest moves in history. Earlier, on April 9 another spike followed the 90-day tariff pause.

These moments clearly show how Bitcoin price rally reacts directly to big political and economic decisions, especially those that weaken the US Dollar or increase the government’s spending.

The Big beautiful bill is a big law which is passed by the U.S government in 2025. The bill includes important tax changes and spending plans that were a main part of Donald Trump’s plans for his second term as a President.

When the government passes tax bills like this it often affects the U.S dollar and the economy like it can weaken the dollar, when dollar loses its value the investors often look for safer places to put their money safely.

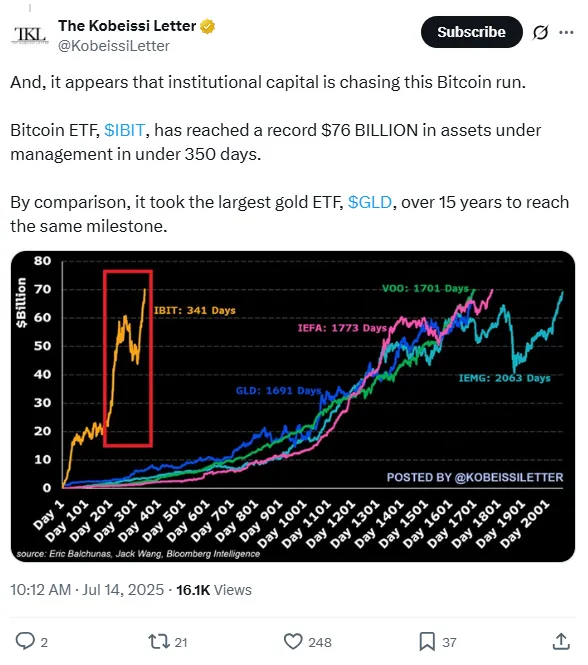

The Bitcoin price rally is not just about retail investors anymore. Institutional capital is now flowing into crypto like never before. BlackRock’s Bitcoin ETF($IBIT) has recently reached $76 billion in assets under management which took only 350 days.

Source: X

The largest gold ETF($GLD) needed over 15 years to reach that mark. Hedge funds, family offices and even conservative investment firms are now allocating 1% or more of their portfolios to BTC.

The signal is clear that BTC is now being taken seriously by big money.

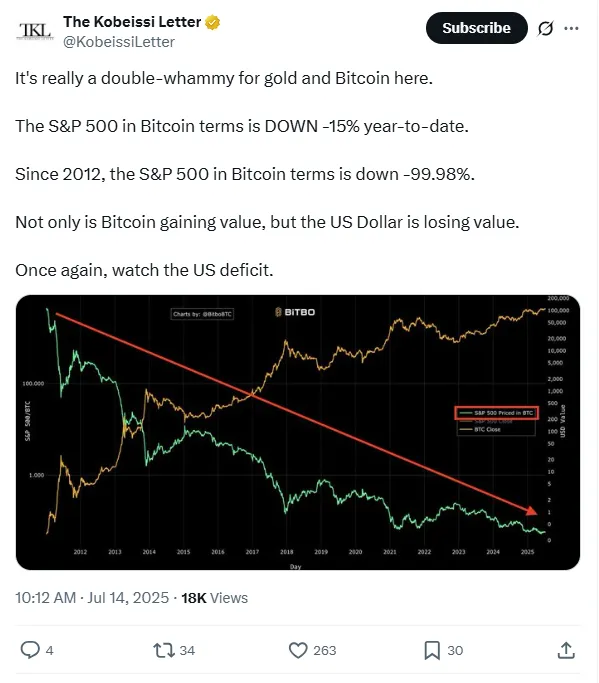

BTC is not rising alone but also Gold is also in rise and bond yields are climbing too. Meanwhile the S&P 500 Iis down 15% in Bitcoin terms this year that is showing how BTC is outperforming traditional markets.

This rally is not just hype but it is a response to a broken financial system. The massive US deficit, rising interest rates and weak dollar are forcing the investors to look for safer stores of value. Bitcoins are sending a message loud and clear that the old rules do not work anymore and crypto is here to stay.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.