Can this Dolomite crypto price surge really last, or is it just a short-term pump? That is what most traders are wondering right now. DOLO surprised the market by jumping almost 58% in just 24 hours, while the rest of the crypto market stayed weak.

This sudden move did not happen by accident. It came right after World Liberty Financial (WLFI) launched its lending platform on Dolomite.

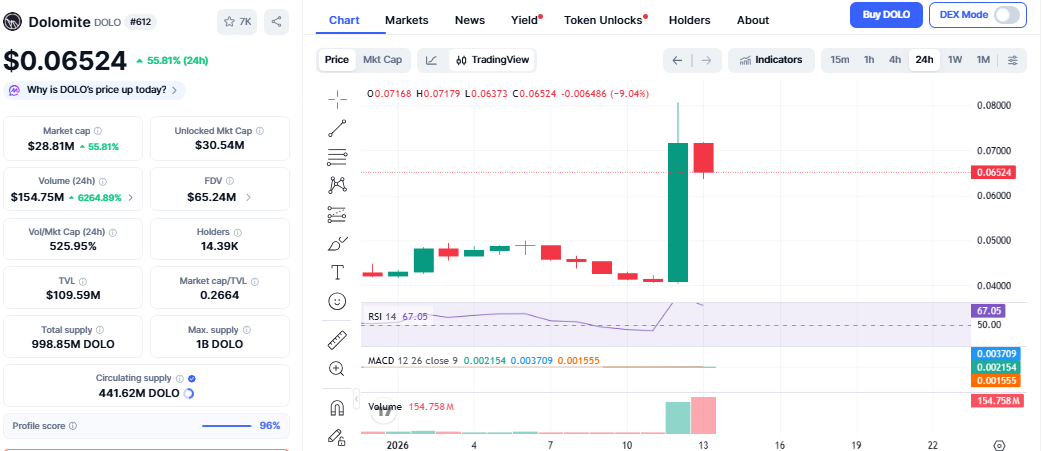

At the moment, DOLO is trading near $0.065. Trading volume has exploded, and interest around the token is rising fast. The DOLO crypto price surge is being driven by real news, not rumors. That is why many people are paying attention.

World Liberty Financial announced its first DeFi product called World Liberty Markets launch.This platform is built on Dolomite and allows users to lend and borrow using USD1, ETH, USDC, USDT, and other assets. USD1 is WLFI’s own stablecoin, and it already has more than $3.4 billion in circulation.

Source: X (formerly Twitter)

It means Dolomite is now the backbone of a growing DeFi system. More users on WLFI means more activity on this project. That creates direct demand for DOLO tokens. This is the main reason behind the Dolomite crypto price surge.

Also, because WLFI is linked to the Trump family, it has attracted massive attention. That alone brings traders and speculators into the market.

One strong sign that the DOLO crypto price surge is real is trading volume. As per the CoinMarketCap, in just 24 hours, DOLO’s volume jumped by more than 6,000% and crossed $150 million. That means many buyers entered the market, not just a few whales.

Source: CoinMarketCap

RSI has broken through the 80 level, which indicates that the token has become overbought. The prices are changing at a rapid pace and can stabilize soon.

Being overbought can have multiple meanings, and it does not always lead to a crash.

MACD signals are still positive, which suggests buyers are in control for now.

USD1 is not just another stablecoin. WLFI plans to take it toward a regulated banking model through a U.S. trust charter. If that happens, USD1 could become a bridge between traditional finance and DeFi.

Compared to many DeFi projects, it now has a strong partner with political and regulatory reach.

Looking at the Dolomite price prediction, DOLO must remain above $0.068. If this level becomes support, a possible target could be approximately $0.080.

If it goes below $0.055, there are traders who might begin to book profits. This leads to a slight fall. It only indicates that the rally gets slowed down.

Will the Dolomite Crypto Price Surge Hold or Crash?

Right now, both outcomes are possible.

Why it can hold:

Real platform launch

Strong trading volume

Growing USD1 adoption

Long-term regulatory vision

Why it can cool down:

RSI is overbought

USD1 lending yields are still low

Liquidity is thin

Early traders may book profits

So a small pullback would be normal. But as long as WLFI activity grows, the DOLO price rally has a solid base.

This is different from normal hype pumps. It is backed by product launch, adoption, and big-name involvement. Short-term dips may come, but if USD1 grows and World Liberty Financial expands, it can stay relevant for a long time.

For now, it has moved from a quiet token to a serious market discussion.

YMYL Disclaimer: This article is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments are risky, so always do your own research before making any decision.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.