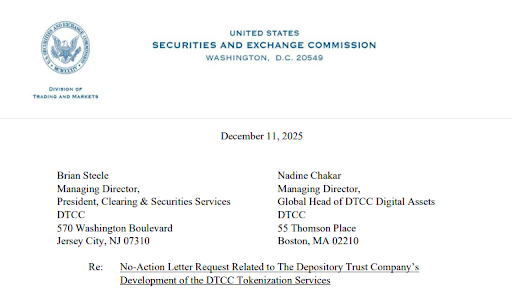

The U.S. Securities and Exchange Commission (SEC) granted the Depository Trust Company (DTC), a subsidiary of DTCC, a no-action letter enabling DTCC tokenization approval.

This regulatory clearance allows the DTC to tokenize real-world assets in a controlled production environment. Assets will retain the same rights, investor protections, and ownership as traditional financial products, ensuring compliance with federal securities laws.

The SEC permission includes highly liquid assets such as the Russell 1000 Index, ETFs on major indexes, and U.S. Treasury bills, notes, and bonds. The three-year license of pre-approved blockchains enables the DTC to commence operations during the second half of 2026. The company anticipates that the initiative will support faster settlement, enhanced liquidity, and programmable assets.

According to experts, the project would help simplify settlement procedures, save on expenses and facilitate almost instant trading as opposed to a typical T +1 settlement cycle.

The implementation of DTCC tokenization approval opens the chance of integrating traditional finance (TradFi) with decentralized finance (DeFi). The tokenized assets will use the ComposerX platform suite of the DTCC to establish a uniform pool of liquidity in the financial ecosystems. The participants in the market will have the opportunity to access financial instruments 24/7 and increase the mobility of collateral while still retaining traditional protections.

According to industry observers, tokenization of highly liquid assets can be used to process trillions of financial products yearly, enhancing efficiency and market inclusivity. This interoperability of the platform helps to ensure that players can move on-chain assets between jurisdictions without depending on standard trading hours. The company highlights that the project will ensure high levels of security, resilience, and legal compliance.

Participants can expect onboarding, wallet registration, and L1/L2 network approvals updates as the rollout approaches. The firm tokenization approval marks a new era of TradFi instruments in the U.S that is consistent with the international trends in digital assets and blockchain innovation. The program focuses on efficiency, transparency, and interoperability and positions the United States as the center of digital finance.

With the DTCC tokenization approval, blockchain adoption in U.S. securities markets reaches a new phase. The program facilitates safety for crypto holdings in the ecosystem and can speed up the use of programmable financial instruments. Analysts expect a quantifiable change in the efficiency of operations and investor access which will indicate a move to a modernized trading model.

This achievement is consistent with the general patterns of financial innovation and puts the company on the leading edge of implementing blockchain technology in the mainstream markets. The 2026 rollout is regarded by the stakeholders as an opportunity to watch new coin listing and digital asset trading opportunities. This would help redefine the manner in which securities are traded, settled, and accessed throughout the world by integrating regulatory clarity and technical strength into the remit of the DTCC tokenization approval.

Experts highlight this development as a key event in crypto market news, bridging traditional finance and blockchain technology.

The DTCC tokenization authorization strengthens a changing market setting in which blockchain forms a central component of financial infrastructure. The stakeholders are now on the verge of observing the way the rollout will be used to define the next step in the modernization of the U.S. securities linking innovation and regulatory certainty.

Shristy Malviya is a skilled English Blog Writer and Content Writer associated with Coin Gabbar, specializing in producing well-researched and SEO-friendly content on cryptocurrency, blockchain innovation, and financial technology. She is passionate about making complex industry topics accessible and valuable to a wide audience. Shristy’s work reflects her commitment to delivering credible and high-quality information that aligns with current market trends. Outside her writing career, she enjoys reading books, an activity that deepens her understanding of global markets and continuously inspires her professional growth.