El Salvador has made its next bold move in BTC. The government has signed into law a new bill that allows licensed investment banks to hold this digital asset on their books and provide crypto services to institutional investors.

Source: X (Previously Twitter)

The El Salvador Bitcoin law creates a clear distinction between the investment banks and normal commercial banks.

The investment banks are now able to deal with digital assets directly, though only if they comply with strict regulations.

To become licensed, an investment bank needs to have registered capital of at least $50 million and maintain $250,000 in additional funds.

Such a high threshold is designed to ensure only serious and economically powerful institutions can participate.

For years, El Salvador Bitcoin news has been primarily focused on ordinary people making payments with BTC. Now, that focus shifts towards large financial institutions.

It allows financial institutions to invest in this coin within a well-defined legal framework, providing bigger investors with more confidence and faith to participate.

It is a major leap toward integrating BTC into mainstream banking. It may also inspire other nations to do the same and pave the way for increased institutional participation.

The legislation also paves the way for new concepts uniting traditional finance (TradFi) and decentralized finance (DeFi).

The banks can now develop investment products that combine old-school banking services with blockchain-based mechanisms.

This is expected to draw international companies and investors seeking a destination where this digital currency can be utilized under reliable and transparent regulations.

This new El Salvador Bitcoin law also solidifies nation's reputation as a financial innovation hub.

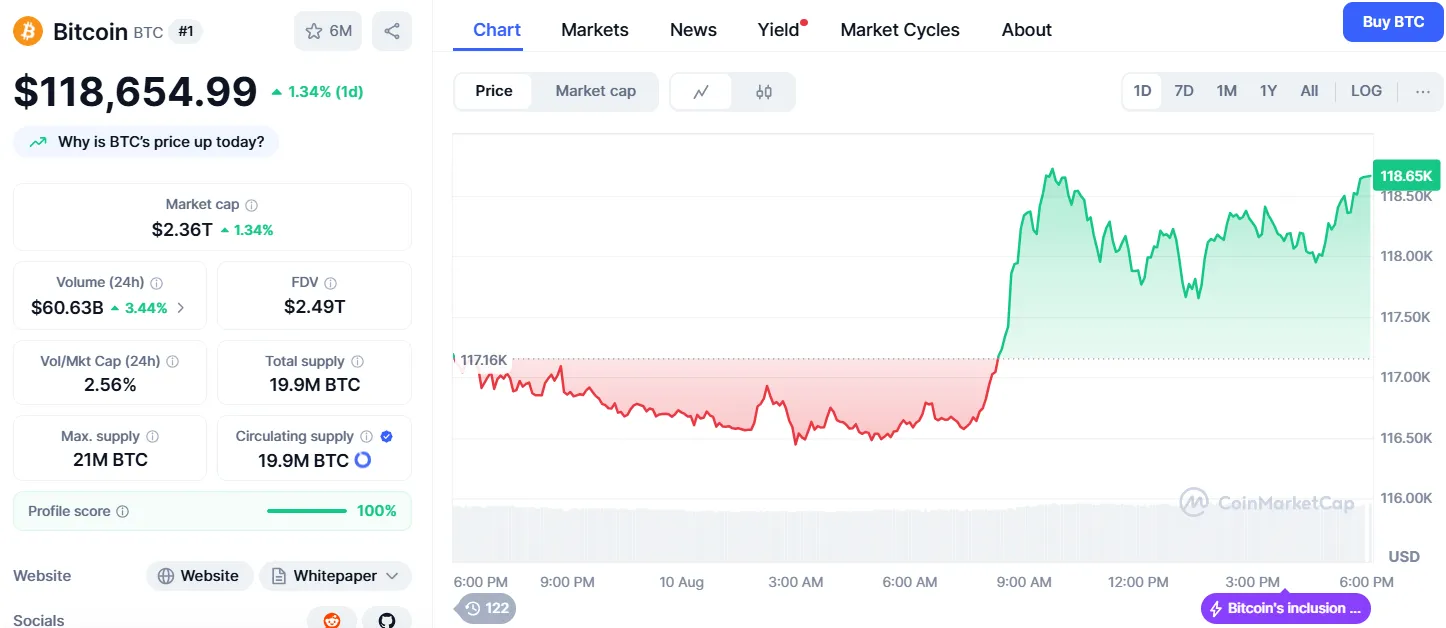

The news is occurring while BTC continues to be strong above $118,000. Most investors interpret the El Salvador Bitcoin policy as an indication that the market is heading towards increased institutional adoption.

The coin is now trading at $118,654 with an increase of 1.34%, while trading volume surged by 5.5% within the last 24 hours as per the CoinMarketCap.

Source: CoinMarketcap

If more nations allow banks to hold BTC, it could cause demand to spike and prices to move even higher.

Whereas other countries continue arguing on the best way to address cryptocurrencies, the nation is acting swiftly with concrete and cognate decisions.

The nation has already created a new history by committing to the use of Bitcoin as a legal currency and the current move to introduce guidelines that the financial institutions can follow to play along the game.

This radical decision indicates that this cryptocurrency and conventional banking are compatible with one another.

The El Salvador Bitcoin law might be the film of a revolution, which makes digital money the common decorum of the international finances.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.