The global cryptocurrency market cap is $4.06 trillion, up 1.1% in 24 hours. Daily trading volume hit $134.46 billion, with Bitcoin dominance at 58.4% and Ethereum’s at 12.7%.

Over 18,031 cryptocurrencies are being tracked, showing continued industry expansion and activity. The largest gainers in the crypto industry are Polkadot and XRP Ledger Ecosystem.

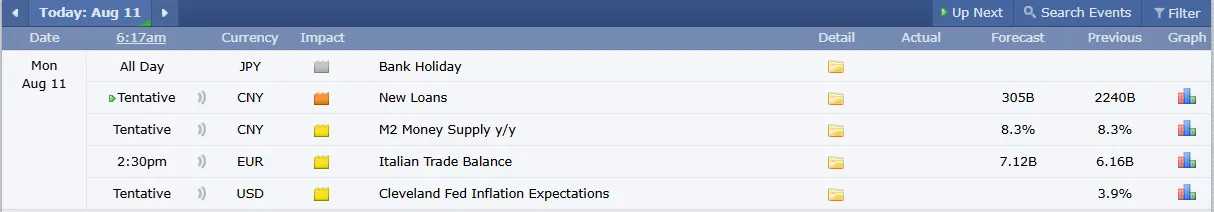

Source: Forex Factory

Bitcoin trades at $119,299, gaining 2.3% in the past 24 hours. With a massive $2.37 trillion market cap and $38.1 billion trading volume, BTC remains the dominant cryptocurrency, holding a 58.4% share of the global market.

Top trending cryptocurrencies: Zora (ZORA) soared 27.2% to $0.1186 with $186.94 million traded. Ethereum (ETH) declined by .9% at $4268 with $27.98 billion in volume. LayerZero (ZRO) gained 9.7% to $2.17 with $227.31 million traded.

Top 3 gainers: Codatta (XNY) surged 65.3% to $0.007941 with a $42.76 million trading volume. Polyhedra Network (ZKJ) rose 45.6% to $0.2726 with $178.60 million traded, while Ava AI (AVA) jumped 43.7% to $0.0459 on $40.46 million volume.

Top 3 losers: SOON fell 23.4% to $0.3466 with $284.84 million in trading volume. Heima (HEI) dropped 19.3% to $0.4961 with $46.02 million traded, GMX slid 16.9% to $17.73 on $278.60M volume, and Pi Network (PI) declined 14.4% to $0.39 with $192.83 million traded.

Stablecoins collectively hold a $277.92 billion market cap, reflecting a modest 0.1% change in the last day. Their trading volume reached $94.18 billion, showing continued dominance in providing liquidity and stability within the cryptocurrency ecosystem.

The DeFi market cap stands at $165.89 billion, marking a 0.8% rise in the past 24 hours. DeFi’s dominance over the global crypto market is 4.1%, with a 24-hour trading volume of $10.07 billion.

Source: Alternative me

The Crypto Fear and Greed Index is 70, which shows Greed. This is a bit higher than yesterday and last week but lower than the extreme greed level of 79 last month, which indicates a continued bullish mood.

El Salvador Bitcoin Law: In El Salvador, a law was enacted that permits licensed investment banks that have a capital of at least 50 million to possess Bitcoin and provide crypto services to institutional investors. The decision will integrate TradFi and DeFi, enhance institutional participation, attract international investors, and strengthen the country's financial innovation leadership.

Base celebrated its 2-year anniversary with record growth, including a 1,280.6% increase in active users. An increase of 2,049.6% transactions, and nearly $4.5B of TVL. Adoption was increased by lower fees, ecosystem growth, and Coinbase support, and new fee-free DEX trading capabilities further cemented its presence in the Layer 2 arena.

There is a possibility of the crypto tax being relieved, as India has withdrawn the Income Tax Bill 2025 and has planned a new version for August 11. The existing laws levy a 30% tax and 1% TDS, and there are crackdowns on evasion. The COINS Act 2025, which is proposed, could introduce regulation, transparency, and potential exemptions for digital assets.

The reformation of the Federal Reserve by President Trump, such as the nomination of pro-crypto Stephen Miran and the announcement of a shortlist of candidates to replace Powell, has led to speculation of a so-called Phantom Fed Chair effect. Markets can turn their attention away from Powell before his May 2026 departure, expecting a sooner rate cut and crypto-friendly policies.

Coinbase announced the availability of DEX trading in the U.S. version of its mobile app (not available in New York) that allows swapping Base-native tokens on 0x and 1inch aggregators without fees. The shift combines centralised and on-chain services, allows supporting curated projects, has plans to integrate Solana, and indicates the trend of the industry towards hybrid and Web3-oriented trading platforms.

Disclaimer: Coingabbar provides informational content on cryptocurrencies, NFTs, and other decentralised assets. This is not financial advice. Users, please DYOR, understand the risks, and consult financial professionals before investing. CoinGabbar is not responsible for any financial losses. Crypto and NFTs are highly volatile—invest wisely.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.