YMYL Disclaimer: This content is for informational purposes only and not financial advice. Always do your own research before investing.

The Enso Price Surge has grabbed strong market attention after it jumped more than 80% in just one day and moved above the $2 mark. While the overall crypto market stayed mostly flat, the token clearly stood out. The rally was mainly driven by a sharp rise in trading volume and liquidity.

Because of this sudden move, many traders are asking the same question, why it is going up today, and can this rally continue?

The biggest reason behind the price surge is a huge jump in trading activity. In the last 24 hours, trading volume increased by more than 277% to around $317 million. This shows strong buying pressure and growing speculative interest. When trading volume rises this quickly, it usually means new money is entering the market.

The price surge does not appear to be linked to any major project announcement. Instead, the move seems to be driven by liquidity flows, speculation, and momentum trading.

This explains why it rallied even though Bitcoin and the broader market barely moved. The altcoin's price surge shows how smaller tokens can rise quickly when attention increases and trading volume spikes.

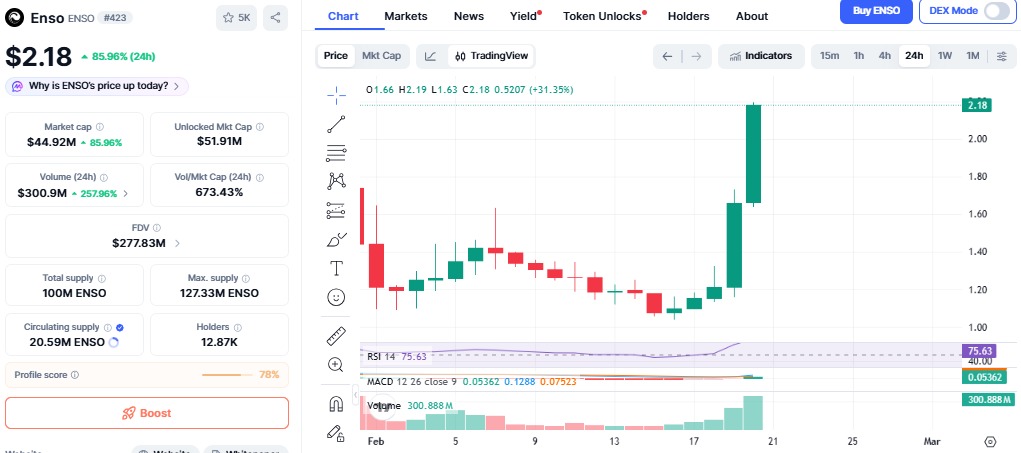

From a technical perspective, the Enso Price Surge has followed a breakout pattern above the resistance level. The above chart illustrates the coin surging above the $1.80 resistance level, which has become a crucial support level.

The momentum indicators illustrate strong bullish momentum, but they also indicate that the price is overbought in the short term.

The breakout is supported by high volume, but it is also common for fast breakouts to be associated with high volatility. This is why the price analysis becomes crucial for traders who are waiting to see what happens next.

It is trading around the $2.1 to $2.2 range after the sharp rally. The move attracted new traders looking for quick opportunities and helped it outperform the broader market.

Source: CoinMarketcap Chart

The rally highlights how sudden liquidity events can quickly change sentiment. At the same time, because there is no clear catalyst, the move depends heavily on whether trading volume stays strong.

The short-term price prediction depends mainly on whether ENSO token can hold the breakout level. If the price stays above $1.80 and volume remains high, the next possible target sits near $2.50.

However, there is also downside risk. After a strong rally, a drop in trading activity could lead to profit-taking. If that happens, it could pull back toward the $1.50 area. This kind of volatility is common after fast rallies.

The biggest question after the surge is whether the rally can last. Strong liquidity suggests real interest, but the lack of major news increases the chance of short-term selling.

If it holds above support and trading stays strong, the bull run story could continue. But if momentum slows, the rally may reverse quickly. The next few trading sessions will be important.

The Enso Price Surge shows how powerful trading volume and speculation can be in crypto markets. it’s breakout above $2 reflects strong momentum, but it also reminds investors that fast rallies carry risk.

Whether ENSO continues higher or drops will depend on volume and the $1.80 support level. For now, the price rally remains bullish, but traders should watch support closely because it will decide if the trend continues or turns into a correction.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.