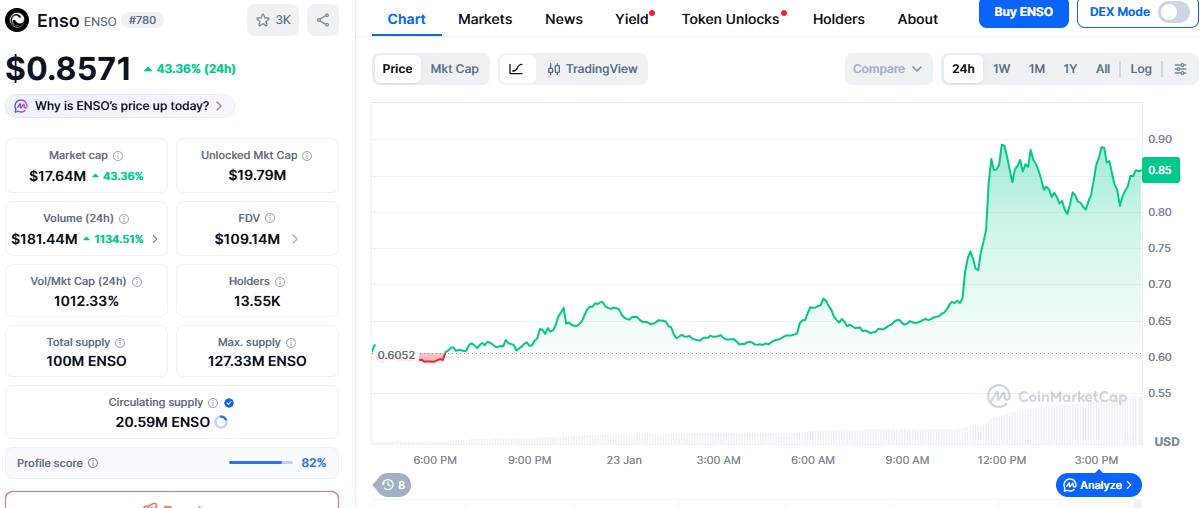

The Enso crypto price surge today has left traders and analysts stunned. After weeks of slow movement, it suddenly exploded from the low $0.60 zone to around $0.85 in just 24 hours. A 43% jump like this is rare, especially for a token with a small market cap.

The CoinMarketCap chart shows a sharp vertical move, which usually happens only when strong buyers rush into the market at once. This is why Enso crypto news today is drawing so much attention.

One major reason behind the price surge is its low circulating supply. Only 20.59 million tokens are in circulation out of a maximum supply of 127.33 million.

When demand hits a low-float token, price moves become sharp because there are not enough tokens available to meet buying pressure.

What made this move even more shocking was the volume. Trading volume surged more than 1100% to $181 million, while its market cap is only around $17.6 million, which means the token was traded for more than ten times its own value in one day.

This activity indicates significant speculation, rapid money rotation, and increasing interest in the reasons behind the altcoin breakout

Another strong factor is adoption news. Ensobuild technology was integrated into Hyperbloom, and ConcreteXYZ added the asset for vault zaps, including institutional strategies.

This means complex multi-step vault entries are now done in a single action. It reduces risk and improves execution. This gives credibility to the project and explains why ENSO coin is rising today.

The Enso crypto price surge is being supported by real market participation. The rally looks stronger than normal short-term hype. The breakout shows buyers were waiting for a trigger, and once it came, price discovery happened quickly.

The TradingView ENSO USDT chart technical analysis shows several bullish signs:

RSI is near 63–64, showing strong momentum but not extreme overbought levels.

MACD has a bullish crossover with positive histogram bars.

Price broke above the $0.75–$0.80 resistance and turned it into support.

The breakout candle is large and strong, showing aggressive buying.

These signals together explain what’s behind today’s price increase and why the structure signals bullish behavior.

For now, the key support zone is $0.80–$0.82. As long as the token holds above this level, the bullish behavior can continue.

Short-term target: $0.92–$0.98

Strong breakout target: $1.05–$1.12

As per Coingabbar’s crypto analysts, the base case would be consolidation between $0.82 and $0.90. A bearish signal appears only if the price falls below $0.78 with heavy selling, which could push the price prediction back to $0.70–$0.72 levels.

The Enso crypto price surge is not random. It is driven by volume, low supply, adoption news, and strong technical signals. It is showing early trend formation, not exhaustion. If support holds, $1 becomes a realistic target. Traders should watch support and volume closely.

YMYL Disclaimer: This article is strictly for informational purposes only. Cryptocurrency investments carry high risk, so it's always better to do your own research before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.