The Epstein Files news have once again pulled global attention after newly surfaced documents revealed years of communication between Jeffrey Epstein and Tether co-founder Brock Pierce, a well-known digital asset entrepreneur. Reports from BSCN News and Decrypt state that the correspondence lasted from 2011 to 2019, continuing even after Epstein’s 2008 conviction.

Source: BSCN News

The emails allegedly discussed meetings, introductions, networking, and personal matters. While no new charges have been reported, the revelations raise difficult questions about who stayed connected with the disgraced financier. The situation quickly evolved into major Epstein Files news, triggering concern among investors already navigating fragile conditions.

This unexpected development arrives at a time when the market is highly sensitive to reputation risk and regulatory uncertainty, making even indirect associations capable of influencing sentiment.

The appearance of Brock Pierce Tether connections intensified debate because of his early role in building one of the industry’s most widely used stable assets. Though the documents do not accuse Pierce of wrongdoing, the association alone has fueled speculation.

Over recent months, the US Department of Justice released millions of investigation records, and each disclosure has added new layers to the story. Names from politics and business have surfaced before — including mentions tied to Donald Trump, yet no criminal activity has been established in those references.

Another rumor gaining traction online connects the mystery creator of Bitcoin to the scandal. Claims around the Satoshi Nakamoto real face resurfaced, despite lacking verified proof. Analysts warn that narratives like Satoshi Nakamoto Epstein files can spread rapidly, shaping perception faster than facts.

Investor psychology often reacts to uncertainty rather than confirmation, which helps explain the speed at which prices moved.

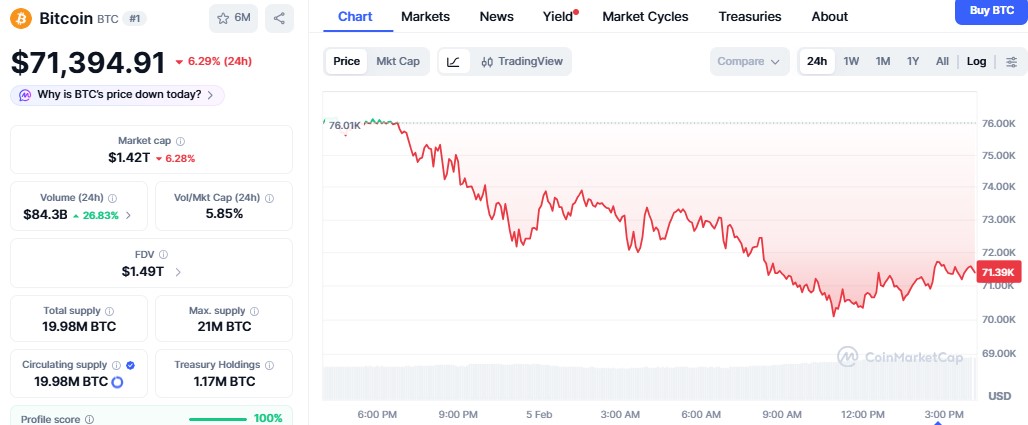

Market data shows a sharp reaction. According to CoinMarketCap, the Bitcoin crash today saw the asset fall from $76.15K to $71,319.25 — a drop of about 6.22%. Over the week, price also slipped from the $87.85K support zone, signaling weakening momentum.

Source: CoinMarketCap Data

Research firm K33 noted a roughly 40% decline from the October peak, including an 11% weekly drawdown amid global risk aversion. Meanwhile, analyst Dan Peña argued that if the identity behind Bitcoin were ever confirmed, trust could erode quickly.

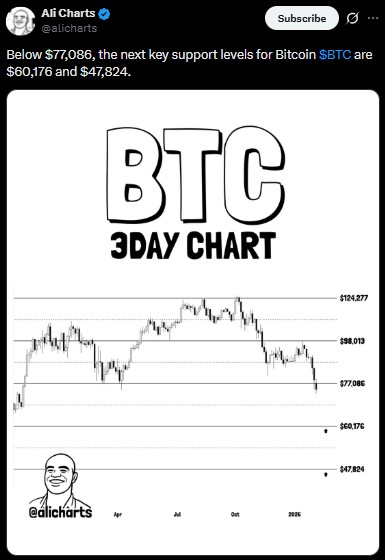

Technical indicators add another layer of caution. Data from AliCharts suggests that whenever the asset loses its 100-week SMA, it often trends toward the 200-week average. Key support levels now sit near $60,176 and $47,824.

Source: Alicharts

Still, macro pressures and political developments may also be contributing factors behind the crypto market crash today, meaning the files are likely one piece of a broader puzzle.

Expert Opinion: Despite the turbulence, long-term outlook discussions continue. Strategists believe structural demand, institutional participation, and supply dynamics could support recovery, keeping Bitcoin price prediction 2026 relatively constructive.

Short-term volatility, however, appears unavoidable as headlines shape trader behavior.

The Epstein Files have introduced another layer of uncertainty into an already nervous environment. While connections alone rarely determine long-term direction, fear can influence short-term moves. Whether this episode becomes a lasting risk or fades into background noise will likely depend on evidence, regulation, and restoring investor confidence.

YMYL Disclaimer: This article is for informational purposes only and should not be considered financial advice. Digital assets are volatile and carry risk. Readers should conduct independent research and consult a qualified financial professional before making investment decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.