The crypto market is shocked after what many traders are calling an NYC memecoin Rug Pull. Former New York City Mayor Eric Adams promoted a new memecoin called $NYC, and it quickly went viral.

Within minutes of launch, the token’s market value jumped close to $600 million. Many people rushed in, hoping to make fast profits from the hype.

But the excitement did not last long. Soon after the price peaked, on-chain data showed that a large amount of liquidity was removed from the token’s trading pool.

This caused panic selling, and the price crashed more than 80%. The NYC token dropped from about $0.58 to nearly $0.11 in a very short time. That sudden fall is why the term NYC memecoin Rug Pull started trending across crypto communities.

Source: X (formerly TwItter)

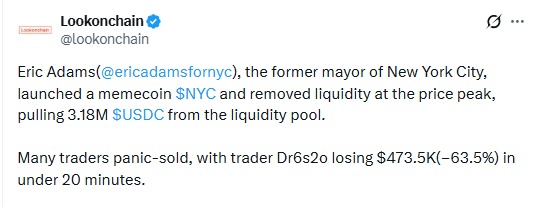

Blockchain trackers like Lookonchain found that a wallet linked to the token’s deployer removed around $3.18 million in USDC liquidity near the price peak.

Source: X (formerly Twitter)

In crypto, liquidity is what allows traders to buy and sell safely. When it is removed suddenly, people cannot exit their positions without heavy losses.

That is exactly what happened here. Some traders reported losing hundreds of thousands of dollars in just minutes.

This type of behavior is one of the strongest warning signs of a rug pull.

One reason this situation became serious so fast is because blockchain data is public. Anyone can see what happened. When traders saw liquidity being removed right at the top of the price, trust collapsed immediately.

This is a common pattern in many rug pulls:

Token launches with hype

Price rises quickly

Liquidity is pulled

Price crashes

Small traders get trapped

The memecoin followed this pattern closely, which made investors lose confidence.

The other major concern was supply management. Approximately 70% of the total 1 billion NYC Tokens were held within a reserve wallet. The top wallets accounted for the total supply.

This is dangerous because a small group can move the price anytime they want. Healthy projects usually lock large token amounts or distribute them widely. That did not happen here, which made the NYC memecoin Rug Pull concerns even stronger.

Eric Adams said the token would support causes like fighting antisemitism and anti-Americanism. But no details were shared. There was no name of a nonprofit, no explanation of how funds would be handled, and no clarity on who controlled the wallets.

During interviews Eric Adams' explanations about blockchain and the project were unclear. In crypto, trust comes from transparency.

Legally, it is safer to say this is an alleged NYC memecoin Rug Pull. Proving intention takes time. But for traders, the result matters more:

Liquidity was removed

The price crashed

Money was lost

Trust disappeared

Whether planned or not, the impact felt the same as a Rugpull.

This case is a strong reminder:

Always watch liquidity movements

Check wallet concentration

Be careful with celebrity-backed tokens

Trust blockchain data more than promises

Hype fades fast, but losses stay.

One wallet action erased millions in value within minutes. For investors, this is another lesson: transparency and responsibility matter more than fame or hype.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.