Crypto markets are facing a downfall from the past few days till today. The Spot Ethereum ETFs and Bitcoin together faced an outflow of $197 million and $122 million recorded on August 18, which is raising questions on the market reactions.

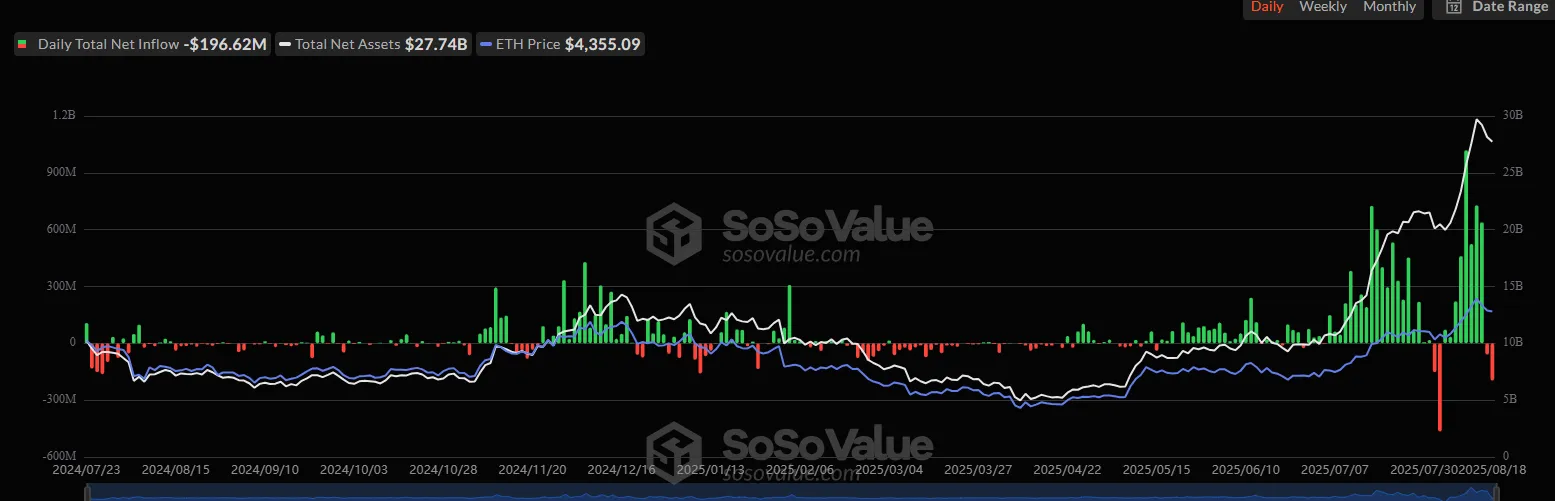

As per the data from SoSo Value, Spot Ethereum ETFs recorded net outflows of $197 million which is the second highest outflows of the Ethereum ETFs. Despite this dip, the product still holds its total net asset value of $27.74B which is 5.34% of Ethereum Market cap and in cumulative total Net Inflow with $12.47B.

Source: SoSoValue

The first time Ethereum ETFs showed a huge outflow of $465.06M on August 4. The weekly trend shows a reduction of $196.62M whereas last week it attained its all time high influx record by $2.85 billion.

On the other hand Blackrock (ETHA) has shown a total reduction of $87.16M with a Cumulative net influx of $12.08 billion , Grayscale (ETHE) and Fidelity (FETH) has shown an outflow of $18.70 million and $78.40 million.

The reason could be the ETH Price drop is the ETH market is running down today and currently it is trading at 4,291.86, according to the CoinMarketCap. And another reason could be the Fed rate cut, if it gets low the crypto market show a boost.

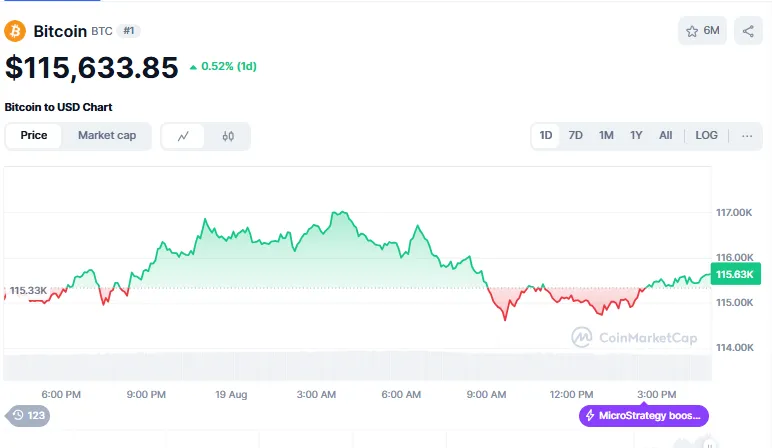

Source: CMC

BTC Exchange-Traded Funds showing reduction from the past two recorded days, as per the data from SoSo Value. Today it has shown an outflow of $121.84M. The total net asset value of BTC ETFs is $150.89B which is 6.54% of BTC market cap and the Total value traded is $2.77B with a cumulative inflow of $54.85B.

If compared to the weekly data then the BTC Exchange-Traded Funds has been recorded this week with a reduction of $121.81 million and last week it showed an inflow of $547.82M.

From the providers only Bitwise (BITB) has shown an inflow of $12.66m with a cumulative inflow of $2.32 billion. Others like Blackrock (IBIT) and Ark & 21 Shares has shown an reduction of $68.72M and $65.75million.

The asset market is now showing green signals as the prices are now moving upwards with a rise of 0.53%(at the time of writing).

Since the morning market showed around $114k in its price and now trading at $115,646. A positive signal for traders.

The Bitcoin Exchange-Traded Funds has shown an outflow this week whereas last week it was with an inflow of $547.82M, both are low if compared to the previous 4-5 weeks.

On the other hand Ethereum ETFs has shown the 2nd largest outflow this week but if you see the previous week record then it surged to its all time high inflow of $2.85 billion.

Bitcoin Exchange-Traded Funds faced outflows due to geopolitical tensions and Fed rate cuts, while ETH, though struggling to surpass Bitcoin, is slowly rising as big players like BitMine and ShareLink invest.

Ethereum ETFs are facing short-term outflows, but the long-term outlook remains positive as big investors like BitMine and ShareLink continue to support growth. Despite challenges, ETH is quietly moving upward

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.