Forget Bitcoin—Ethereum is stealing the spotlight today. Over $2 billion has quietly flowed into this cryptocurrency this month, and Bit Digital just dropped a $1B bombshell. Is this the spark that sends ETH price to $8K? Something big is brewing in the crypto world, and you’re not too late.

It is riding a tidal wave of bullish momentum, and the numbers prove it. According to Wu Blockchain, its spot ETFs recorded a jaw-dropping $453 million net inflow on July 25 alone.

That marked 16 consecutive days of Ethereum ETF inflows, with BlackRock’s ETHA ETF dominating at $440 million in a single day.

In parallel, Why ETH is going up today is being closely watched. As of writing, it trades at $3,772.36, up 1.39% in 24 hours, with a market cap resurgence driven by institutional adoption, staking, and major whale activity.

In a stunning move, Bit Digital (BTBT) filed to triple its authorized shares—from 340 million to 1 billion shares. Why? To buy more of these tokens.

Source: Coin Bureau

The firm aims to reposition its treasury with $1 billion worth of assets, marking one of the largest public treasury shifts to date. So with no about, this Bit digital news today is one of the biggest reasons behind Ethereum price increase.

This company’s accumulation may have sparked headlines, but it's part of a much bigger on-chain trend. According to Lookonchain, over the past few weeks:

583,248 coins ($2.17B) was accumulated by just 8 fresh wallets since July 9

170 new whale wallets holding 10,000+ coins each joined the network

On July 26, another $159 million (42,788 tokens) was scooped by new entities

Additionally, SharpLink Gaming reportedly moved $145M in USDC to Galaxy Digital’s OTC desk, likely prepping for another institutional Eth buy.

From a crypto analyst’s perspective, this behavior strongly signals long-term positioning, not short-term speculation.

Despite all the excitement, technicals suggest caution in the short term. Its RSI is at 78.61, placing it firmly in overbought territory, signaling a possible pullback, as per TradingView chart analysis.

However, momentum remains bullish:

MACD Line (301.8) > Signal Line (276.3) — indicating continued upside

Histogram bars are shrinking — early signs of potential cooling

Immediate resistance zones are at $3,900 and $4,050, while support levels remain near $3,600 and $3,450.

Based on market signals and institutional behavior, here’s where the price could be headed next:

Short-Term (1–2 weeks) Target: $3,850 – $4,050

Scenario: If it sustains above $3,700, breaking $3,900 could trigger a test of $4,000. Minor pullbacks toward $3,600 are possible due to RSI heat.

Mid-Term (2–3 months) Target: $4,400 – $5,200

Catalysts: Execution of Bit Digital ETH treasury shift and continued ETF inflows post-FOMC

Long-Term (By End of 2025) Target: $7,000 – $8,800

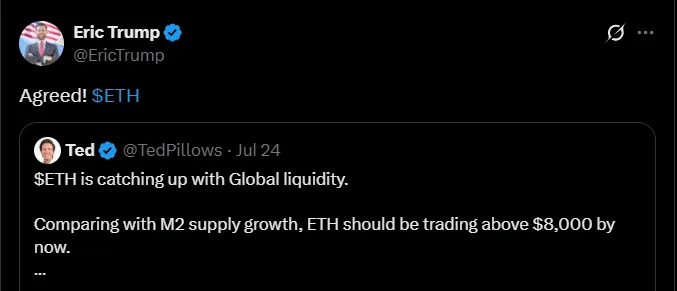

Outlook: It may become the standard corporate treasury asset, similar to BTC in 2021. Notably, Eric Trump recently projected $8,000 ETH, citing historical correlation with global M2 money supply.

Source: Eric Trump X Account

With ETF inflows topping $2B, a $1B bet from Bit Digital, and whales accumulating over $2.17B assets, the signals are loud and clear—Ethereum price increase today isn’t just another altcoin surge anymore.

It’s becoming a core institutional asset, backed by real-world staking. While short-term volatility can’t be ignored, the convergence of corporate actions, ETF demand, and whale confidence could soon trigger ETH's new price target of $8K. So keep any eye on its support and resistance level to witness the breakout soon.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.