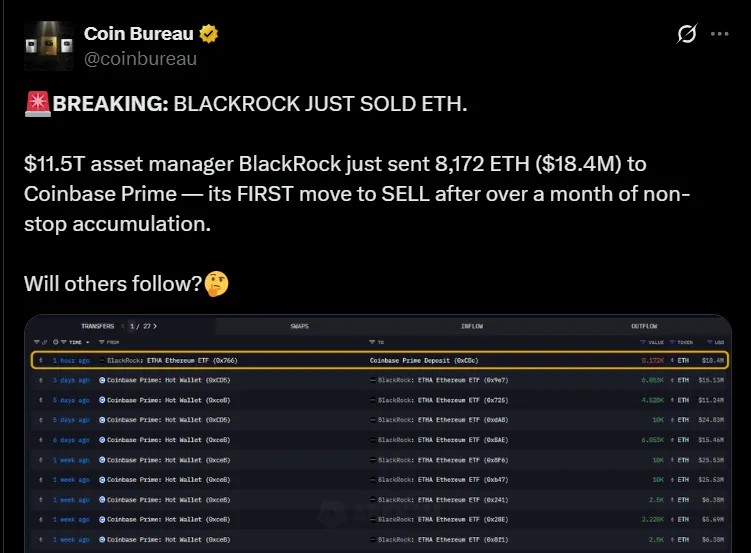

The market was shaken after BlackRock, the world’s largest asset manager, reportedly sold a portion of its Ethereum holdings for the first time in over a month.

According to Coin Bureau, BlackRock sent 8,172 ETH (worth $18.4M) to Coinbase Prime, marking a shift after accumulating over $750M worth of coins in June alone.

Source: Coin Bureau X Account

Source: Coin Bureau X Account

The sudden BlackRock sell ETH move has reignited debate over its mid-term outlook. However, Ethereum price prediction June 2025 remains bullish among analysts and traders, especially as institutional holding via BlackRock’s iShares ETF still stands at 1.66M tokens (approx. $3.83B), per Lookonchain data.

As of writing, The price today is trading just below $2,272.53 with a 3% daily increase, but the 24-hour trading volume is down 28.84%, now $20.09B, according to CoinMarketCap.

Here are the 2 green signals behind why ETH is pumping:

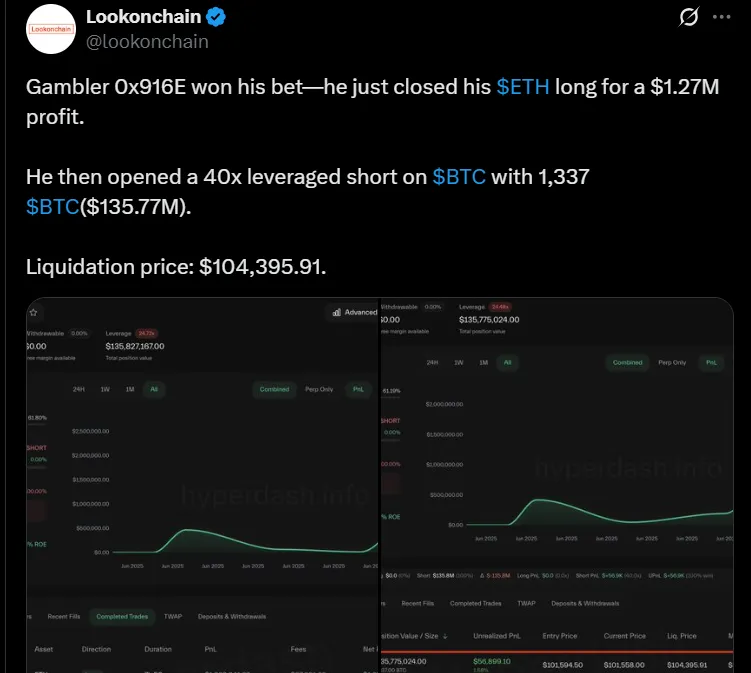

1. The price bump appears to be supported by both on-chain bullish trades and macro stability. As per the latest reports, newcomer wallet 0x916E deposited $4.28M USDC into Hyperliquid and opened a 25x ETH long, injecting sudden demand.

Source: Lookonchain

2. Good Entry Point: After observing the technical indicators flashing signals of a potential bounce, the RSI had just dipped near oversold territory (35.84) which also tells us there is a chance of reversal in the short term, and pricing was still above major support zones which were around $2,100, and with traders establishing a good entry point the price could have the chance to bounce.

Given these signals, the price prediction for June 2025 has started gaining fresh momentum despite the ETF outflows.

As per Cipher X ETH analysis , the price increase is following a Wyckoff accumulation pattern, suggesting that value could be gearing up for a rally. After retesting support successfully, the token avoided a breakdown and held its bullish structure.

Source: Cipher X

However, he clearly warns: a daily close below $2,100 would invalidate the pattern. If price action stays strong, the short term target is $2.9K–$3K, with long-term potential to reach $3.5K–$4K in Q3 2025. These predictions strongly align with growing interest around the next Ethereum price target.

Technical Indicators:

RSI: 35.84 → near oversold territory, suggesting a bounce is likely

MACD: Bearish but flattening, showing potential for reversal

Volume: Average – no whale reentry yet, but also no panic

Source: TradingView

Short-Term (3–7 Days): Consolidation in $2,200–$2,300

Mid-Term (2–3 Weeks): Rise toward $2,400–$2,550 with volume breakout

Long-Term (1–2 Months): Rally to $2,800–$3,000 possible with ETF inflows

While the market reacted to the BlackRock sell, being a crypto analyst, I believe the transaction may be a portfolio rebalance or liquidity test for the company.

Traders are watching for daily closes, ETF activity, and global market news to confirm whether this was a short-term action or something bigger.

Despite the short-term noise, the bigger picture for Ethereum price prediction June 2025 remains optimistic. If it remains above $2,100 and ETF outflows slow down, a run toward price target $3K+ could play out within weeks.

For now, this move looks more like a setup than a selloff—especially with whales still placing leveraged bets, so keep an eye on the latest market updates to see where the price goes next.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.