The crypto world is buzzing with Hyperliquid news today, but why? Its native token crashed around 10% in the last 7 days, but there’s more to the headlines.

Former Barclays CEO BOB Diamond is calling it a rare opportunity, while whales and institutions are quietly stacking up. Traders are watching closely, and the numbers hint that something big might be coming—but only if you catch it before the wave hits.

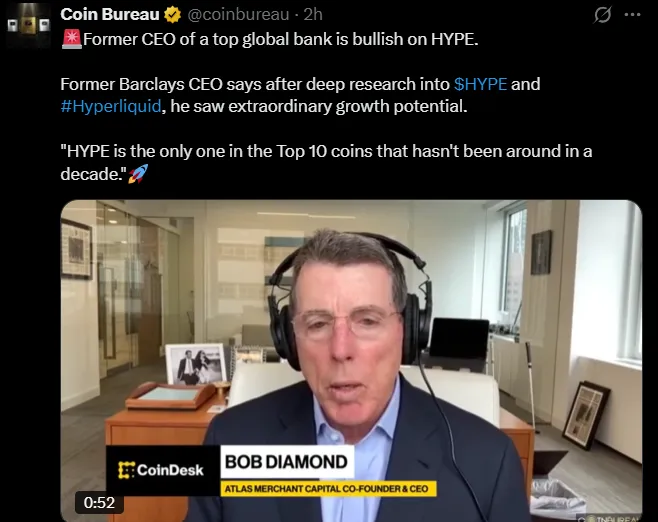

In the latest Hyperliquid news today, Former Barclays CEO BOB Diamond said that after studying this token, he sees huge growth potential.

According to CoinBureau's latest X post , He even pointed out, “This token is the only one in the Top 10 coins that hasn’t been around in a decade,” making it unique and exciting.

Even though the token dropped around 10% in the past week, the reason is simple. People were selling assets to cover their trading positions, not because the token lost value. So, this Hyperliquid crash might actually be a chance for smart investors.

Crypto analyst Greeny , on his official X account, said that the asset is quietly “loading the next leg”. What does this mean? Basically, whales (big investors) and buybacks are slowly collecting crypto, preparing for the next upward move.

As per my analysis, being a crypto observer, this movement clearly indicates that more than short term dip, it's the perfect opportunity for crypto watchers to jump in.

Some impressive numbers show how strong the token is:

$6B+ assets under management (AUM)

$5.7B USDC collateral

$151B trading volume in just 48 hours of DeFi launch

Galaxy Digital invested $125M USDC, showing that big institutions trust the asset.

Now the question comes, if it's just a minor crash then, what will be the $HYPE price prediction? So, let's look at the technical side now.

Looking at the TradingView daily chart on OKX:

Current price: $42.39, bouncing from $40 support

Resistance: $44–45

Support: $40 key level

RSI: 48, neutral, with a small bearish hint

MACD: Slightly bearish but flattening, meaning selling pressure is slowing

In simple words, this hyperliquid price analysis shows that the coin is resting for now. If it goes above $44, it could rise higher. But if it falls below $40, it might drop further.

Short-Term (1–2 weeks): Expect $40–45. A break above $44 can reach $48.

Mid-Term (1–2 months): Staying above $42 might push the $HYPE price target to $50–55. Falling below could test $36.

Long-Term (3–6 months): If former Barclays CEO Bob Diamond prediction comes true, and momentum and support holds, breakout potential could take it to $60–65.

This Hyperliquid news today shows the fundamentals are strong, but crash looms for a short period. Whales are buying, big investors are entering, and the revenue numbers are impressive.

If you are following $HYPE price targets then this could be an exciting time. Short-term dips might be a chance to enter, while the next move could push prices much higher.

Keep an eye on $40 support and $44 resistance—these levels will tell where the token is heading next.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.