Ethereum price is on an upward trend on all fronts as it is backed by high institutional inflows, strong on-chain fundamentals, and aggressive accumulation. Large financial players are redefining the ETH ecosystem by taking in almost all the net issuance since the Merge.

At the time of writing, the crypto was trading at $4,444, 0.50% higher in the past hour and 6% in the past week, but down 4% in the previous 24 hours.

As the institutional players scramble to have access to Ethereum, the bullish set up on the token is fast gaining momentum.

Ethereum price has broken out of a long-term downward trendline on the ETH/BTC chart, which indicates a structural change that has not been witnessed since 2021. The ETH/BTC is currently trading at 0.03791 BTC with strength and volume confirming the move.

Source : X

In less than two months, companies have already bought 1.5% of the total supply, or about $6 billion worth of the token, with much of it being staked or used in DeFi. Entities such as Bitmine, Trump-related funds, and other treasuries are rapidly amassing, and some already hold more than $10 billion in the token in total.

These treasury buyers have, since the Merge, taken up all 2.4 million of the altcoin issued. This creates a supply squeeze that institutions show no sign of slowing down, aiming for 5% of total supply in the near future.

U.S. spot ETFs have recorded the highest inflow of all time at $2.85 billion in a single week, according to SoSoValue. It had one record-breaking day that brought in over $1 billion, and the six-day total was at $2.3 billion, indicating extraordinary demand.

Weekly ETFs Net Inflow : Source : SoSo Value

In the meantime, Trump World Liberty just spent 8.6M to purchase 1,911 ETH at 4,500, further to their already held 77,226 ETH worth 296M with 41.7M in profit. Other companies, such as Bitmine, deposited an amount of $130M ETH within one hour and are currently in control of over 5.75B ETH.

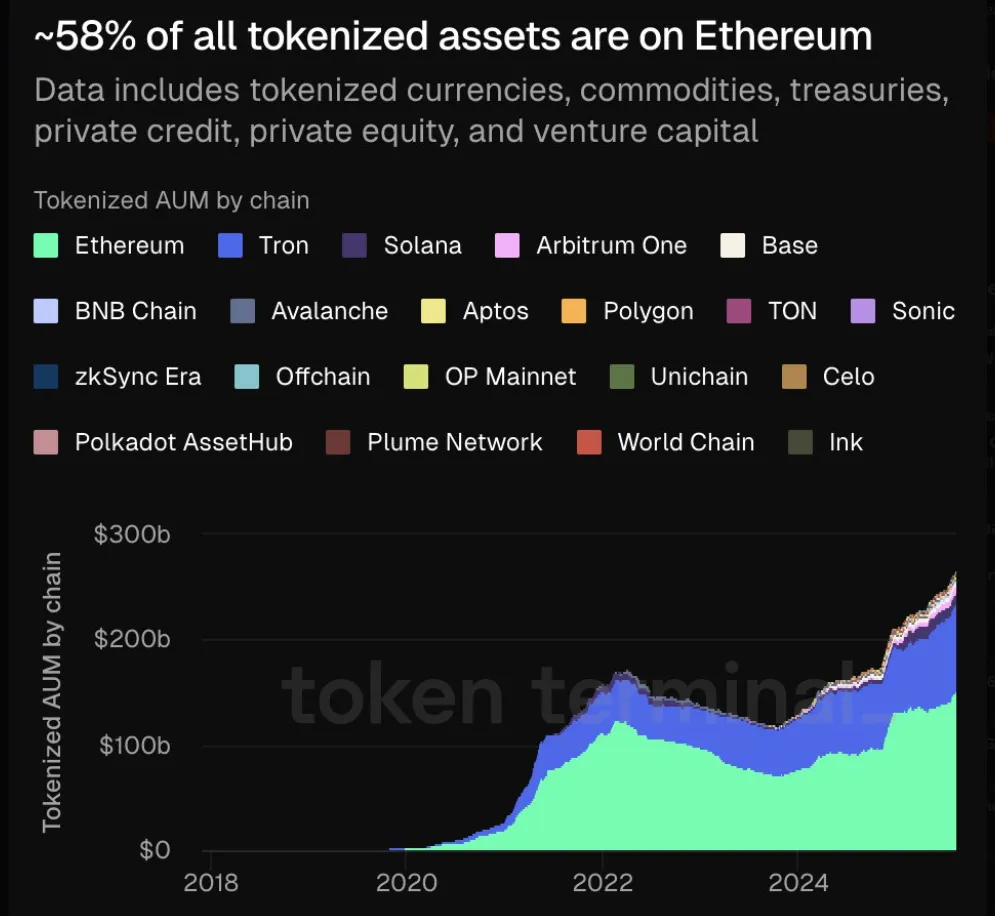

Tokenized assets : Source : token terminal

At the same time, real-world asset (RWA) tokenization is booming, and 58% of all tokenized assets exist on Ethereum Layer 1. Whether it is currencies or private equity, Ethereum is the unchallenged centre of on-chain settlement of value.

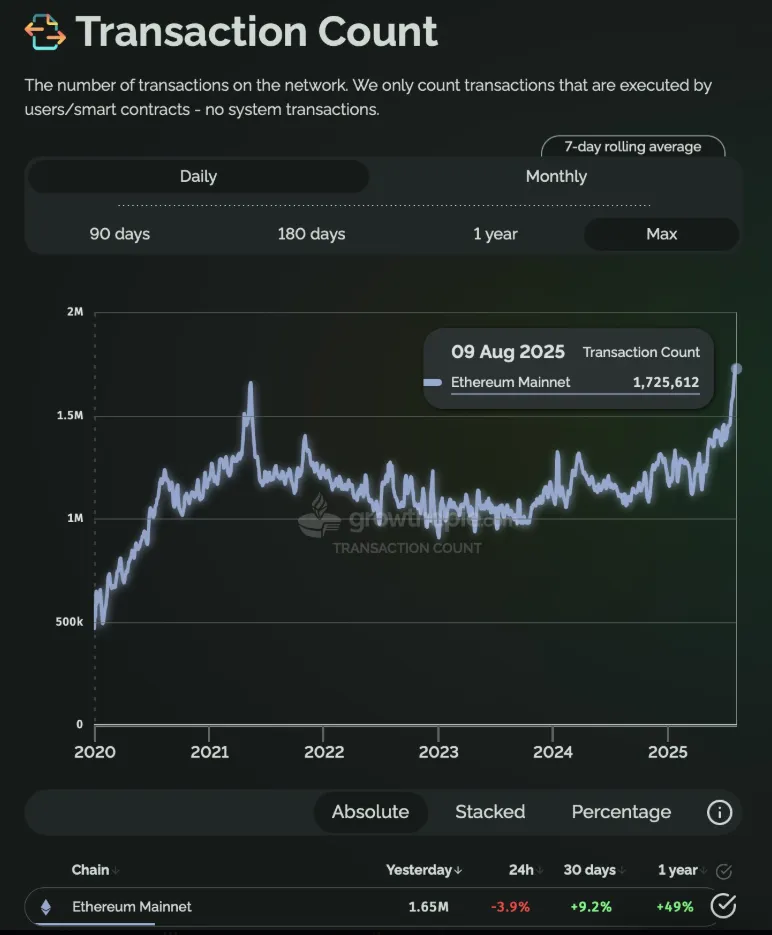

The number of transactions on the network is at a new all-time high, with Ethereum transactions per day at 1.73 million (a 49% YoY increase) and active addresses and stablecoin volumes increasing. And yet, fees are close to the lows.

Transaction Count : Source : growthpie

More than half of the volume of stablecoins settled globally was on Ethereum last quarter. Meanwhile, the staking landscape is changing- Lido is losing its dominance as other providers such as Figment expand, increasing decentralisation and institutional flexibility.

Institutional uptake and belief have gone through the roof. An anonymous user has moved 92,899 ETH or about 412M within three wallets within four days. At the same time, BitMNR saw an inflow of 106,485 ETH ($470M) within 10 hours, indicating sustained institutional demand.

The U.S. Senate recently voted the GENIUS Act into law by a 68-30 margin, providing a framework for regulated stablecoins in the U.S. In this bill, fintechs, banks, and large retailers will be able to issue digital dollars that are fully reserved and audited.

It is a historical event in U.S. crypto markets as it may create a boom in the use of stablecoins. The altcoin is now being touted as a treasury-grade asset, and analysts are predicting short-term prices of up to $6K and long-term prices of up to $12K-15K. With institutional demand, ETFs, and regulatory tailwinds, the token price is setting up to make a move higher.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.