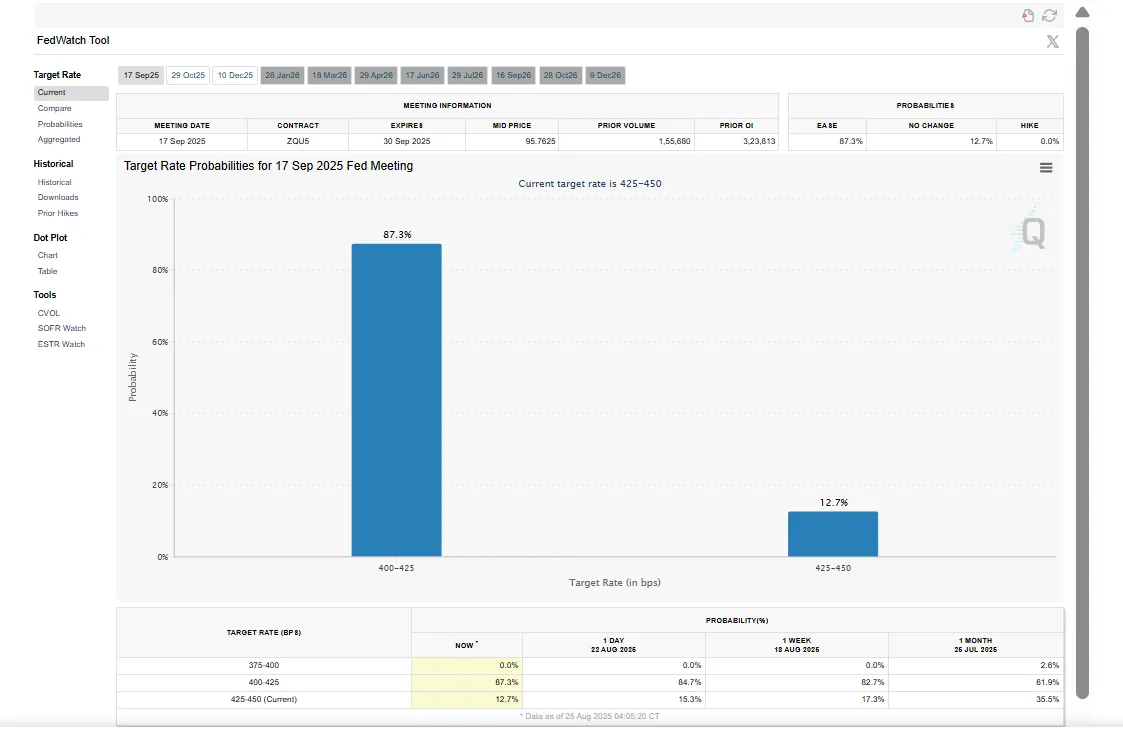

In the recent announcement, the probability of a Federal Reserve rate cut in September 2025 has jumped to 87.4%, indicating a sudden change in the mood. The spike coincides with recent economic data that indicate that inflation might be slowing down, with the Consumer Price Index (CPI) indicating that it is stabilizing after reaching its highest point of 6.8% in November 2021.

Investors and analysts are keenly following the upcoming FOMC meeting set to be held on 16-17 September 2025, because the decisions reached there may have an impact on the global financial markets and investment plans.

The increase in the rate cut probabilities is in stark contrast to the doubts cast by Federal Reserve officials. In a speech delivered at the Jackson Hole Symposium on August 21, 2025, Cleveland Fed President Beth Hammack pointed out economic fundamentals and inflation risks posed by tariffs and warned against expectations that a rate cut is imminent.

In spite of this, market participants, using the futures data on the CME FedWatch Tool, now have almost an 87% likelihood of a September rate cut as they believe that inflation is cooling off.

Such cuts have previously been linked with market volatility. A 2019 study by the National Bureau of Economic Research concluded that the stock market generally declines by an average of 15% within six months of a rate cut, which is why investors should be careful to avoid being carried away by optimism.

Source: Fed Watch CME Group

Yardeni Research President Ed Yardeni warned that a September rate cut is not a sure thing. Although Jerome Powell's speech at Jackson Hole indicated the possibility of easing policy, Yardeni has highlighted that the upcoming inflation numbers and the August employment report will play a decisive role in the decision of the Fed. I am not sure we are going to get 25 basis points at this September 17 meeting, he said, adding that the possibility of a 50 basis points cut is still uncertain.

Yardeni also highlighted the risk of a market “melt-up” if the Fed cuts rates prematurely, warning of the potential for excessive speculation and volatile price swings.

Yardeni has not changed his S&P 500 targets, which remain 6,600 by the end of 2025 and 7,700 by 2026, based on high corporate earnings and not market valuations. He suggested that the earnings fundamentals are quite strong. Thus, they support the US equities even in the face of possible rate adjustments.

Source: Crypto Jack X

The international implications of the news of a potential Fed rate cut are also there. Yardeni highlighted a complicated tariff scenario that involved India and former US President Donald Trump.

He stated that in the case of India cutting down on the purchases of cheaper Russian oil, the country will be strained economically, but the reverse can lead to punitive tariffs. He termed it as tossing a coin having both sides a loss, and it is a geopolitical uncertainty that is facing Indian markets.

As the September 2025 FOMC meeting approaches in a few weeks, markets are gearing up for a possible Fed results. Yet analysts such as Yardeni are cautioning that the move is not a given. Investors should pay close attention to inflationary trends, job reports, and Fed communications as they will dictate true data. With the clock ticking towards the meeting, the historical trends, market optimism and expert caution make the next few weeks decisive in the US and global financial markets.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.