Why has crypto reacted so sharply after the latest Federal Reserve decision?

This recent Fed Rate Cut news has caused a wave of uncertainty across global markets, especially crypto.

The Federal Reserve reduced its upper bound rate to 3.75% down from the previous 4.00%, a 25-bp move expected by the consensus but confusing some investors with ambiguous signs for further cuts.

With the dissension from three officials and strong doubts regarding the next Fed rate cut, traders are now concerned that easing may pause in January.

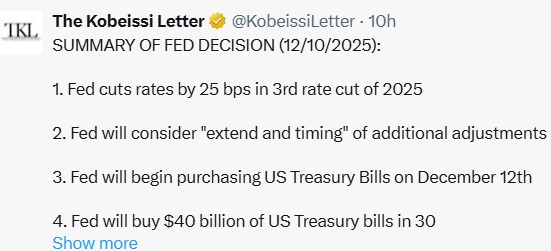

The latest FOMC meeting ended with a 25 bps cut, the third of the year, but the message was far from dovish. The Kobeissi letter reported that two officials Schmid and Goolsbee opposed the decision entirely, while another wanted a bigger 50-bps reduction. New projections show only one cut in 2026, leaving markets wondering if the Central Bank is stepping back again.

Source: X (formerly Twitter)

The news only added more tension around the FOMC meeting, with real-time interest in the FOMC meeting live updates building even further.

During the press briefing, Jerome Powell indeed said that the central bank is "well-positioned to wait," hinting that January may bring no action.

He also said it would begin buying $40 billion in Treasury bills over the next month, in an effort to stabilize liquidity in the financial system.

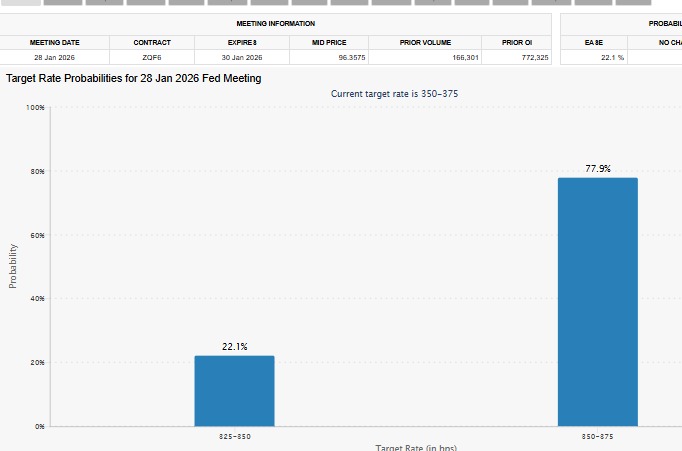

Right after the announcement, the US dollar weakened against the euro, yen, and Swiss franc. Powell also underscored that a hike isn't the base case for 2026. Futures traders now see a 78% chance of no change in January. However, despite the central bank projecting just one, markets still price in two cuts next year.

Source: FedWatch Tool

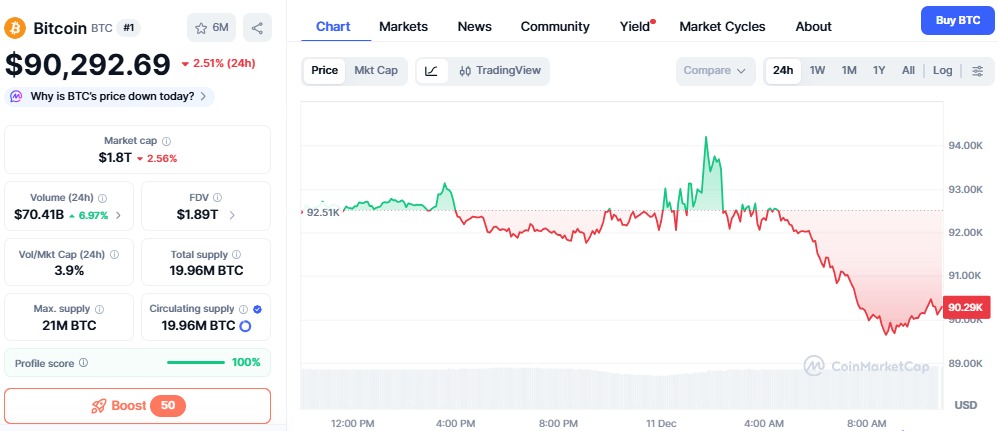

The crypto market instantly reacted to the Fed Rate Cut news. In 24 hours, the global digital currency market fell 3%, further extending its sharp plunge throughout the month.

As per the Coinmarketcap, this update sent Bitcoin tumbling 2.5%, while its dominance climbed to 58.6%, indicating a very clear risk-off shift.

Source: CMC

Altcoins suffered more, with ETH and XRP lagging. The Altcoin Season Index slipping to 17 shows how investors are avoiding high-risk tokens.

Technically speaking, the total crypto market cap broke below the 200-day EMA, $3.49 trillion, suggesting weakened momentum. Traders believe the market needs to reclaim $3.16 trillion to avoid further downside.

Attention for the markets turns to Friday's PCE inflation report. A hotter number would result in delaying the next Fed rate cut and adding more pressure to crypto. Still, ETF inflows and whale activity-including plans for a $500M Bitcoin buy-offer some support. The big question now: Can Bitcoin hold $89K as macro pressure builds?

Disclaimer: This article is for informational purposes only, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.