Have you ever seen the market this volatile before a Fed meeting?

That’s exactly what’s happening as investors wait for the FOMC meeting today, which many traders say could be the biggest Federal Reserve moment since late 2024.

And the reason is simple: this meeting may decide whether we get a Crypto Santa Rally or a rough Christmas correction.

The US Fed's two-day FOMC meeting runs from 9–10 December 2025, with the interest rate decision announced at 2:00 p.m. EDT (12:30 a.m. IST). Chair Jerome Powell will hold a press conference at 2:30 p.m. EDT.

FedWatch now shows 87.6% probability of a rate cut. At its October meeting, the Federal Reserve lowered interest rates by 0.25%, bringing them down to between 3.75% and 4.00% to help the US economy.

The Fed already cut rates in the past two meetings, and another cut is almost fully expected. But this time the focus isn’t the cut itself, it's what comes next.

Several major banks are saying the central bank might hint at new liquidity tools to help ease stress in the financial system. Some even think the Fed could bring back direct reserve injections. If Powell confirms anything along these lines, it would signal that more money might enter the market.

And when liquidity rises, crypto usually moves first.

But not everyone is convinced the Federal Reserve's decision will go soft according to Crypto Rover.

Source: X (formerly Twitter)

Fresh economic data added confusion.

The October JOLTs report showed more job openings than predicted, meaning companies are still hiring. That’s usually a sign the labor market is strong, not weak.

On top of that, inflation is holding above the Fed’s target, and bond yields jumped again. This combination normally pushes the Fed into a more hawkish stance, even when cutting rates. That’s why some investors worry that Powell might sound cautious, just like he did in December 2024.

Based on the current market mood, tomorrow can go in two very different directions:

Rate cut confirmed

Liquidity support or new tools mentioned

Signs of cooling in jobs or demand

This would almost guarantee a Crypto Santa Rally, especially for Bitcoin, Ethereum, and risk assets.

Rate cut, but with warnings

No mention of bond buying or injections

Strong comments on inflation

This would echo the FOMC meeting December 2024, which was followed by a brutal 60–80% drop in altcoins.

The market clearly remembers that.

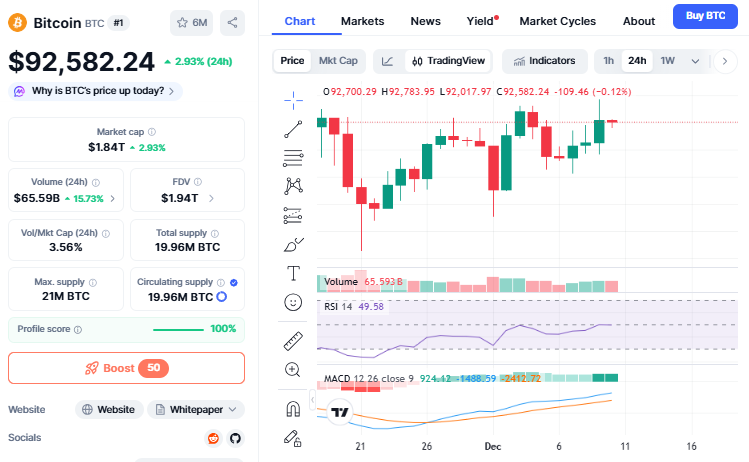

As per CoinMarketCap, Bitcoin jumped nearly 3% today, and the rest of the market followed. One of the biggest drivers was a large short squeeze; hundreds of millions of dollars in short positions were liquidated as BTC pushed above $94,000. When that happens, forced buying lifts prices sharply.

Source: CMC

ETF inflows also picked up again, with $151 million entering on December 9. Technical indicators like MACD showed momentum turning back upward. Ethereum climbed 7%, while Solana and Cardano also moved strongly.

The Fear and Greed Index rose from last month’s extreme fear level of 11 to 30, showing that sentiment is slowly improving.

The FOMC meeting today is not a regular Fed meeting. It has the power to decide how crypto closes the year. A soft tone from Powell could light up a Crypto Santa Rally, while a tough stance could trigger a December drop.

For now, all eyes are on tomorrow’s decision and the tone that follows.

Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.