Fidelity, one of the world’s largest asset managers with around $6 trillion in assets, has officially entered the stablecoin market. On January 28, 2026, the firm announced the launch of its first Fidelity Stablecoin, called the Fidelity Digital Dollar (FIDD).

Source: Official Doc

The asset firm confirmed that both retail and institutional investors will be able to buy, redeem, and transfer FIDD directly through the native platforms. The rollout is expected to begin in early February 2026.

Currently there are two major stablecoins dominating in the market: USDT and USDC, and now with Fidelity Stablecoin announcement, markets are highly comparing them in context of the next leader.

The Fidelity stablecoin, FIDD, is a USD-pegged digital token built on the Ethereum blockchain, one of the most efficient blockchains in today's market. Each token is backed 1:1 by U.S. dollars, cash equivalents, and short term U.S. Treasuries.

While there are many USD-backed stable tokens in the market, what makes this product special and attention gathering, which even led to the comparison with Tether’s USDT.

FIDD is under the management of Fidelity Digital Assets, National Association, a federal chartered trust bank approved by the U.S. Office of the Comptroller of the Currency (OCC), regulated banking authority.

In simple and short terms:

FIDD comes from a trusted, well-known financial firm

The issuer is legally approved by the U.S. government

It operates under strict banking rules and supervision

These all together contribute to make FIDD one of the most regulated stablecoins launched by a traditional financial institution.

The stablecoin market is already large and competitive with both USD and non-USD coins adding to its portfolio. As of January 2026, the total stablecoins market value has crossed the $308 billion mark which was around $208.47 billion in January 2025, representing ~48 % yearly increase.

Source: DefiLlama Official

USDT and USDC remain as the major players of the space where USDT alone stands with 60.43% of the total market’s share. In the short term, FIDD vs USDT-USDC is unlikely to change market dominance. USDT has strong global liquidity with reputation, while USDC is deeply connected to DeFi and exchanges.

However, the firm’s trusted brand, strict regulation, and huge client base could help the new stable coin grow steadily, especially among institutions that already use its services.

Ethereum network is emerging as the top choice for the stablecoins due to its fast, low-cost, and efficient infrastructure. The blockchain processed over $8 trillion in stablecoin transfers in Q4 2025, surpassing traditional finance benchmarks like SPY’s ~$3.4 trillion quarterly volume.

As for now, the total market of stablecoin on Ethereum chain stands at $160.5 billion with $886.74 million in trading volume as per DefiLlama.

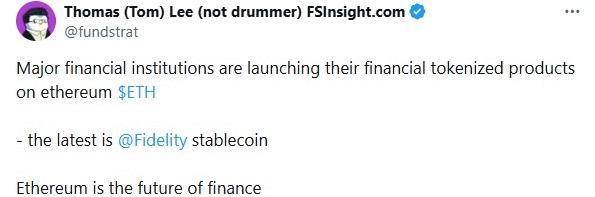

Tom Lee, Fundstrat strategist, said FIDD launch proves major institutions trust Ethereum. Lee added that regulated stablecoins need security, liquidity, and constant uptime, areas where Ethereum already leads.

He believes this strengthens Ethereum’s role in secure, 24/7 tokenized finance.

The asset giant already runs a strong crypto infrastructure, including custody services for digital assets and multiple institutional-grade platforms for trading and tokenized products. Launching an USD-pegged coin allows the organisation to move money on-chain faster, cheaper, and 24/7.

As stablecoins continue to grow, 2026 could see more banks and asset managers follow the lead. For now, Fidelity’s move marks a clear milestone in mainstream crypto adoption and strengthens the case for regulated stablecoins in global finance.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency carry risks; please do your own research before investing or using digital assets.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.