The major digital assets firm, Tether, and Bitqik, the local licensed crypto exchange, are partnering to educate people on digital finance knowledge, particularly about stable coins like USD₮.

Source: Tether Official

The Tether Stablecoin Education collaboration is focused on educating people across Laos about how digital dollars work, how to use them safely, and why stablecoins are becoming an important part of everyday finance.

The initiative will provide virtual learning sources and conduct quarterly events in major cities like Vientiane, Pakse, Luang Prabang, and Vang Vieng. The goal is to educate over 10,000 people during 2026, helping them understand how to use stablecoins safely and effectively.

Stablecoins (USDT, USDC) are now the most practical and widely used segment of crypto. They act as virtual dollars on blockchains, allowing fast, low-cost transfers without the volatility of Bitcoin or Ethereum.

Stable Coins are significantly getting their place in:

Cross-border payments & remittances: Real-time, cost-effective international money transfers, particularly in emerging countries.

Financial inclusion: Billions of people without bank accounts can use wallets and mobile apps.

DeFi & Tokenization: Functioning as a collateral, settlement tool, or yield in DeFi.

Bridging traditional finance and crypto: Allowing smooth on/off-ramp between fiat and blockchain.

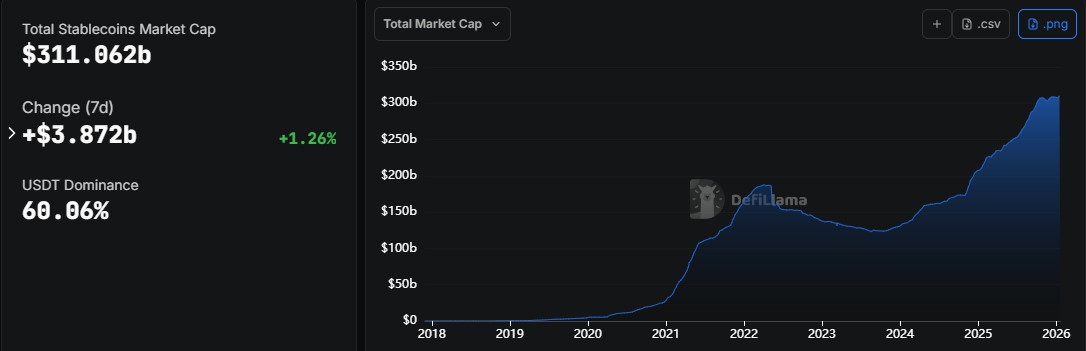

The total global stablecoin market has reached all-time highs, with a market cap of $310-311B and transaction volumes of $33-40 trillion per annum in total. USDT sits at the top with ~$187B or about 60%, followed by USDC at around 25%, and then other stable coins at 15-20%.

Source: DeFiLlama Analytics

Clear regulations in the US, EU, and Asian regions have led to an increase in adoption of stablecoins by institutions, rendering stablecoins an integral base of modern finance today.

Though there are decentralized stablecoins such as DAI, USD₮ has been widely adopted in emerging economies due to its acceptance and liquidity. USDT is preferred for everyday payments, trading, and remittances, whereas DAI focuses on fully decentralized, on-chain finance.

By combining e-learning with live community events, Tether stablecoin education in Laos is making digital finance practical and accessible for thousands of people, enabling them to participate actively in the growing virtual economy.

Bitqik offers trading and brokerage services for cryptocurrencies to make digital assets more usable. CEO Virasack Viravong said the initiative will give communities, students, and entrepreneurs better access to blockchain knowledge.

Paolo Ardoino, CEO of Tether, added that “financial inclusion requires understanding” and underscored how important a Tether Stablecoin Education will be in building confidence to use USD₮ and other digital assets. The project will also consolidate USD₮'s presence in Laos, where high inflation and inadequate access to banking have been fully felt.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.