Is the Fight listing date the moment when combat sports finally meets real Web3 adoption? That is the question many traders and fans are asking right now. The project has shared strong hints through its latest post on X, pointing toward January 22, 2026, as the expected launch day. Even without a direct exchange announcement, the timing, queue movement, and community response suggest the ecosystem is entering its most important phase.

Built around digital identity, reputation, and ownership, the platform connects fans, fighters, and partners in a licensed network. Its identity system is already an official partner of the UFC, which gives the project a rare real-world connection. That credibility is why the Fight listing date has become a major discussion point across crypto communities.

According to the recent X update, January 22, 2026, is the expected day for trading to begin. Although the team has yet to publish the names of the exchanges, market patterns indicate the process of token listing is already ongoing.

Source: Official X

The current exchanges list includes Binance, MEXC, KuCoin, Bitget, and Gate.io. Normally, when a number of exchanges are in line, the project waits to announce them all at once. This is a good strategy for building more liquidity on launch day.

Importantly, the date of the first fight is where development activity shifts to participation in the open market. This is where price discovery starts. This is where actual demand is determined.

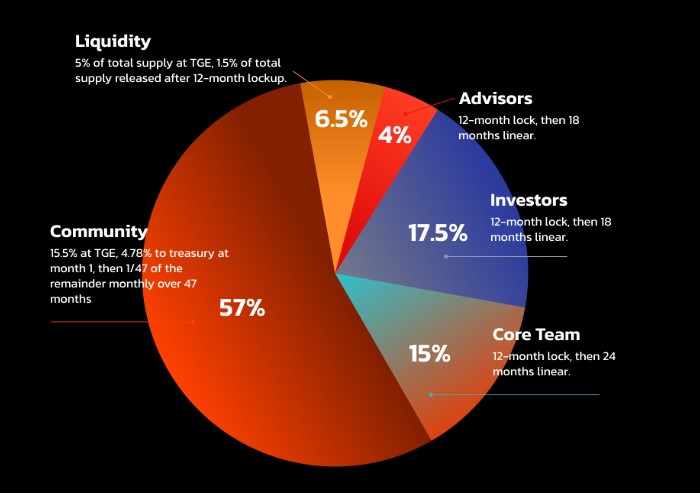

The total supply has been fixed at 10 billion units, but only 20.5% of it will be supplied at the time of launching, which amounts to 2.5 billion units. The controlled supply at the time of launching will counter any selling pressures exerted on its price at this stage. The distribution is as follows:

Source: Official Website

Community holds 57% of total supply, showing strong focus on decentralization, user rewards, ecosystem growth, and long term network participation.

Investors receive 17.5% with a 12 month lock and 18 months linear vesting to prevent dumping.

Core Team gets 15% with 12 month lock and 24 months linear release for commitment.

Advisors hold 4% locked for 12 months then unlocked over 18 months steadily.

Liquidity gets 6.5%, supporting trading stability and smooth price action after launch.

This is broken down to 15.5% unlocked during TGE, 4.78% unlocked one month later for treasury, and the remaining unlocked over 47 months. Five percent is released at TGE, and 15 percent after twelve months, hence a good balance between growth and preservation.

Taking into consideration the market conditions and allocation structure, it has been estimated that the initial launch price and price prediction range will likely fall between $0.05 to $0.20.

If leading exchanges such as Binance join, then there might be a sudden rise in momentum. Analysts believe there will be more visibility and more volume and faster price discovery in this case. There are also forecasts which state that reaching $1 might be possible in future cycles.

The Fight listing date is expected to be January 22, 2026, and this is a milestone for this Web3 ecosystem which is designed specifically for fighting games. The tokenomics are excellent, and there are big exchanges lined up, and there is also a realistic price expectation.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.