In a significant move to introduce stablecoins into mainstream banking and retail, payments giant Fiserv has revealed plans to issue its own stablecoin, FIUSD, later this year. The new digital currency will be backed by Fiserv's enormous network of banks and merchants, and developed in collaboration with leading crypto companies such as Circle, Paxos, Solana, and PayPal.

Source: Fiserv

Stablecoins are digital currencies pegged to real-world currency, such as the U.S. dollar. They do not fluctuate in value like Bitcoin or Ethereum and are employed to send money faster and more inexpensively, 24/7. With more than 10,000 bank clients and 6 million merchant outlets, Fiserv currently processes 90 billion transactions per year. By bringing this stablecoin into its infrastructure, it is offering banking organisations and retailers with a simple means of start to make use of blockchain technology without altering the way they operate.

FIUSD is being built to operate on various platforms and with other prominent stablecoins such as USDC (issued by Circle) and PYUSD (issued by PayPal). It will be released on reputable platforms of Paxos and Circle which are some of the best regulated and established digital finance brands. The current market cap of USDC is $61.69 billion as per the CoinMarketCap.

The coin will be deployed in the Solana blockchain, which is very fast and known for low cost. It implies that companies may be able to make payments with the help of FIUSD and get their money paid almost immediately, including the weekends or holidays, which remains impossible with regular banks.

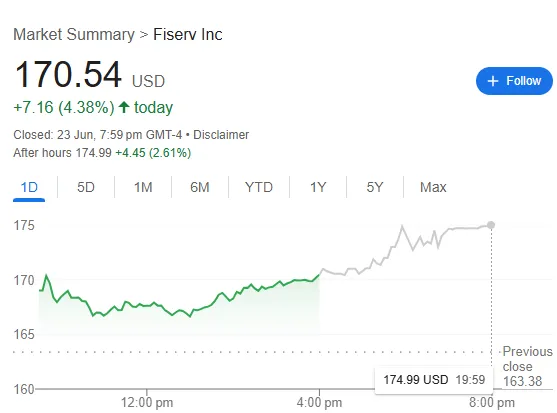

Noteworthy, Fiserv is ensuring bank level security in FIUSD such as detection of fraud, risk tracking, and complete compliance procedure. It will also come in the form of simple to work with tools to the banks, including software kits that can be plugged into the current banking systems including Finxact by Fiserv. After the announcement the price of the Fiserv stock has experienced a 7.16% increase in the last 24 hours as per Google Finance.

Source: Google Finance

Fiserv’s move follows earlier stablecoin launches by Circle (USDC), Coinbase (via partnerships), and PayPal (PYUSD). Many experts see these moves as signs that traditional finance (often called “TradFi”) is warming up to the idea of digital currencies.

Many big crypto organisations including Circle and Paxos have already gone public or listed IPOs and it is generally anticipated that Ripple, the developer of the XRP token, will soon announce an IPO. Such a wave indicates that stablecoins are not a crypto experiment anymore, but they are becoming the future of money.

Fiserv says FIUSD will help banks and businesses build new digital services, like faster payments, programmable money, and cross-border transfers. With trusted players involved and strong tech foundations, it could become a preferred “on-ramp” for small banks and fintech startups.

Industry watchers are calling FIUSD one of the most “bank-ready” stablecoins yet, and social media chatter from traders and developers is strongly bullish. Many see this as a sign that real-world crypto use is finally here, and the stablecoin war is heating up.

As stablecoin regulation like the GENIUS Act gains ground in the U.S., and as digital dollars go mainstream, FIUSD might just be the stablecoin that brings banks, merchants, and consumers together on blockchain, for good.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.