The crypto world is closely watching January 13, 2026, as the long awaited Fogo Chain Airdrop Snapshot is finally completed, and the asset is now moving into the final phase of its multi-exchange CEX debut.

When is Fogo Mainnet Launch Date? Well, it's a new "Layer-1" blockchain, which is like a digital highway for money and apps. After months of testing, the team is moving from "practice mode" to the real coin, launching its full mainnet and the first round of its airdrop together on January 13, 2026.

Traders who were active on asset’s testnet or participated in their "Flames" program, are likely on the list to receive free listing tokens in just 8 days.

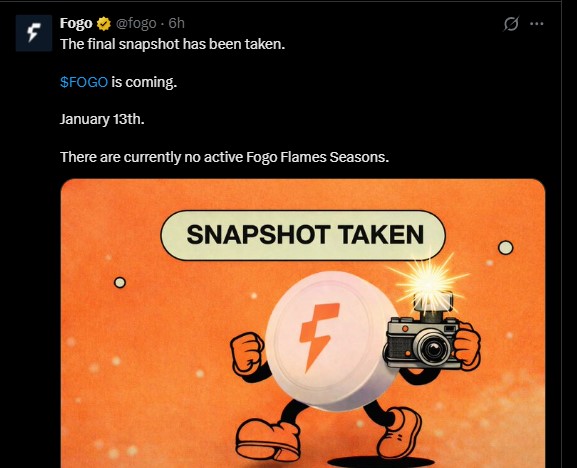

According to the official FOGO X account, the final snapshot has been completed and there are currently no active Flames seasons. The team confirmed that full mainnet will launch on January 13, alongside an airdrop preview and early positioning for what it calls a $16T tokenization opportunity.

Founder Robert Sagurton, who used to work at major banks like JPMorgan designed this asset to be incredibly fast. In the tech world, this is called "low latency."

Project’s experts think the tokenization market will be worth $16 trillion by 2030, and the token wants to be the highway that carries all that value. Despite raising $15M from Echodotxyz, it has delivered a high layer-one performance.

When the Fogo Chain Airdrop Snapshot rewards transition into token distribution on 13 Jan, users won't just have to sit on them. There are already several apps ready to use:

Ambient Finance: A place to trade "perpetuals" (a type of advanced trading) that focuses on fair prices.

Brasa Finance: This lets you "stake" your tokens (lock them up to help the network) and get secured coins in return so you can still use your value elsewhere.

FogoLend: The very first place on the chain where you can lend your coins to earn interest or borrow against them.

FluxBeam: A simple tool for swapping one coin for another, with built-in safety features to check for scams.

The project previously cancelled ‘December 17 2025 Fogo presale’, and gave those tokens to the airdrop instead.

Here is how the 10 billion tokens are split up:

Core Team: 34% (Locked for a long time to show they are committed).

Foundation: 27.58%

Community & Airdrop: 15.25%.

Investors & Advisors: About 23% (Also locked up to prevent big sell-offs).

According to on-chain metrics, almost 60% of all tokens are locked when the project starts. As per Coingabbar’s top crypto expert’s analysis, this is a "bearish" sign for people who want to sell everything at once, but a "bullish" sign for people who want the price to stay steady.

While nothing is official, analysts are looking at where the asset might be listed. Names like Binance, Bybit, OKX, LBank, BitMart, and MEXC are being whispered in trading circles.

Listing Price: Experts guess it will start between $0.08 and $0.15.

2026 Outlook: If the project becomes the go-to place for tokenized assets, the price prediction could see it reaching $0.30 or higher. However, if people just sell their Fogo chain airdrop snapshot coins immediately, the price could drop toward $0.01 until trading volume surges.

Traders note: Low float, no early VC unlocks, and a strong infrastructure narrative support this price outlook.

The Fogo Chain Airdrop Snapshot is the first major milestone in a long journey. By focusing on speed and the $16 trillion tokenization market, it is trying to be more than just another new crypto project.

Market participants tracking the $FOGO mainnet listing January 13 should keep a close eye on upcoming reward details to determine project’s long-term credibility.

YMYL Disclaimer: This article is for informational purposes only, and does not support any financial advice. Traders are requested to do their own research before investing in any cryptocurrency.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.