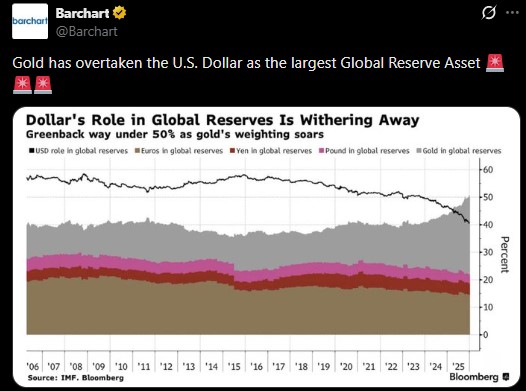

Claims are spreading online that gold has overtaken the US dollar as the largest Global Reserve Asset, especially after the metal's prices surged above $4,400 per ounce in early 2026.

Source: BarChart Official

However, official IMF data shows this has not happened yet – though the gap is clearly narrowing.

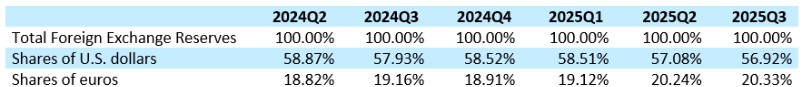

According to the IMF’s COFER (Currency Composition of Official Foreign Exchange Reserve) data for Q3 2025, the US dollars remain the dominant global reserve currency.

Total global FX reserve: ~$13 trillion

US dollar share: ~56.9%

Dollars value in reserves: ~$7.4 trillion

Gold, meanwhile, is not included in COFER because it is tracked separately from foreign exchange reserves.

Where Gold Stands Today: Central banks collectively hold about 36,000–36,400 tonnes of the asset.

At current prices (~$4,400–$4,460/oz):

Estimated value of global gold-reserves: ~$5.1–$5.2 trillion

This means:

The precious metal has overtaken the euro as the second-largest gloabal reserve asset by value

But it still trails the USD, which remains larger by over $2 trillion

So the claim that gold has already surpassed the dollar is not correct in current context, especially until the release of the latest COPER report in April/May 2026.

But, why is gold overtaking dollar narratives surging potentially in the markets? Is the reason hidden in Gold’s demand or Dollar’s performance?

Even though the confirmation hasn’t released by any official organisation, speculation is intense, and for clear reason it’s not specific toward any asset, but both are contributing to the surging narratives equally:

Gold-Prices: The physical asset is rising rapidly. It already passed the euro in mid-2025, becoming the second-largest reserve asset overall, even though it is not a currency.

Source: Trading Economics

Currently trading at $4,467.65 (+0.47%) per ounce, extending gains for a third straight session. On a broader scale, the metal has surged 6.6% over the past month and an impressive 68.6% year-on-year. Its rally underscores its growing appeal as a safe-haven asset mainly due to:

Heavy central bank buying (over 1000 tonnes per year recently)

Political and Economical tensions

Inflation fears

Reduced trust in long-term fiat stability

Gold’s reserve “share” is rising mostly because its price is exploding, not because countries are selling dollars aggressively.

The Dollar’s Share Is Slowly Declining: The dollar’s reserve dominance has fallen from ~71% in 2000 to 57% in recent reports. It coincides with the USD’s long term value downfall. Currently the value index has steadied around 98.4, down 0.14%, where it declined 9.51% on yearly basis.

Source: Trading Economics

Importantly:

There is no evidence of rapid de-dollarization

Recent decline is mainly driven by diversification into euro, yen, and other currencies, not panic selling.

Still, if gold prices continue rising while FX reserves grow slowly, it could surpass USD by value in future reports.

Alongside the hard metals, digital assets are quietly entering national balance sheets, though outside traditional IMF reserve frameworks. Some governments now treat Bitcoin like “digital gold”, holding it in treasuries rather than central bank FX reserves.

Some nations with highest crypto portfolio include:

United States: Around 200k BTC from seizure, formalized as a strategic reserve

Bhutan: BTC accumulated via state-backed mining

EI Salvador: Ongoing treasury purchases

China & UK: Large seizure-based holdings

Source: BitcoinTreasuries.Net

Globally, Governments hold more than 640,000 BTC, worth around $60 billion. Comparative to physical product's reserves, it surely holds a tiny share, but symbolically important and rapidly growing.

While most central banks reject crypto due to volatility, institutions and sovereign funds are experimenting, especially to deal with inflations.

The USD is still king of global reserves, while the yellow metal is rising fast, driven by price gains and central bank demand. Crypto is emerging as a strategic hedge for a small but growing number of countries.

For now, Gold has not surpassed the dollar, but if current trends continue, future IMF reports could show a historic shift.

Disclaimer: This analysis is based on publicly available IMF and market data and does not represent investment advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.