We’ve seen ETH price rally buzz before, but this time feels different. Big money is no longer sitting on the sidelines. From $5M GameSquare ETH buy surprise to BlackRock’s growing ETF stash and whales quietly draining Binance—all the signals are flashing green.

Could this be the Ethereum price breakout moment? Whether you're a trader, holder, or just curious, it’s time to pay close attention—because Today’s price surge might be gearing up for a serious move.

Nasdaq-listed GameSquare has just entered the crypto arena in a big way. As per the company’s official confirmation, it has completed its initial $5 million tokens purchase, buying 1,818.84 coins at an average price of $2,749.

This is part of a larger $100 million GameSquare Ethereum treasury strategy—a clear signal that companies are beginning to treat this currency as a long-term digital asset.

As more corporations begin to hold this token in their balance sheets, the narrative of the coin as a treasury asset is starting to gain real traction, mirroring the Bitcoin playbooks we’ve seen over the years.

Backing this bullish sentiment is a major wave of capital flowing into its exchange traded funds. As of July 10, Lookonchain data indicates the net ETF inflows of +76,940 assets, which is equivalent to $214.51 million.

The largest contributor? BlackRock's iShares ETF, which added 57,801 assets ($161.15M) and now holds a total of 1.89 million coins, which is valued at $5.28 billion.

This surge in inflows shows growing faith in this cryptocurrency as an investable asset, adding strong institutional support to the current momentum.

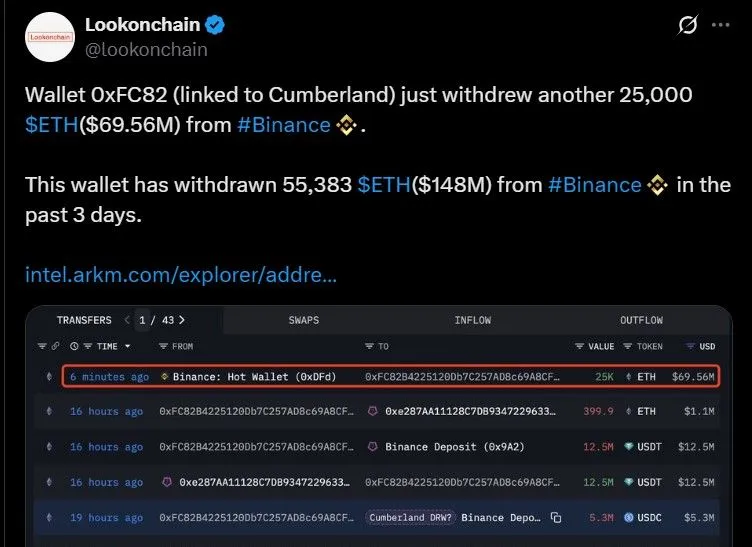

Whale activity is heating up. Wallet address 0xFC82, linked to Cumberland, just withdrew 25,000 tokens ($69.56M) from Binance. In the past 72 hours, the same wallet has pulled over 55,000 coins ($148M) in total.

Source: Lookonchain

Such large-scale withdrawals usually point to accumulation and reduced exchange supply, key ingredients that often precede a price breakout.

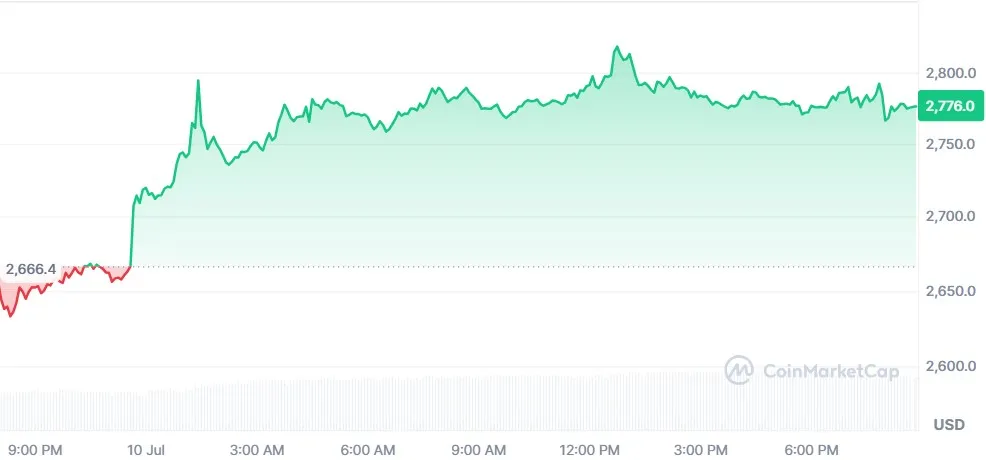

The ETH price today according to CoinMarketCap is $2774.95, is up 4.82% within 24 hours, and has a trading volume of 28.94 billion with a 38.94% increase. This upward change indicates high activity and increased investor enthusiasm.

Traders are eyeing the $2,800–$2,900 resistance range closely. A breakout above this could trigger a new leg up toward $3,000 and beyond—especially if Ethereum price surge today keeps accelerating on the back of ETF flows and corporate buying.

Final Word: Is the Ethereum Breakout Already Underway?

With corporate interest, institutional ETF inflows, and on-chain accumulation, it is showing all the signs of strength. Ethereum price breakout is no longer hypothetical; it is now a possibility supported by real capital and changing narratives. For now, all eyes are on second largest cryptocurrency, and the market is watching.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

3 months ago

Good