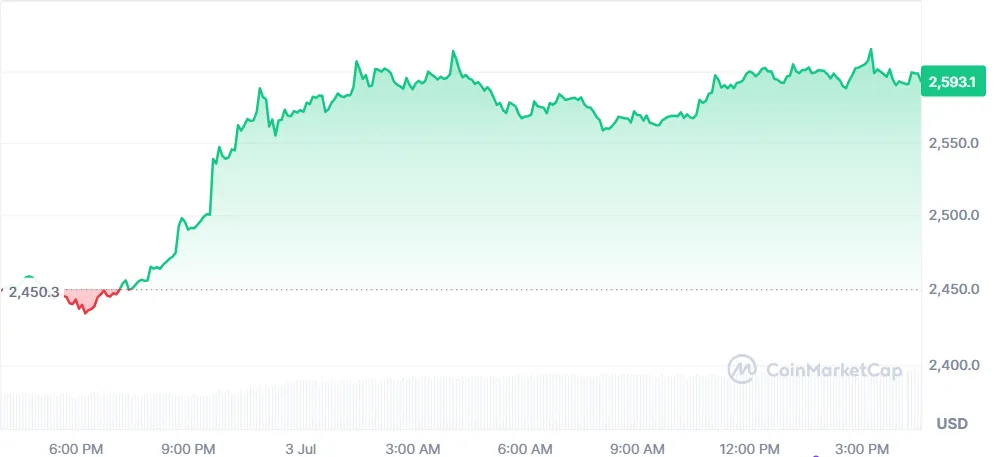

At the time of writing, ETH is trading around $2,594.11, posting a 6% gain in just 24 hours. But this rally isn’t just technical—it’s backed by macro signals, institutional flows, and insider moves that suggest something bigger might be brewing.

So, is this just another dead cat bounce, or the early signs of a breakout toward its all-time high?

Let’s break down what’s really happening behind the scenes—and what it means for the Ethereum price prediction today.

While a 6% price move is strong, it’s the volume surge that’s more telling. It’s 24-hour volume has jumped 65.09% to $26.22 billion, according to CoinMarketCap.

This suggests high conviction, not just speculative chasing. When price moves with this kind of volume, it often signals smart money is entering—and not just retail panic-buying.

The rally isn’t random. It’s rooted in three powerful forces converging at the same time:

1. Arthur Hayes: Former BitMEX CEO Arthur Hayes said on July 3 that it is becoming the base layer for future banking—especially with JPMorgan launching its JPMD stablecoin on Base.

He pointed out that $6.8 trillion in US Treasury demand could quietly funnel through the token-based stablecoins. If this happens, It doesn’t just go up—it becomes part of the global banking core.

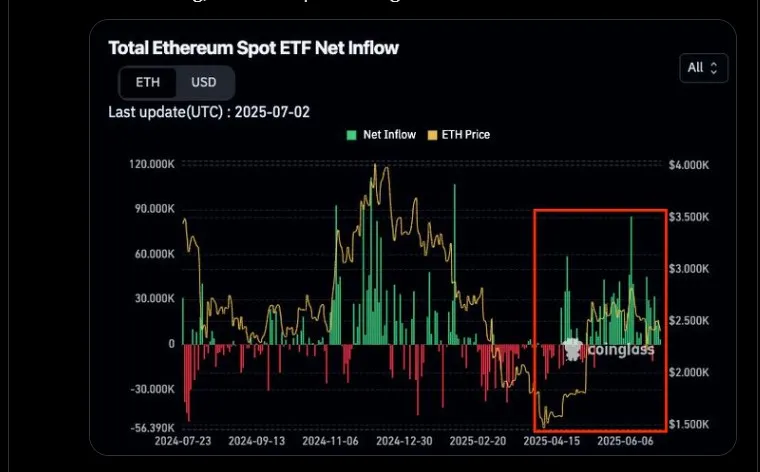

2. BlackRock and ETF Inflows: In the latest Ethereum news today, on-chain analyst Edward shared that BlackRock has bought ETH on 29 of the last 30 days. With spot Ethereum ETF inflows rising, this steady buying could send ETH to new highs.

Source: X

3. Technical Breakout:

RSI is now at 53.29, breaking above the neutral 50 zone, indicating a shift in buying pressure.

The MACD has also made a bullish crossover indicating a technical breakout signal.

The price structure is now cleanly defined:

Support Zone: $2,375–A critical weekly support. As per my analysis of its TradingView chart, a break below invalidates the current bullish setup.

Resistance Zone: $2,800–A tough barrier. The Coin has failed to clear this several times since March.

If it breaks above $2,800 with volume, it could trigger a sharp rally to the $3,200–$3,500 zone.

Here’s a breakdown of where the token could be headed next, based on technical and macro analysis:

1. Short-Term (2–3 Weeks):

Target: $2,750 – $2,800

The RSI and MACD combo shows bullish power. Holding above $2,375 means it could retest $2,800 soon.

2. Mid-Term (2–3 Months):

Target: $3,200 – $3,500

If it breaks $2,800, it opens the gates for March 2024 highs. Co-founder of Bybit named Christiaan, and Glassnode echo this view.

3. Long-Term (By End of 2025): Will ETH Hit $5K?

Target: $5,000 – $5,500

With ETF inflows, staking growth, and macro optimism, it could hit—and possibly surpass—its 2021 all-time high near $4,900.

ETH latest rally isn’t just a reaction—it’s a setup, and if momentum holds and $2,800 is broken, it’s path to $3,500—and even $5,000 by 2025—could become more than just a prediction. It could become the new narrative.

And if you're wondering about the Ethereum price prediction today, it’s this: Hold above $2,375, and the bulls stay in control. However, always do your own research before pulling out or investing in any cryptocurrency to avoid high-risks.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.