GameStop has shocked both Wall Street and the crypto world by announcing the purchase of 4,710 Bitcoin worth $512.78 million. The bold GameStop Bitcoin buy sent GME stock up by 22% in just three days, while the largest cryptocurremcy price action is already reflecting fresh institutional momentum.

In a press release dated May 28, 2025, $GME confirmed it has added 4,710 BTC to its balance sheet. The announcement was shared via the company’s official X account, as posted from its headquarters in Grapevine, Texas, and cited by the press release available on its Investor Relations page.

Source: X Account

This GameStop Bitcoin buy marks one of the most significant steps into crypto by a major retail brand.

This strategic acquisition places this stock alongside companies like Tesla, MicroStrategy, and Block, which hold significant reserves as part of their treasury strategy.

Although it has not disclosed the specific reason behind the GameStop Bitcoin investment 4710 BTC, analysts suggest it reflects strong confidence in this top cryptocurrency store-of-value role amid rising fiat inflation.

This holding now becomes a part of the growing corporate crypto trend.

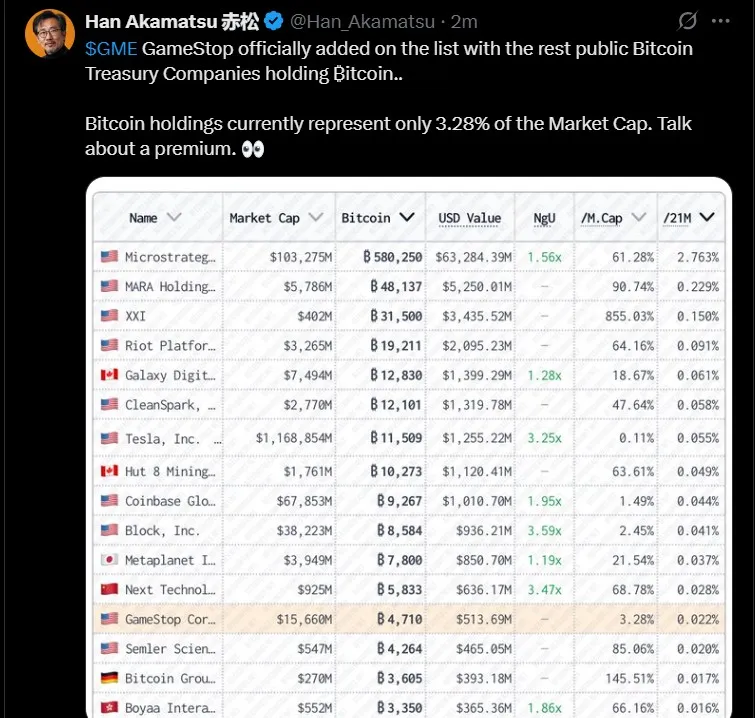

“GameStop officially added to the list of Bitcoin Treasury Companies,” tweeted Han Akamatsu, a known crypto investor (source: X).

Source: Han Akamatsu

The stock market was quick to react. Its shares (NYSE: GME) have surged from $28.50 to $35.00 in the last three sessions—a solid 22.8% rally.

On the day of this $BTC purchase announcement alone, the stock jumped 5%, forming a classic V-shaped breakout pattern. (Source: TradingView)

Source: TradingView

As a crypto analyst, I’ve calculated the next potential technical target near $53.50, provided the stock holds above $34 and volume continues rising. This sets up a strong GME stock price prediction trajectory in line with broader crypto-related sentiment.

Key Highlights:

Price before BTC news: $28.50

Current price: $35.00

3-day increase: +22%

Pattern: V-shaped recovery breakout

Next target: $53.50 (if momentum holds)

While BTC is currently trading around $109,006, down 0.70% on the day, the 24-hour trading volume has spiked to $51.63 billion—a 3.1% increase. The sudden volume surge is widely linked to the GameStop purchase effect on BTC price, based on live data from CoinMarketCap.

Source: CoinMarketCap

Technical Snapshot (As of Writing):

Price: $109,006

MACD: Slightly bearish but flattening—bullish crossover possible in 2–3 days

RSI: 65.14 — bullish, but not overheated

Support level: $104,000

Resistance zone: $112,000–$115,000

7-Day Price Outlook:

Bullish Case: It may climb to $112K–$115K if sentiment improves

Neutral Case: Price likely to consolidate between $107K–$109.5K

Bearish Case: If negative macro news hits, it could test $104K support

This could be an initial catalyst for a greater BTC bull run, especially if other institutions act on the buying this digital gold trend. The move also adds weight to the ongoing price prediction of a breakout above the Bitcoin $112K target in the short term.

According to data compiled from $GME balance sheet and the other currency market prices from CoinMarketCap, the 4,710 BTC now represent approximately 3.28% of GameStop’s market cap. While it's still small, it marks a watershed moment for how retail giants view crypto. In fact, this news could motivate other companies that are holding cash reserves to take a deeper look at crypto assets as well.

GameStop Bitcoin purchase isn’t just a treasury play, it’s a statement. The immediacy of both stock and crypto market reactions has been bullish and swift. GME is currently trading back at multi-month highs, and the technicals are suggesting the digital gold might have a short-term rally in the making.

As companies continue to take a piece of the treasury trend, keep your eye on momentum indicators like RSI and MACD to determine what's ahead.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.